The Chicago Mercantile Exchange (CME) has recently clinched the title of the largest Bitcoin futures exchange by open interest, overtaking the renowned crypto exchange, Binance.

Data from Coinglass reveals that CME’s open positions have reached roughly $4.04 billion across 108,900 Bitcoin contracts, accounting for 24.22% of the entire Bitcoin futures market.

Open interest in the context of futures trading refers to the total number of outstanding derivative contracts, such as futures, that have not yet been settled. This metric is crucial as it indicates the market’s liquidity level and trading activity.

For BTC futures, it represents the total value of all positions yet to be closed, offering insights into market sentiment and investor behavior. The rise of CME to the top position signifies a notable shift in the market dynamics, indicating a growing preference among institutional investors for regulated derivatives products.

Institutional Appetite For BTC And Implications For SEC Spot ETF Approvals

Binance, once the leader in BTC futures open interest, now trails CME with $3.90 billion in open interest, comprising 23.37% of the total market. This change underscores a significant trend: institutional investors increasingly favor Bitcoin as an investment vehicle, as evidenced by entities like MicroStrategy.

This enterprise software company, known for its substantial Bitcoin holdings, recently acquired an additional 155 BTC for $5.3 million. With Bitcoin’s current trading price above $37,000, MicroStrategy’s investment boasts roughly $1.1 billion in paper profits, underscoring the asset’s appeal to corporate investors.

In October, @MicroStrategy acquired an additional 155 BTC for $5.3 million and now holds 158,400 BTC. Please join us at 5pm ET as we discuss our Q3 2023 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/w7eRUcGobi

— Michael Saylor⚡️ (@saylor) November 1, 2023

The overtaking of Binance by CME in Bitcoin futures open interest has captured market participants’ attention and raised crucial questions among regulatory observers.

Notably, Bloomberg Intelligence ETF research analyst James Seyffart, echoing sentiments from Will Clemente, has speculated on whether CME’s growing Bitcoin futures open interest might address the US Securities and Exchange Commission’s (SEC) concerns about market depth and potential manipulation in Bitcoin markets.

Okay this is interesting… Does this constitute ‘market of significant size’ now? haha https://t.co/eQb7QXvO3H

— James Seyffart (@JSeyff) November 9, 2023

This shift in market leadership from a crypto exchange like Binance to a traditional and regulated derivatives marketplace like CME could signal a maturing BTC market. Such a development might influence the SEC’s stance on approving spot Bitcoin ETFs.

Bitcoin Latest Price Action

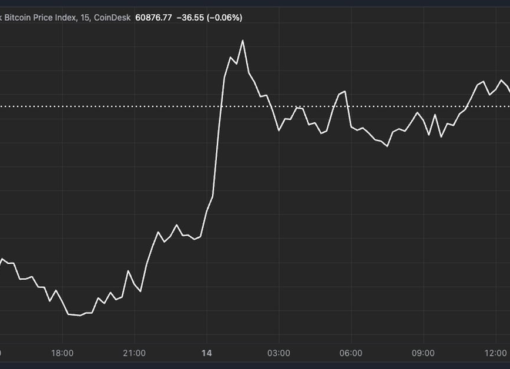

While CME is overthrowing Binance regarding Bitcoin’s open interest, the crypto asset has recently reclaimed its $37,000 zone in the past hours after retracing slightly below that price mark following the quick spike on Thursday.

Notably, BTC currently trades for $37,350 at the time of writing, up by 2.1% in the past 24 hours and nearly 10% over the past 7 days.

Featured image from Unsplash, Chart from TradingView