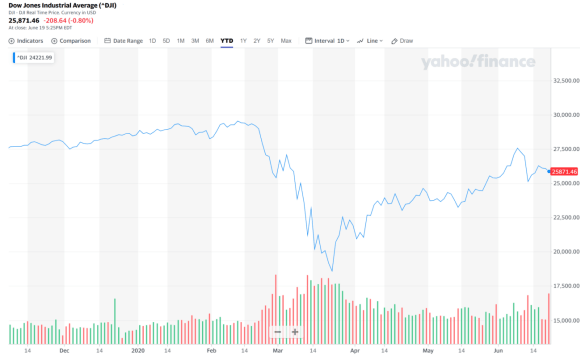

- The U.S. stock market fell over 6% after the Fed’s balance sheet started to contract.

- The correlation leaves equities vulnerable to a steep correction if the Fed slows down its asset purchases.

- The addition of 30,000 new virus cases in the U.S. on a single day may put even more pressure on equities.

The Federal Reserve’s balance sheet has been showing an uncanny correlation with the U.S. stock market. In the short-term, this trend may spell trouble for equities.

Since June 8, the U.S. stock market is down 6.2%. The correction came immediately after the Fed’s balance sheet stopped expanding.

The correlation indicates that stocks could see a severe pullback if the Fed halts its aggressive liquidity measures.

Are the Fed’s Current Actions Enough to Sustain the Market Uptrend?

For now, the Fed expects to continue providing enough stimulus to the U.S. financial market.

For the central bank, high unemployment is the most significant concern. The upward momentum of the stock market is merely a byproduct of the Fed’s attempt to lower jobless claims.

Based on Minneapolis Fed President Neel Kashkari’s recent comments, the central bank is unlikely to return to conventional monetary policy anytime soon.

As long as the Fed does not become cautious, the stock market is in an ideal position to climb upwards.

Central bankers still expect unemployment to rise. For investors, this is a clear sign that monetary policy will remain ultra-loose in the near term.

Unfortunately, my base case scenario is that we will see a second wave of the virus across the U.S., probably this fall. If there is a second wave, I would expect the unemployment rate to climb again.

While the stock market’s trend remains strong, analysts say it can reverse quickly. The market is overly dependent on the Fed, which leaves equities vulnerable to a steep downtrend.

Preston Pysh, co-founder of The Investor’s Podcast Network, said:

The FED’s balance sheet was slightly down this week for the first time since the start of the 3 trillion dollar fiat tsunami injection over the past 3 months. The stock market peak coincided with the FED balance sheet peak. It doesn’t take much to understand what’s happening.

The addition of 30,000 new virus cases in the U.S. on a single day puts even more pressure on the stock market, which has been rallying since April on optimism for a full economic reopening.

A Second Wave is Not a Myth

A stock market that is reactive to the pandemic can easily fall if new cases start to climb once again.

Not only are vaccines far out from distribution, existing drugs like hydroxychloroquine reportedly do not help patients of the virus.

The National Institutes of Health says:

A data and safety monitoring board met late Friday and determined that while there was no harm, the study drug was very unlikely to be beneficial to hospitalized patients with Covid-19.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.