The total crypto market cap added $11.1 billion to its value for the last seven days and now stands at $274.4 billion. The top 10 currencies were all green for the same period with ChainLink (LINK) and Cardano (ADA) leading the pack with 66.8 and 37 percent of gains respectively. By the time of writing bitcoin (BTC) is trading at $9,281 while ether (ETH) moved up to $242. Ripple’s XRP reached $0.20.

BTC/USD

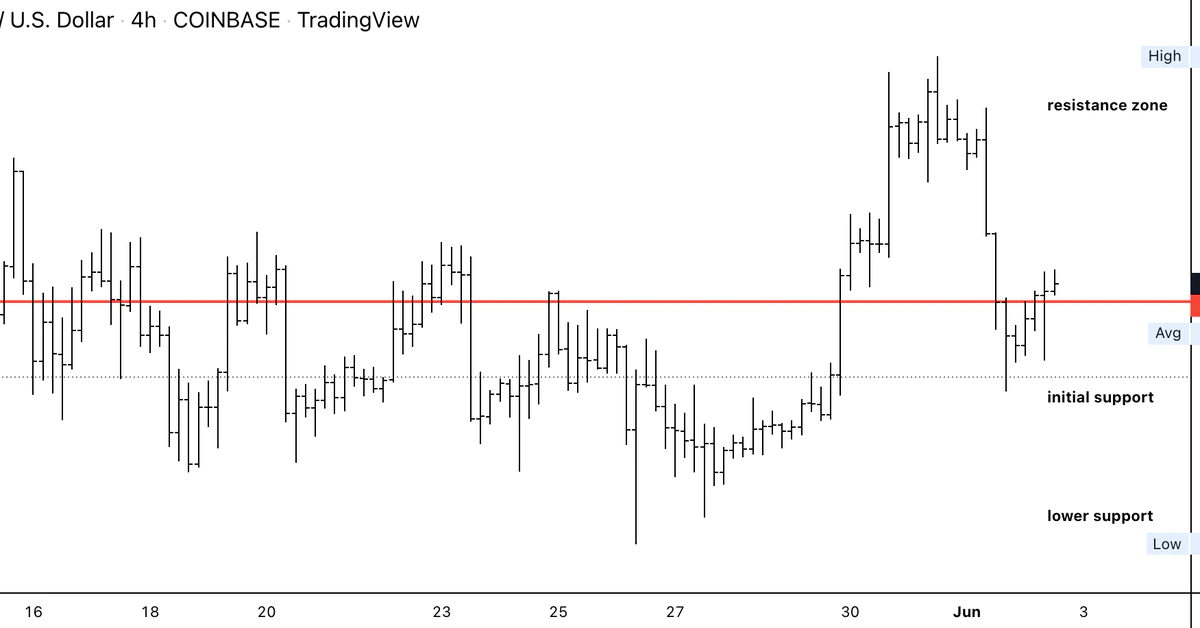

Bitcoin closed the trading session on Sunday, July 5 with a loss to $9,073 and remained flat for the seven-day period. The coin was still trading above the uptrend line coming from the last time it touched $8,600 on May 11.

The BTC/USD pair formed a huge green candle to $9,350 on Monday and added 3 percent to its value for the day. The leading cryptocurrency successfully moved out of the $9,000-$9,300 range and peaked near the 50-day EMA.

On Tuesday, July 7, bitcoin made a pullback down to $9,250 but avoided further losses suggesting the move was just a minor price correction.

The mid-week session on Wednesday was once again positive for bulls and BTC added another 4 percent climbing up to $9,441.

Trading volumes were once again near $21-$22 billion, slightly higher than the average values for the last two weeks.

On Thursday, July 9 BTC experienced a sharp drop to $9,232, which resulted in a 2.2 percent correction.

The last trading day of the workweek came with a rebound to $9,276. Bitcoin dropped to $9,052 or right below the mid-term uptrend line during intraday but managed to partially recover in the evening.

The first day of the weekend brought some red to the charts and the biggest cryptocurrency fell down to $9,236. Then on Sunday, July 12, it once again hit the $9,300 resistance line and closed near that mark. The BTC/USD pair was 2.5 percent up on a weekly basis.

ETH/USD

The Ethereum Project token ETH was gravitating around the 50-day EMA ever since it touched $220 on June 27. The coin formed a short red candle to $227 on Sunday, July 5, and closed the week flat.

The ether opened the new trading period on Monday by following the example of bitcoin and initiating a solid uptrend movement. It climbed up to $241 and added 6 percent to its value. What is more important, the ETH token closed above the mid-term downtrend line for the first time.

On Tuesday, July 7, it dropped down to $235 during intraday but found stability near that level and recovered to $239 in the evening hours of the session.

The third day of the workweek came with more solid gains as the coin climbed up to $247. The price of ETH closed above $245 for the first time in more than a month. The move resulted in a 3.3 percent increase.

On Thursday, July 9, the ETH/USD pair initiated a correction and dropped down to $242 after hitting $238 during intraday.

The coin made another leg down on Friday and reached $241. Bears were even able to push the price all the way down to the $235 support line at some point during the day.

The weekend of July 11-12 started with a third-straight losing session on the daily chart. The ether stopped at $239, which corresponded to a 2.4 percent decrease for the last three days.

On Sunday though, bulls managed to end the streak and formed a green candle to $242. The coin was 6.6 percent down on a weekly basis.

XRP/USD

The Ripple company token XRP fell as low as $0.173 in the early hours of trading on Sunday, July 5, but managed to recover to $0.177 later in the evening, ending the week flat.

The XRP/USD pair started the new seven-day period on Monday by moving up to $0.188. The coin moved out of the downtrend and successfully re-entered the $0.18-$0.19 S/R zone after staying near the $0.175 support line more than a week.

On Tuesday, July 7, it made a short pullback down to $0.184 or near the fast 26-day EMA.

The mid-week session on Wednesday saw a continuation of the bull trend. The “ripple” formed a solid green candle to $0.205 in its best day since April 28. The move resulted in a 11.5 percent of price increase and a breakthrough into the $0.20-$0.21 resistance area.

On Thursday, July 9, the major altcoin closed with a small loss to $0.202 after buyers were rejected at the 200-day EMA in the morning. The session was quite volatile with XRP trading in the $0.212 – $0.197 range.

The last day of the workweek came with another losing session, this time to $0.198. The coin dropped as low as $0.192 during intraday.

The weekend of July 11-12 started with yet another move into the $0.20-$0.215 zone. The XRP/USD pair partially recovered from its losses in the previous session and closed at $0.201.

The trading day on Sunday was marked by low volatility and the price of XRP remained flat, closing the week with 14.2 percent increase.

Altcoin of the Week

Our Altcoin of the week is Elrond (ERD). This little-known cryptocurrency project promises to significantly increase the transaction speed on the blockchain and resolve scalability issues by combining all three sharding types: State, Transactions & Network in a new process called “Adaptive State Sharding”.

ERD added 117 percent to its value for the last seven days and its 164 percent up for the two-week period. It peaked at $0.0134 on Sunday, July 12 and is currently ranked at #56 on CoinGecko’s Top 100 list with a market capitalization of approximately $178 million.

The recent surge is most probably caused by the upcoming Mainnet launch which is scheduled to happen in 17 days.

As of the time of writing ERD is trading at 0.0136 against USDT on the Binance platform.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4