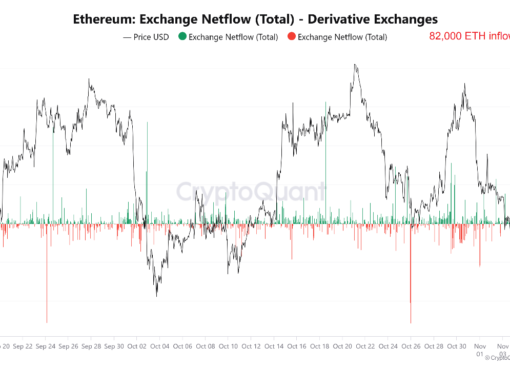

The network value to transactions (NVT) ratio for Bitcoin has reached its highest level in five years, hitting 1,779.542 on Oct. 31st, according to data from Glassnode.

The NVT ratio is used to evaluate whether Bitcoin is overvalued or undervalued. The NVT ratio works similarly to the price-to-earnings (P/E) ratio used in stock markets.

A high NVT ratio indicates that Bitcoin’s market valuation is exceeding the value transmitted through its payment network. This can happen when Bitcoin is experiencing high growth and investors are valuing it as a high return investment, or if prices are in an unsustainable bubble.

Bitcoin’s market capitalization is currently divided by the daily volume transmitted through the blockchain to calculate the NVT ratio. The higher the ratio, the more overvalued Bitcoin may be based on its transaction activity.

The NVT ratio has been climbing steadily over the past year with significant dips interrupting the growth. In addition to the rising NVT ratio, the amount of Bitcoin that has been held or lost long-term also hit a 5-year high according to Glassnode data. This shows strong holder conviction and belief in Bitcoin’s long-term potential.

The combination of the elevated NVT ratio and rise in long-term held coins points to extremely bullish sentiment around Bitcoin currently. While a correction is likely at some point, the network continues to grow at a rapid pace.