- After a dramatic stock market crash, the Trump administration is trying to distance itself from the dip on Wall Street.

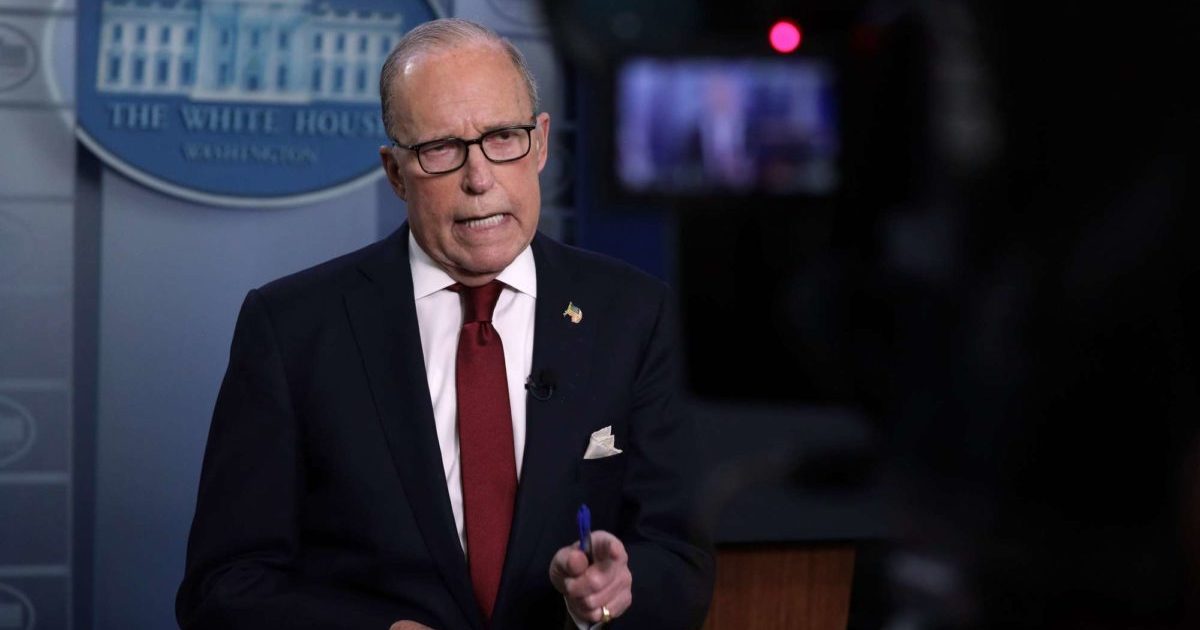

- Larry Kudlow spoke to reporters on Friday and claimed the government does not control the economy.

- This comes just two weeks after President Trump blasted Barrack Obama for stealing credit for “his” rally in stocks.

White House economic advisor Larry Kudlow made an astonishing U-turn on Friday, complaining that the government shouldn’t be blamed for the direction of the stock market or the economy.

After years of taking credit for the huge rally in the Dow Jones and S&P 500 at virtually every opportunity, the Trump administration has abruptly changed course in response to this week’s stock market crash.

White House Washes Its Hands of the U.S. Economy

Suggesting that stocks look “cheap” and repeatedly urging investors to buy the dip has been the main message coming from Donald Trump’s economic team over the last few days.

After failing to pin the blame for the stock market’s plunge on the Democratic debate, the new marching orders are simple: Abandon ship.

Burdened with a media blitz to try and soothe a worried Wall Street, Larry Kudlow ha a lot on his plate. And the fatigue may be setting in.

After appearing to forget that he was on the coronavirus task force, Kudlow made the astonishing claim:

Well, you know, the government doesn’t run the economy, we can learn and report on it, but we can’t control it.

That may be true, but it marks an incredible – and hilariously abrupt – about-face for Kudlow and the Trump administration as a whole.

Economists warned President Trump from year one that tying his success to the stock market would be an extremely dangerous tactic.

The flip-flop is especially astounding given Trump’s almost daily tweets about how significant an impact he has had on the U.S. economy.

Just ten days ago, Trump blew up on Twitter when former President Barack Obama allegedly tried to take some credit for the current state of the economy.

Trump said he deserved all the credit for himself.

But the White House is singing a different tune now.

Kudlow Compares Trump to Reagan, Recalls 1987 Stock Market Crash

Kudlow wasn’t ready to entirely give up on stocks, though.

Comparing this week’s downturn to the 1987 Dow Jones crash under the presidential administration of Republican hero Ronald Reagan, he suggested the sell-off would be a momentary blip on Wall Street’s long-term bullish trend.

I was a Reagan cub-scout way back when, and I remember the 1987 market crash, and I remember President Reagan saying the economy was sound and the economy grew 3% or 4% after that… I don’t think this short term stock market plunge is going to have any effect.

A master of optimism and charm, Reagan ran on the economy, but he picked his moments to boost sentiment much more carefully than the current president.

Investors are so numb to the “Trump pump” on Twitter that his remarks are largely ignored as political advertisements these days.

Donald Trump must be incensed that he can no longer claim exponentially better stock market gains than Obama. And he must be even more terrified that if the coronavirus crash continues, he won’t be able to point to the Dow as the main selling point for his reelection.

You’d hope this black swan event would be enough for Trump and his advisors to learn their lesson.

Yet if the Dow Jones roars higher next week, and we see an end to the global stock market crash, Kudlow will no doubt be back on TV claiming credit for the economy again.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.

This article was edited by Josiah Wilmoth.