For critics of Tether, the new economy of digital assets is based on the world’s oldest profession: real estate speculation.

Crypto markets took a dip Thursday just around the time it was reported that China’s Evergrande Group was on the verge of defaulting on a bond payment. While the embattled housing giant ultimately made its scheduled payment of $148 million, questions persist about the long-term prospects for it and other real estate developers in China. Bitcoin, meanwhile, remained above all-time highs by about 5.5%.

This article is excerpted from The Node, CoinDesk’s daily roundup of the most pivotal stories in blockchain and crypto news. You can subscribe to get the full newsletter here.

What does one have to do with the other? Well, think of a detective in a movie who takes a corkboard, some photos and a lot of white strings to put all the parts of a story together.

It goes something like this: About half of all bitcoin trades against stablecoin tether (USDT), according to data from CryptoCompare. About half of Tether’s roughly $75 billion in assets, which back USDT, is in commercial paper. While Tether (the company) said back in September it doesn’t hold Evergrande commercial paper, about a month ago Bloomberg BusinessWeek reported Tether’s holdings included “billions of dollars of short-term loans to large Chinese companies – something money-market funds avoid.”

So while Evergrande may not be on the books, the concern is that the commercial paper may be from other real estate firms.

Scaled to size

Understanding the magnitude of size and growth of USDT, bitcoin and Chinese commercial paper may help give some perspective to the latest headlines.

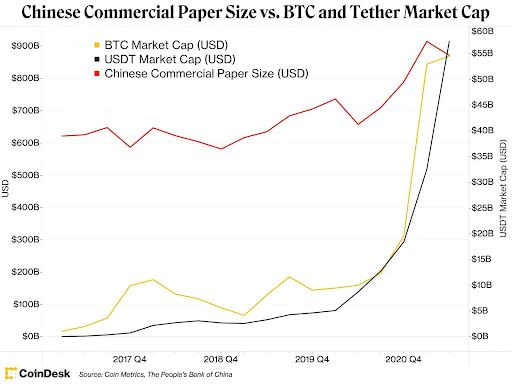

Just two years ago, USDT’s market cap was a mere $4 billion. Thus, it has grown 19-fold in a matter of two dozen months.

In those two years, bitcoin’s market cap has gone up eight times, from $159 billion to $1.3 trillion.

Meanwhile, based on data from the People’s Bank of China, Chinese commercial paper ended Q2 in 2021 at around $900 billion, up from just shy of $700 billion that same quarter in 2019, a gain of less than a third.

In absolute terms, the sizes look something like this:

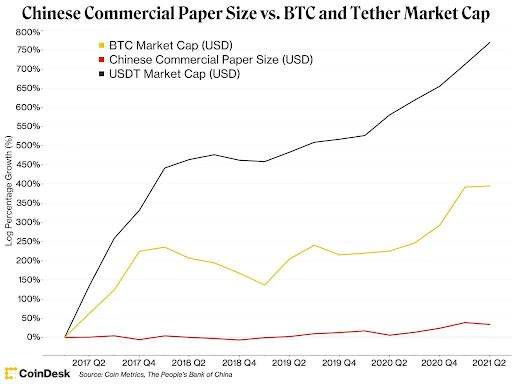

A chart like the one above doesn’t give a sense of the rate of growth for each, but this does:

Bitcoin and USDT look somewhat related, but does one move as a function of the other? Perhaps, if one were to scale tether on a different Y-axis like so:

Perhaps the tail wags the dog. Or perhaps there are other ways to explain things.

Read more: A Bridge Called Tether

Tether’s defenders can say that even if one were to assume Tether spent half of every dollar it is said to have taken in over the past two years on commercial paper in China, that would be under one-fifth of new issuances and 4% of the market.

That should refute anyone who could try to argue USDT may have fueled China’s boom in commercial paper. Yet, does Tether truly own a lot of Chinese commercial paper? Can it be liquidated to meet redemptions? Those questions can only be answered with a little more transparency from the stablecoin’s issuer.

Given Tether’s record to this point, that may take a while.