Popular decentralized exchange Uniswap and Ethereum scaling solution Polygon announced that all Uniswap V3 contracts are officially deployed to the Polygon mainnet on Wednesday, a few days after UNI holders voted to pass a governance proposal to do so.

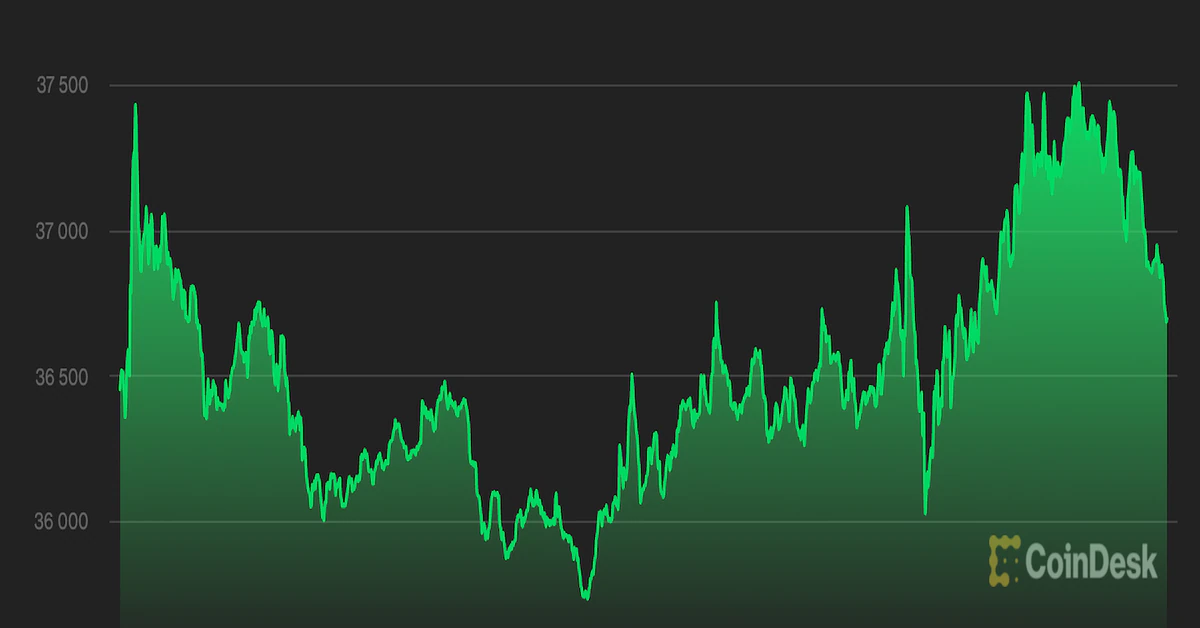

Amid the latest development, prices of MATIC and UNI were both in the green, with MATIC, the native assets of the Polygon network, hitting a fresh all-time high of $2.66 earlier today.

“Ethereum introduced a noble vision of an open, borderless economic system accessible to everyone,” Mihailo Bjelic, co-founder of Polygon told CoinDesk in a Telegram chat. “With the increased usage, fees on Ethereum layer 1 have effectively ‘priced out’ most of the users.”

The Polygon version of Uniswap aims to change that, he added.

“With this deployment, Uniswap as the flagship Ethereum application returns back to the original vision and again offers low fees and open access to everyone,” Bjelic said.

As the largest DEX by trading volume, Uniswap is already deployed on two layer 2 solutions, Arbitrum and Optimism. According to data from Defi Llama, about $62.19 million in value is locked on Uniswap on Arbitrum, while roughly $36.94 million worth of tokens are locked on the Optimism version.

Both numbers are much smaller than the total value locked (TVL) on the Ethereum mainnet version of the Uniswap: a staggering $8.75 billion.

That said, Uniswap’s TVL lags behind Curve’s $22.23 billion, the biggest DeFi protocol by that metric. Curve currently supports several blockchains and layer 2 solutions including Avalanche, Harmony and Polygon.

Bjelic, the Polygon co-founder, told CoinDesk they believe Uniswap will be hugely successful on Polygon, citing the network’s already successful DeFi ecosystem system. Polygon is currently the No. 7 chain by TVL, per Defi Llama data.

A report by blockchain data firm Chainalysis earlier this year said DeFi is still dominated by experienced crypto traders and investors, partly due to the costly transaction fees on the Ethereum blockchain. Scaling projects like Polygon have been benefited from Ethereum’s congestion problem.