- Goldman Sachs is predicting a Democratic clean sweep in November as the best outcome for the U.S. economy.

- Other analysts are predicting something similar, with increased fiscal stimulus seen as the main catalyst for improved GDP.

- But a Biden victory is still far from certain, let alone a Democratic clean sweep.

Goldman Sachs has said a Biden victory in November’s election would boost the U.S. economy by 2% to 3%. The bank claims that a “blue wave” would increase the chances of an extensive stimulus package making it through Congress.

Other analysts have also suggested in recent weeks that a Biden victory would be good for the American economy. Moody’s chief economist Mark Zandi said something very similar two weeks ago, while the stock market itself has been buoyed by Biden’s improved polling.

But while Goldman Sachs claims the probability of a clean sweep is increasing, market signals suggest otherwise. And while the polls still largely point to a Biden victory, we all know what the polls said in 2016.

Goldman Sachs: Biden Victory Would Be Good For GDP

Writing in a note to investors, Goldman Sachs’ chief economist Jan Hatzius highlighted the likely economic benefits that would follow a Biden victory and the Democrats regaining the Senate.

A blue wave would likely prompt us to upgrade our forecasts. The reason is that it would sharply raise the probability of a fiscal stimulus package of at least $2 trillion shortly after the presidential inauguration on January 20.

Goldman would also expect spending on infrastructure — including climate, health care, and education — to increase over the longer term. This would come at the price of tax hikes, although Goldman expects such increases to be focused mostly on corporations and higher-income earners.

Goldman Sachs’ predictions follow in the footsteps of similar forecasts from other analysts. Moody’s also identified a Democrat clean sweep as the best possible outcome in November. Its economists Mark Zandi and Bernard Yaros wrote the following at the end of September:

The economic outlook is strongest under the scenario in which Biden and the Democrats sweep Congress and fully adopt their economic agenda. Greater government spending adds directly to [gross domestic product] and jobs, while the higher tax burden has an indirect impact through business investment and the spending and saving behavior of high-income households.

They’re not the only prominent economists who agree with Goldman Sachs. Harvard economist Jason Furman wrote an op-ed yesterday claiming that “Biden’s Tax Plan Would Spur Economic Growth.” British economist — and former Goldman Sachs’ CEO — Jim O’Neill has argued that Trump has too much of disruptive effect on international trade.

Is A ‘Blue Wave’ Really Likely?

There is a problem with all of these predictions. We don’t really know how likely a Biden victory is in November, let alone a Democratic clean sweep.

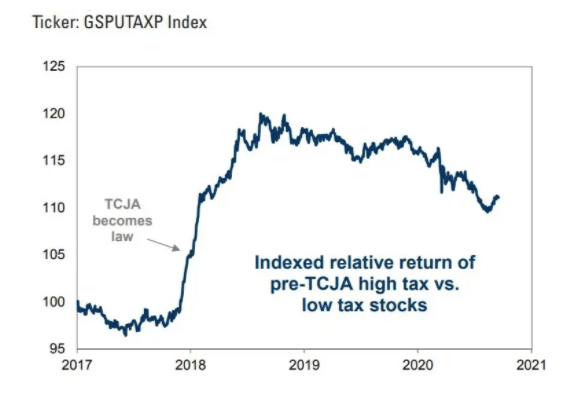

Data indicates that the market has actually become less convinced of a Biden victory in recent weeks. Goldman Sachs’s own research shows that stocks benefitting from tax cuts have recently risen.

This same research also indicates a declining probability of Biden’s proposed tax increase.

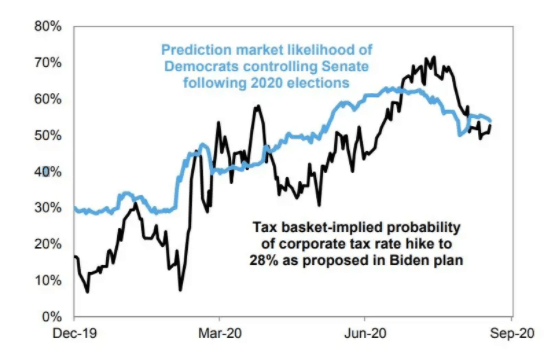

Goldman now thinks a Democratic clean sweep is the likeliest outcome. It has previously warned of a contested election.

But the chart above shows that they’re giving it a probability only slightly above 50%. And this is based on their own forecasts, which have been notoriously unreliable in the past.

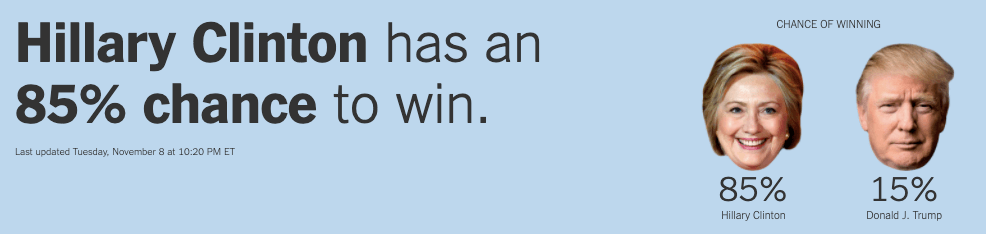

Let’s not forget that polling in 2016 was a wildly off the mark. The New York Times gave Hillary Clinton an “85% chance to win” in 2016, whatever that means.

A blue wave may be the best possible outcome for the American economy. But let’s not count our eggs before they’ve hatched.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.