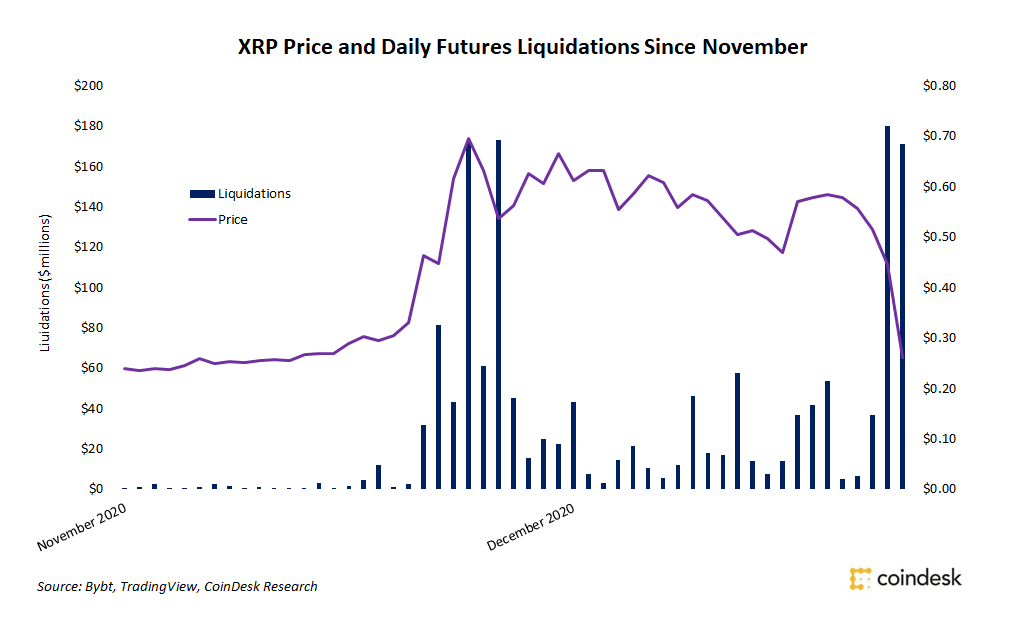

Liquidations for XRP futures contracts have soared at year’s end as bullish signals in November followed by decidedly bearish news in December whipsawed the token’s price.

Over $1.5 billion worth of XRP futures contracts have been liquidated since the start of November, per data from analytics provider Bybt. Barely $700 million in liquidated futures contracts were recorded between March and October.

In November, the price of XRP skyrocketed over 220% to two-year highs just below $0.80 as traders anticipated a scheduled token airdrop event by the Flare Network to all XRP holders. In short, anyone holding XRP would automatically receive a portion of the new Spark token, spurring new buyers to accumulate XRP.

Adding fuel to the frenzy, leading U.S.-based cryptocurrency exchange Coinbase announced its plans to support the upcoming airdrop, per CryptoX’s previous reporting.

“XRP experienced massive upward price movements in November due to retail investors’ interest on the Spark airdrop scheduled for Dec. 12, 2020,” said Florent Moulin, a cryptocurrency researcher at data provider Messari. “The market also saw experienced investors accumulating XRP in anticipation of a retail-led bull market.”

The acute XRP bull trend quickly ended when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple for allegedly violating federal securities laws in selling the cryptocurrency to retail consumers, which raised $1.3 billion over a seven-year period.

Traders reacted negatively to the news as XRP instantly started giving back large chunks of its gains from the previous month. Institutional investors followed suit with cryptocurrency money manager Bitwise liquidating its index’s entire XRP position and prominent brokerages like OSL notifying clients that they have halted all XRP trading.

Both events – the airdrop and the lawsuit – have pushed XRP price volatility to its highest level since July 2018, per Coin Metrics data, with a more than 130% increase in volatility since early November.

Sharp downward price action for XRP is probably due to a combination of factors, Moulin told CryptoX. But the most significant is likely the SEC’s lawsuit against Ripple.

Also noteworthy is increased selling by Ripple co-founder Jed McCaleb, who sold over $120 million worth of XRP in December, Moulin said, an amount over three times larger than previous months.

Some of December’s downward price movement was also caused by XRP holders selling after receiving tokens from the airdrop event, Moulin said.

Regardless of the reason, since news of the SEC’s lawsuit broke, XRP has dropped over 60% and fallen below its pre-airdrop frenzy levels in early November, hitting $0.21 on Wednesday.

And with the price still dropping and over $350 million in futures contracts liquidated the two days before Christmas Eve, XRP investors are left to face a not-so-happy holiday season.