By CCN Markets: As the resident “Bitcoin Skeptic” here at CCN, it’s my job to provide some level – headed arguments about why you should be extremely careful about buying or trading bitcoin, or any other cryptocurrencies. Don’t be a sucker.

And ignore hype from the media.

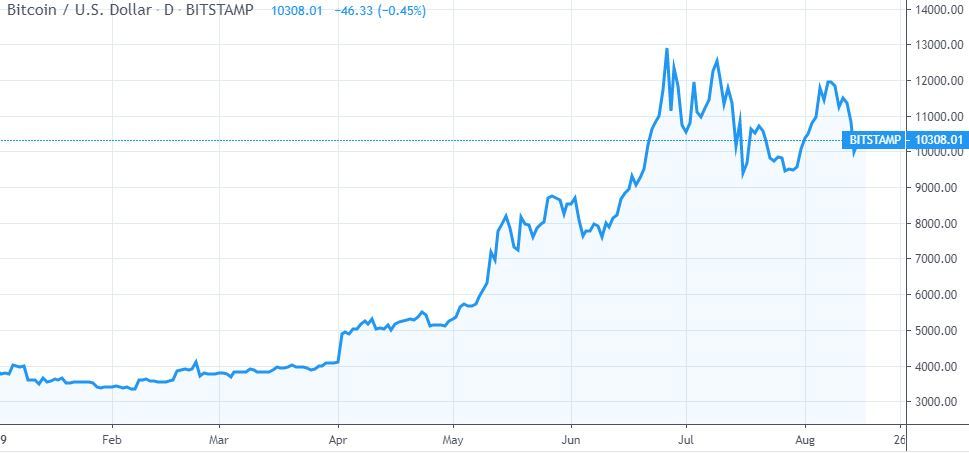

Today I’m focusing on the argument that bitcoin’s limited supply will mean that the cryptocurrency is always in demand. Consequently, ongoing demand with limited supply will drive the coin’s price up over the long term.

There are three gaping holes in this argument.

1. Bitcoin Is Not Unique

The first argument is that bitcoin is not the only game in town. There are numerous other cryptocurrencies, some more well-known than others. Because all of these cryptocurrencies are effectively the same, they are commodities.

The price of bitcoin in US dollars will depend on its exchange rate relative to other cryptocurrencies, and we would expect other cryptocurrencies to continually appear.

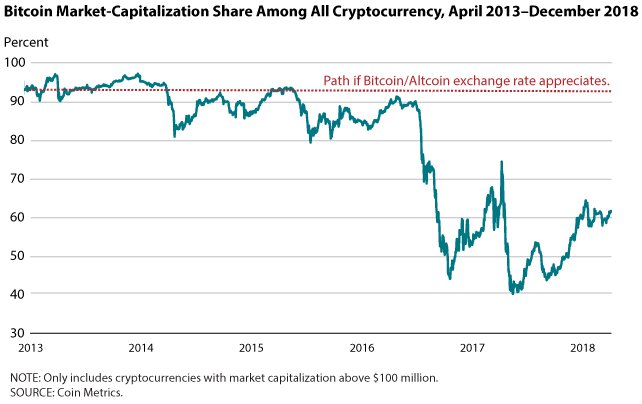

Bitcoin bulls believe the exchange rate between BTC in relation to other cryptocurrencies will constantly adjust in proportion to their relative supplies.

Bulls also say that as the supply of other cryptocurrencies increases, there will be an appreciation in the exchange rate of BTC with respect to these other cryptocurrencies.

Therefore, bitcoin’s share of market capitalization should remain stable over time.

That’s not necessarily true. In fact, we already know it not to be true via this chart:

Even worse, its value with respect to other cryptocurrencies does not even show a vague correlation.

2. No Intrinsic Value Means Demand Will Fade

The second argument is rooted in the fact that neither bitcoin nor any other cryptocurrency has any intrinsic value. Crypto tokens are not beholden to any fundamental economic factors, either.

Bitcoin, like gold and the US dollar and many other securities, trades at a premium to its fundamental intrinsic value. Gold and the US dollar trade a premium because they possess value as exchange units.

So does bitcoin…for now.

Yet gold and the US dollar will retain that exchange unit element, giving them a floor.

3. Bitcoin’s True Value Is Meager

Bitcoin is only useful to people as long as it retains its decentralized database management and its permissionless access.

That may provide it with a floor, but that still destroys the concept that it will have unlimited demand against limited supply.

Ed Butowsky, Managing Partner and Chapwood Capital Investment Management, tells CCN:

“There’s no limit to how many cryptocurrencies will appear on the market. That flood of supply will impact bitcoin eventually. Economic theory also proves that the price of asset that has no backing will always be volatile and unpredictable. Trading and owning bitcoin is thus like playing with fire.”

And I’ll make you one promise: You’ll inevitably get burned.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.

This article is protected by copyright laws and is owned by CCN Markets.