- Wall Street anticipates a vaccine by November ahead of the presidential election.

- Institutional investors are likely to enter the stock market as vaccines offset weak fundamentals.

- Nations can reopen their economies freely with vaccines, lowering the threat of a second virus outbreak.

After a historic rally, the U.S. stock market has lacked conviction in recent weeks. But, crucial data points suggest that it is about to change.

High-profile analysts at Jefferies and Raymond Jones believe the U.S. will see one or two vaccines before the 2020 presidential election.

Analysts say both the Trump administration and pharma giants have all the incentives to push out a vaccine to November.

Will Hedge Funds Finally Re-Invest in the Stock Market?

Despite the market’s strong rally since April, many hedge funds and billionaires are still fearful of equities.

On June 4, Dymon Asia Capital founding partner Danny Yong said the stock market is not pricing in the high unemployment rate and economic consequences of the pandemic.

Yong said:

I believe we will see new lows in global equity markets later this year. As March has shown us, prices cannot diverge from fundamentals for too long.

Institutional investors are scared of the stock market, mainly due to weak fundamentals.

As long as the pandemic is still around, there will always be severe risks of a steep economic downturn and a cascade of bankruptcies for small businesses.

A vaccine is one variable that may offset most of the concerns hedge funds have towards the market.

Major economies can open freely with a low probability of a second virus outbreak once a vaccine is developed, produced, and distributed.

For now, Wall Street is hopeful that the Trump administration will work aggressively to create a vaccine in the next five months.

Both Moderna and Pfizer, which have been working on two separate vaccines, reportedly saw definite progress in recent months.

The U.S. government’s plan to fully reopen the economy and the positive sentiment around vaccines fueled the momentum of equities in May.

Jefferies healthcare strategist Jared Holz said:

All the data points we’ve collected make me think we’re going to get a vaccine prior to the election. [The Trump administration is] incredibly incentivized to approve at least one of these vaccines before Nov. 3.

Raymond Jones’ policy team further emphasized that the Food and Drug Administration (FDA) is feeling significant pressure from the White House to issue an emergency use authorization (EUA) for a vaccine by November.

Asia Ramps Up Vaccine Production, Putting Pressure on the U.S.

Japanese biotech firm AnGes reportedly plans to prepare 1 million vaccine doses by March 2021, rivalling major pharmaceutical companies in the U.S., U.K., and Switzerland.

Nikkei reports that the company initially said it would distribute 200,000 vaccines by the first quarter of next year. The forecast of 1 million doses is five times larger than the initial estimate.

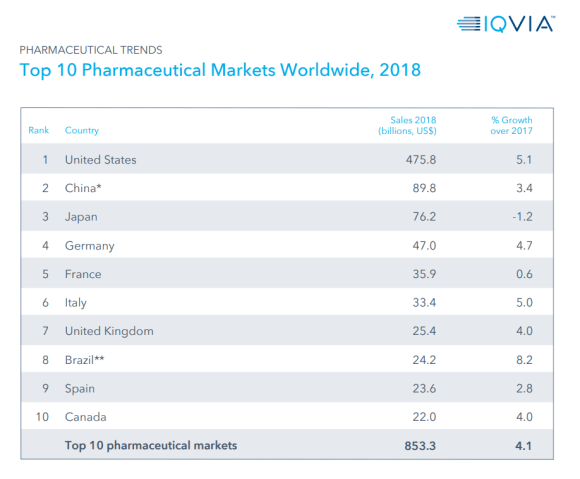

The U.S. has the incentive to be the first nation to distribute vaccines en masse as the largest pharmaceutical market in the world. It remains to be seen whether a U.S. company will be the first to penetrate the market.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned companies.