The total crypto market cap lost $1.5 billion to its value for the last seven days and now stands at $272.6 billion. The top 10 currencies were mostly in red for the same period with ChainLink (LINK) adding 10.3 percent while Bitcoin SV (BSV) lost 7.6 percent. By the time of writing bitcoin (BTC) is trading at $9,181 while ether (ETH) is hovering around $238. Ripple’s XRP reached $0.198.

BTC/USD

Bitcoin once again hit the $9,300 resistance line on Sunday, July 12, and closed near that mark. It closed the seven-day period with a 2.5 percent of increase.

The BTC/USD pair formed a similar candle, but in the opposite direction on Monday and fell down again to $9,230 after it was rejected near the above-mentioned major horizontal line.

On Tuesday, July 14, it fell down to $9,090 during intraday as bears were able to push the price below the mid-term uptrend line (diagonal support), but bulls successfully recovered in the evening. BTC closed with a small gain to $9,255.

The mid-week session on Wednesday was a bad one for BTC as it moved down to re-test the uptrend line and closed the day at $9,180.

The leading cryptocurrency continued to trade sideways, in an obvious consolidation.

On Thursday, July 16, the BTC/USD pair made another step-down and reached $9,120 closing below the dynamic support for the first time since its inception on May 11.

The Friday session was seen as an effort from buyers to re-gain their positions, but they lacked both momentum and trading volume to do so. The coin moved up to $9,150 but failed to initiate a price reversal.

The first day of the weekend came with a second straight day of gains as BTC climbed up to $9,207 to hit the support turned resistance line before closing at $9,178.

On Sunday, July 19 it continued with its good performance and reached $9,218.

In terms of trading volumes, they picked up the pace and reached the $18-$19 billion zone on Monday after seeing some lows during the weekend. After five relatively stable days, the volumes started to fall on Friday evening and hit a low of $15 billion on Saturday.

ETH/USD

The Ethereum Project token ETH successfully ended the losing streak on Sunday, July 12, and formed a green candle to $242. Still, the coin remained 6.6 percent down on a weekly basis.

The ether fell down to $239 on Monday after bulls failed to extend the weekend gains up to the zone near $250. The coin dropped below the horizontal support but found the needed stability near the previously stable mid-term downtrend. That line was broken on July 6 and since then is acting like minor support near which the price of ETH is gravitating.

On Tuesday, July 14, the trading session was relatively calm with the biggest altcoin registering a small increase to $240.

The third day of the workweek came with a drop to $238 after the coin tested the diagonal support at $236 earlier in the day.

On Thursday, July 16, the ETH/USD pair followed the example of BTC and continued to slide towards the next support level. We saw the price trading below $230 for a short period of time before bulls partially recovered in the evening stopping at $233.

The Friday session found ether still struggling to turn the tide. It made one more step South and ended the workweek at $232.

The weekend of July 18-19 started with a short candle up. The leading altcoin added 1.3 percent to its value and closed at $235 near the diagonal resistance.

On Sunday, July 19 it broke above the mid-term downtrend and closed above it, at $239.

XRP/USD

The Ripple company token XRP remained flat near $0.20 on Sunday, July 12 in a low volatility session. It ended the seven-day period with a 14.2 percent increase.

The coin was in an obvious consolidation since the rapid growth during the previous week. It opened the trading day on Monday by falling down to $0.198. This time the XRP/USD pair was quite unstable and fluctuated in the wide range between $0.206-$0.192.

On Tuesday, July 14 bears successfully pushed the price down to $0.194 in the early hours of trading but lost momentum later in the evening and the “ripple” closed with a short green candle to $0.199.

The mid-weeks session on Wednesday, however, found bulls struggling to establish an uptrend. The XRP token made a reversal to the downside and ended with a loss to $0.197. The 100-day EMA acted as dynamic support and provided the required stability, which prevented further decrease.

On Thursday, July 16, the major altcoin formed its second consecutive red candle on the daily chart and dropped down to $0.194 after reaching $0.187 during intraday.

The last day of the workweek came with a calm session and even though the XRP/USD pair was moving in the $0.191-$0.198 range, it remained flat at close.

The weekend of July 18-19 started positively for buyers and they managed tо re-enter the $0.20-$0.215 support/resistance zone after a very solid upward movement. This resulted in a 3 percent of price increase.

On Sunday, the “ripple” was rejected at the horizontal resistance and closed the session at $0.199.

Altcoin of the Week

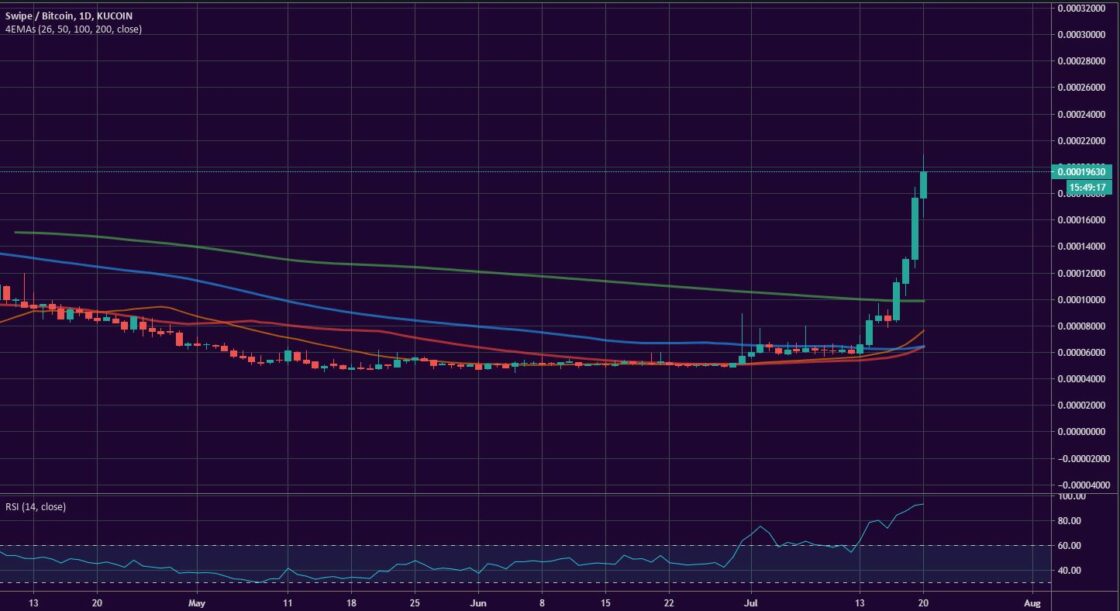

Our Altcoin of the week is Swipe (SXP). The aim of this project is to bring digital assets to the mass consumer by introducing a cryptocurrency to fiat funded debit cards. The product enables end users to buy, sell, or pay with cryptocurrencies at multiple locations worldwide by using an easy crypto-to-fiat conversion.

SXP doubled in value for the last seven days and peaked at $1,31 on Sunday, July 19. It is also 137 percent up for the two-week period reaching #96 on CoinGecko’s Top 100 list with a total market capitalization of approximately $80 million.

The reason for the surge is without a doubt the recent acquisition of the company by the leading cryptocurrency exchange Binance and the SXP listing there.

By the time of writing, Swipe is at 0.000201 against BTC on KuCoin.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4