More warnings flashed for Yearn Finance’s governance token YFI even as it showed signs of recovering after an upside weekend session.

Market analyst Teddy Cleps envisioned a waterfall-like trend for YFI/USD, noting that the pair is likely to continue trading lower with anticipations of bouncing back on every support-retest. He further hinted that price floors might trick traders into believing that YFI has bottomed out, but the support with the best possibility of beginning a strong rebound lies $8,000 below the current price levels.

YFI bearish outlook, as presented by Teddy Cleps. Source: YFIUSD on TradingView.com

“[I’m] waiting for 1) Retrace, and 2) Buying contact with resistance (hopefully new support), [followed by] Invalidation back below the dotted line,” tweeted Mr. Cleps. “Patience is key, no need to rush this.”

The analyst appeared confident about YFI’s long-term aspects as a financial asset. Nevertheless, his short-term outlook for the decentralized finance token raised worries about the long period it would take to pare all the losses back to its record high near $44,000.

YFI/USD has corrected by more than 60 percent from the said price top.

Yearn Finance Fundamentals

Calls for another bearish leg for YFI come as traders show uncertainty over the Yearn Finance’s latest mishaps. Alameda Research and FTX crypto exchange CEO Sam Bankman-Fried noted that investors sold-off their YFI holdings because of three separate but converging reasons.

First, Mr. Bankman-Fried noted a negative sentiment across all the DeFi projects. Almost all of them rose exponentially at a rapid pace earlier this year. That stoked profit-taking sentiment among traders, causing steep declines in every overbought asset, including YFI.

Second, the analyst blamed bad press coverages for fueling the token’s correction further. That included Eminence, a gaming project launched by the Yearn Finance creator Andre Cronje, that lost about $15 million worth of funds locked inside its contracts.

Mr. Cronje, nevertheless, was not seeking anyone to put money into his Eminence contracts, he clarified later, adding that people invested out of their own will, knowing that he was running contracts in a test-stage.

The founder later quit social media.

Third, yields offered by Yield Farming projects plunged heavily during the third quarter. As an aggregator, Yearn Finance relied on higher returns to boost the adoption of YFI. The token’s intrinsic value borrows a portion from the yields generated by the Yearn Finance protocol.

New Influx

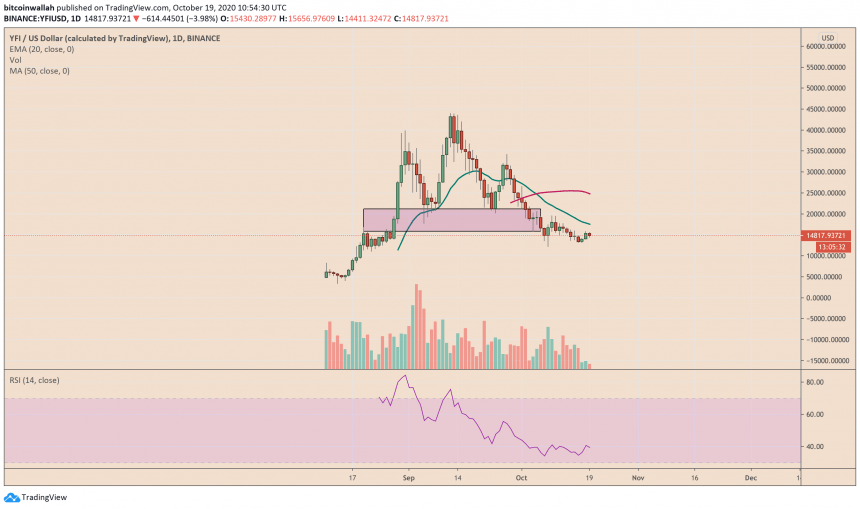

YFI entered a stage where the short positions against it surged higher than the long ones. But over the weekend, the Yearn Finance token defied bearish expectations after rebounding 20.66 percent from its local low at $13,124.

Yearn Finance was on the track of paring part of its weekend gains this week. Source: YFIUSD on TradingView.com

The surge appeared after Polychain, an asset management firm, invested about $5 million into the YF market. Some treated the news as a validation of Yearn Finance’s success as a yield-farming project. Market analyst Chad tweeted:

I have seen some bullish maturing in the $YFI market:

1) The hypersensitive $YFI market is becoming desensitized to sensationalist news.

2) The market is finally accepting that @iearnfinance is not a corp. and Andre is not its CEO

3) Kirby is gone#DeFi— 아론 | 🦸♂️ ΞtherMan | 🍠 Chad | 🐢 $NXM SuperBull (@krugman25) October 19, 2020

Meanwhile, Jason Choi of the Spartan Group warned that traders should not take Polychain’s YFI investment as their cue to long the token. Instead, they should wait for the firm to increase its holdings of the Yearn Finance token.

“In the short term,” he added, “we still need to break this cycle: Collapsing APY -> TVL drain -> fewer fees -> less value capture by YFI. This will likely continue unless yields return and/or yearn strategies diversify beyond reliance on yCRV vault/ yield farming alone.”

YFI was trading at $14,795 at the time of this writing.