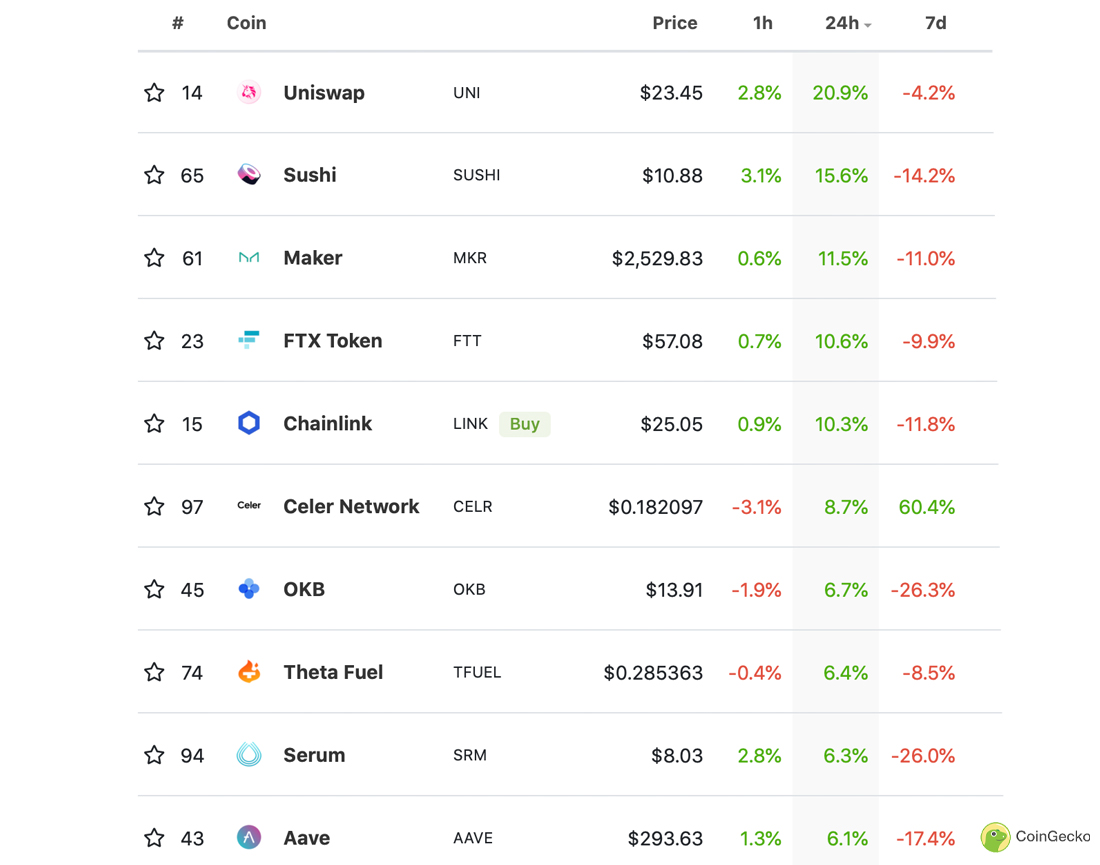

While a number of popular crypto-assets like bitcoin have been consolidating, decentralized finance (defi) tokens have captured significant gains during the last 24 hours. A few defi crypto assets have seen double-digit gains and the leader of the pack is Uniswap which has jumped 20.9% in the last 24 hours.

Uniswap’s Defi Token Leads the Percentage Gains on Sunday

Decentralized finance (defi) tokens are making waves during Sunday’s crypto trading sessions, as a dozen defi tokens have seen better gains than most of today’s well known digital assets.

While bitcoin (BTC) has risen 2% today and ethereum (ETH) is up over 3%, crypto tokens like uniswap (UNI) and sushi (SUSHI) have seen double-digit gains. Uni has jumped over 20% during the last day while SUSHI is up 15.6%.

Both UNI and SUSHI are followed by coins like maker (MKR) up 11.5%, ftx token (FTT) up 10.6% today, and chainlink (LINK) which has risen 10.3% on Sunday. Uniswap (UNI) has a $12.1 billion market valuation today and around $1.1 billion in global trade volume.

FTT has a market valuation of around $6.8 billion and $869 million in global trades. LINK’s market cap on Sunday is $11.4 billion with $1.8 billion in 24-hour trade volume. UNI, SUSHI, FTT, and LINK are followed by celer network (CELR), okb (OKB), theta fuel (TFUEL), and serum (SRM) respectively.

Defi Total Value Locked Spikes 6% in 2 Weeks, Terra’s 7-Day Defi TVL Surges

On September 10, 2021, metrics from defillama.com indicated that the aggregate total value locked (TVL) in def across a myriad of chains was around $163 billion. On Sunday, September 26, the aggregate total value locked in defi is $174.39 billion which is an increase of 6.987% in just over two weeks.

In the past 24 hours, the entire defi TVL has increased by roughly 0.74%. The platform Curve.fi dominates the pack of decentralized apps (dapps) that make up the entire defi TVL with 7.78% of the aggregate.

As far as the defi TVL on Ethereum there’s $124.31 billion on September 26, which is an increase of 2.53% in a single day. However, the Ethereum defi TVL during the course of the trailing seven days has shed 5.76%. The Binance Smart Chain (BSC) TVL on Sunday is roughly $15.92 billion and up 0.05% today.

Seven-day stats show BSC has lost 13.57% of the blockchain’s TVL held in defi. Solana (SOL) has seen a weekly dip in TVL as well, losing 12.27% of its TVL value in seven days with an aggregate total of around $8.83 billion. Terra has seen a seven-day increase as it jumped 7.30% to $8.51 billion.

What do you think about the recent surge in defi coin values and the defi TVL increasing over 6% since September 10? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko, Defillama, Tradingview,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.