Bitcoin holders facing steep tax bills have a new option to ease the burden — by converting what they owe into income-producing mining hardware.

Crypto lending firm Arch is rolling out TaxShield, which uses a specific provision of the U.S. tax code — bonus depreciation under IRS §168(k) — that allows investors to write off the cost of mining equipment against taxable income.

This is how it works: Users post Bitcoin as collateral for an overcollateralized loan from Arch, then use the loan proceeds to buy and host mining rigs through Blockware. The investor gets to deduct the full purchase in year one, potentially erasing hundreds of thousands in taxes while continuing to earn monthly mining rewards in BTC.

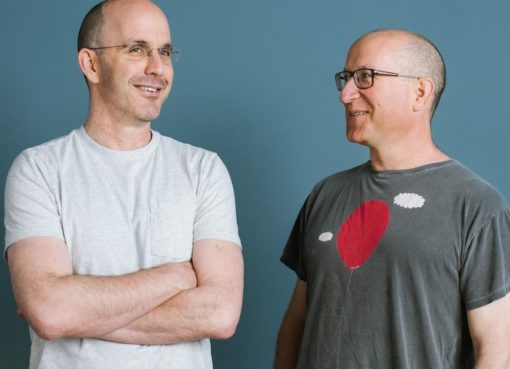

The offering, developed with prominent Bitcoin educator Mark Moss and Blockware, targets predominantly high-income BTC holders, Arch co-founders Himanshu Sahay and Dhruv Patel said in an interview with CoinDesk. A client with $1 million in taxable income could reduce their federal tax bill by roughly $400,000, while maintaining BTC exposure and earning mining income, they explained.

This is part of a broader push by Arch, best known for crypto-backed loans, to build out a suite of niche offerings that is typically available in traditional finance but aimed at high-net-worth digital asset holders.

“A lot of people who have built significant wealth in digital assets over the last 12 to 15 years, have not been able to access the same level of high quality financial services that you can access in the real world,” Sahay told Coindesk.

The company’s long-term goal, the founders said, is to evolve into a private bank-like service for crypto holders: a next-generation wealth management platform that handles lending, income, custody and tax planning.

TaxShield follows the recent launch of “Perpetual Income,” another product built with Mark Moss, which lets bitcoin holders draw recurring, tax-advantaged income without selling their assets.

Last year, Arch secured $70 million in debt financing from Galaxy and a $5 million equity round led by Morgan Creek Digital and Castle Island Ventures to expand its platform.

In the next few months, Arch is planning launching trading and is considering introducing card products beyond that, the co-founders said.

Read more: Bitcoin-Backed Loans Are Going to Get Way Cheaper Around the Globe: Ledn Co-Founder