Bitcoin (BTC) price has gained more than 10% in the last week, giving bulls some hope that the road ahead is a bright one for the leading digital asset.

However, despite an effort to blast through the critical resistance level of $7,200 as mentioned in last week’s analysis, there was a huge rejection bringing home the reality that perhaps it may be a little too soon to be expecting a miraculous bounce back to the $8,000+ levels.

Daily crypto market performance. Source: Coin360.com

$5,500 then moon?

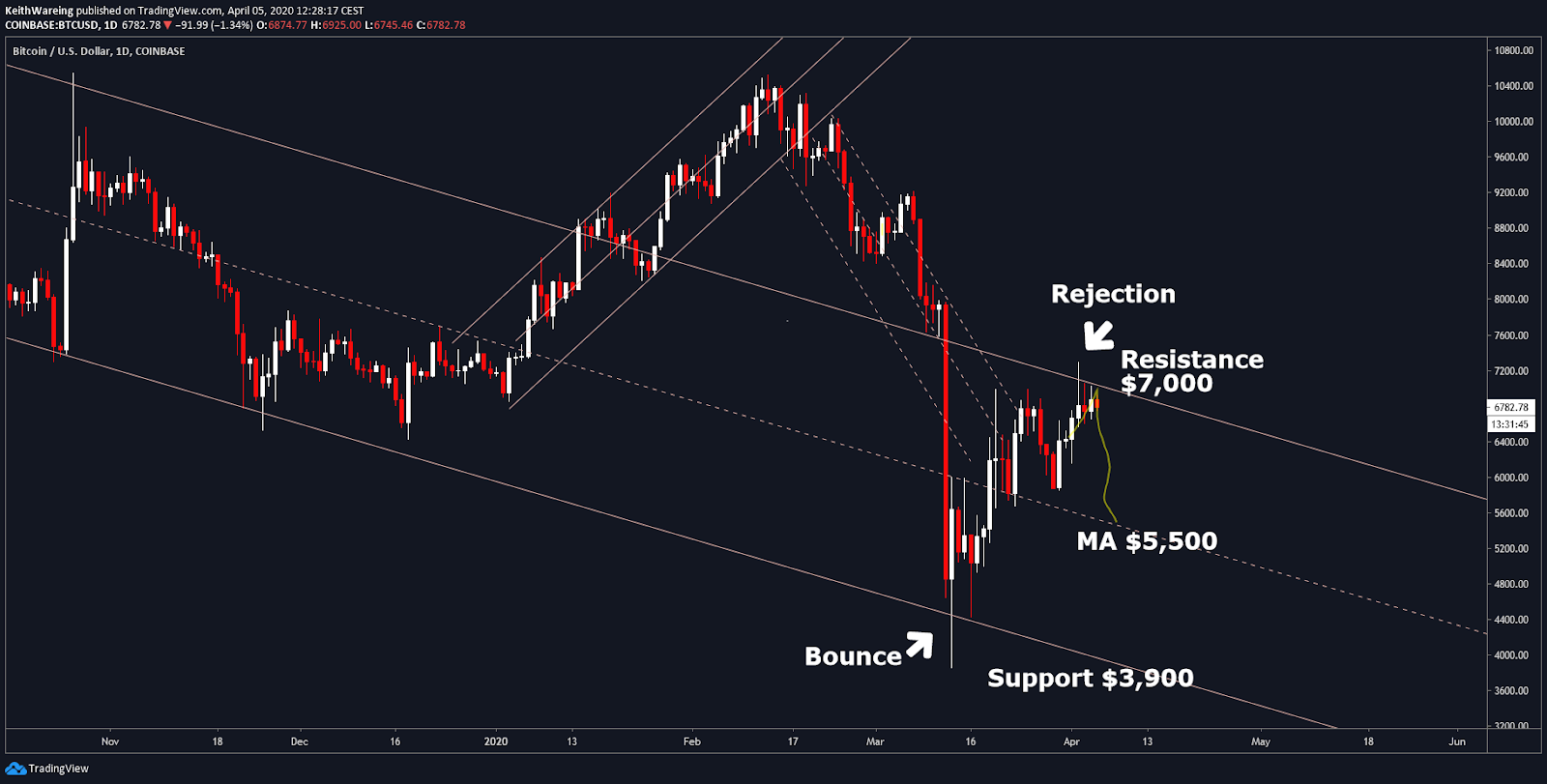

BTC USD daily chart. Source: TradingView

I think it’s safe to assume that Bitcoin has settled back into the descending channel that formed in the second half of 2019. As Bitcoin has now not only bounced off support on the daily, leaving nothing but a wick, but it has now done exactly the same with the resistance.

To me, this validates the channel even more so than before, as the price is currently following a path marked I marked out in yellow, on a video I published to YouTube on March 31. This was one of three scenarios I was waiting on, and the one I felt that was most likely.

As such, since Bitcoin cannot seem to break out above $7,200, it seems probable that bears might be about to regain control ahead of the much-anticipated halving event, and this puts $5,500 as the critical price to hold before cheap corn is back on the menu.

However, many key indicators are contradicting this sentiment.

Is momentum returning?

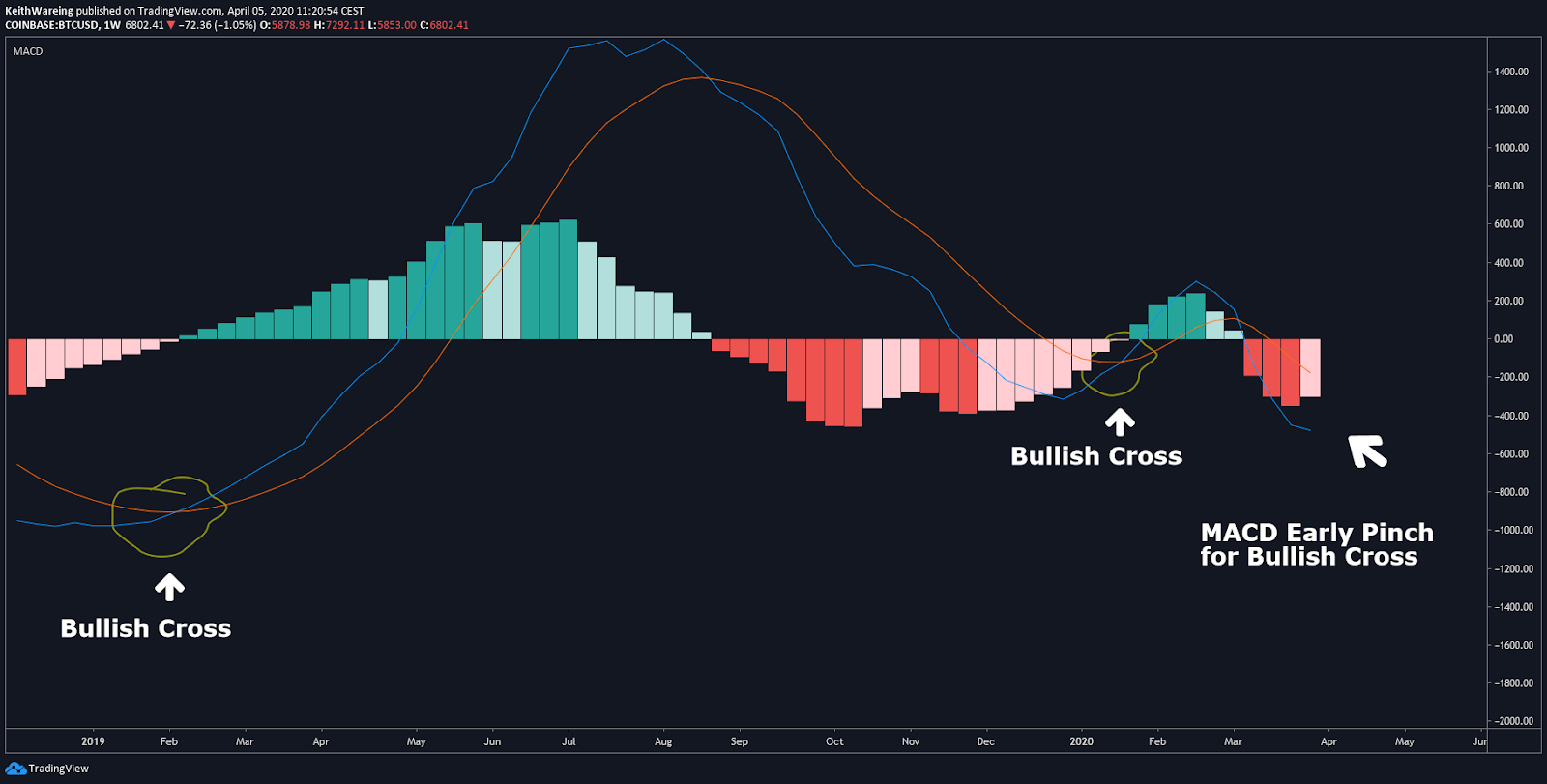

BTC USD weekly MACD chart Source: TradingView

During sideways market periods, it is easy to get chopped up and spat out when working off lower time frames, and often a glance at a higher time frame can help validate your bias. However, one such indicator that isn’t good for bears right now is the weekly moving average divergence convergence (MACD) indicator, as this is now mooing to the herd.

As can be seen from the chart, the MACD is already starting to pinch towards the signal line. Since we have had a relatively bullish week, we should see this move in even more so when the weekly candle closes, bringing us closer to a bullish cross, which typically results in a sustained uptrend, which almost always lasts over a month if not several.

However, right now, there are bigger things happening in the world that may invalidate this as a possibility, and my concern is that we will begin to see a significant reduction in retail buying power due to the rise in unemployment resulting from the coronavirus lockdowns.

While the worldwide quarantine is in the early stages — with many believing it will only last a couple of weeks — you only need to look at China to see that this will last a lot longer, so who exactly would be buying?

The answer may lie in the Relative Strength Index, which could be enticing smart money into crypto.

RSI hinting at a bounce

BTC USD weekly RSI chart Source: TradingView

The last time Bitcoin approached oversold territory on the weekly, it experienced a 300% price increase within six months as can be seen on the Relative Strength Index (RSI) indicator. This is based on the Dec. 10, 2018, pivot from 29.07 on the RSI scale.

However, Bitcoin had already experienced a bounce on the RSI on March 9, 2020, when it was 33.37 on the RSI scale, and even with the colossal dump on March 12, the RSI is still trending upwards. This brings to light two pertinent questions:

- Will Bitcoin see another 300% price rise within a similar timeline after the last oversold pivot?

- Was the price purposely pushed down after March 9 to load up on cheap BTC for a high probability of 3x?

But perhaps another clue as to what can be expected from Bitcoin over the coming weeks can be found in the mining difficulty charts?

Mining difficulty drop is slowing

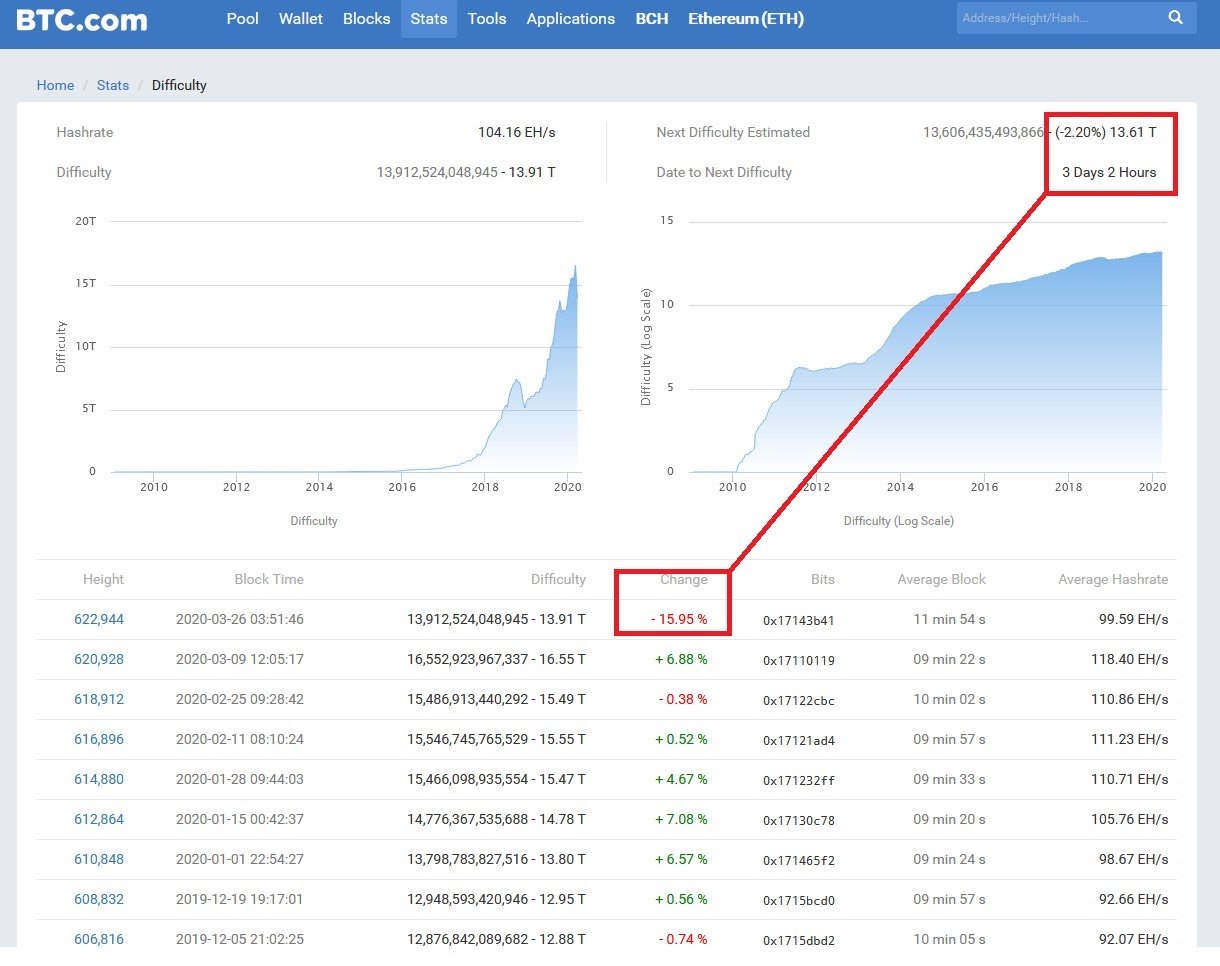

BTC mining difficulty. Source: BTC.com

The Bitcoin mining difficulty dropped by a monstrous -15.95% — the biggest since 2011 — on March 26, an adjustment that helped ease miners’ concerns surrounding profitability. This time last week, it looked as if the mining difficulty would drop by a further -14%.

However, as the week has progressed the adjustment estimate has dropped to just -2.2% and with three days left to go, this could end up closing as a positive adjustment.

You only have to look at the impact the positive adjustments had on the price of Bitcoin this year to see what this could be yet another bullish indicator.

Bullish scenario

All the indicators are bullish, so why does it feel bearish? Right now we are at the top of a valid channel, as such a breakout could well be imminent. For this to happen Bitcoin would need to flip $7K resistance into support and from here $8,200 looks like the next level of resistance we would encounter.

Bearish scenario

The price of Bitcoin has already doubled since its recent bottom, as such a pullback to $5,500 over the next week would be completely reasonable to expect.

If this level fails to hold, then it opens up $3,900 as a possibility. If bulls don’t step in then, I’d be very surprised.

The views and opinions expressed here are solely those of @officiallykeith and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.