Ethereum’s network is experiencing its busiest days in 10 months amid increased issuance of stablecoins and the runup to Ethereum 2.0.

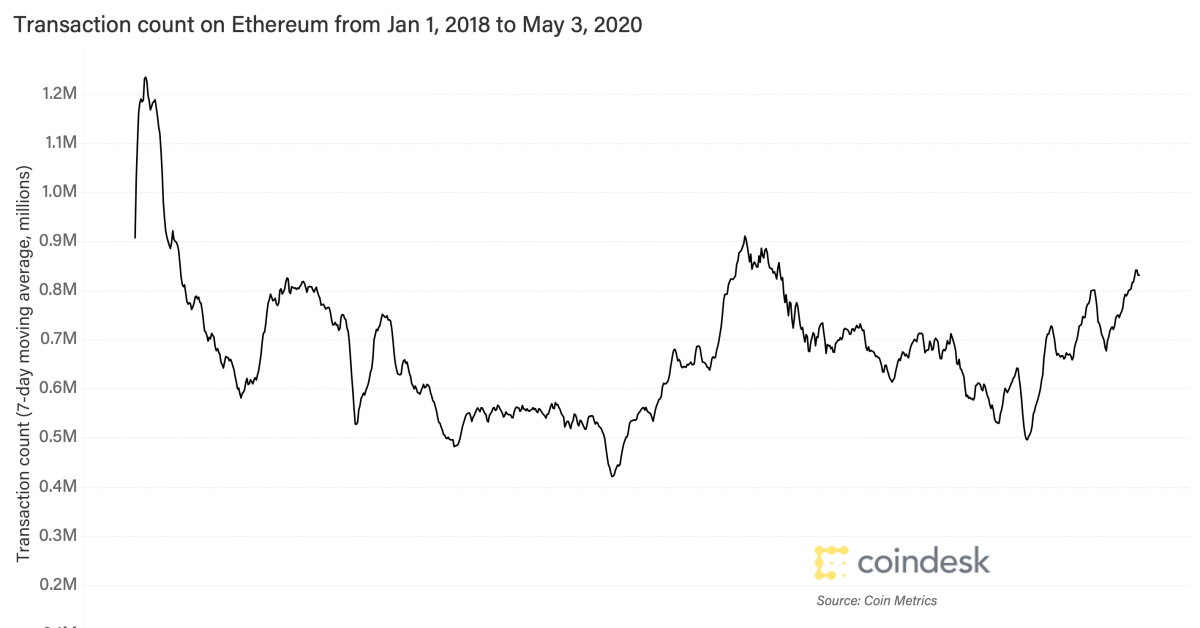

The seven-day moving average of the total number of confirmed transactions on Ethereum’s blockchain rose to 845,400 on April 30 to hit the highest level since July 1 , 2019, according to the data source Coin Metrics. As of Sunday, the average was 837,100.

The transaction count had declined to 12-month lows in February. Since then, however, it has surged by 72%.

“The recent Cambrian explosion of stablecoin issuance has been a considerable driver of on-chain activity,” said Lucas Nuzzi, network data product manager at Coin Metrics, a provider of crypto financial data.

Stablecoins are cryptocurrencies that offer price stability characteristics by pegging their value to some external reference, usually the U.S. dollar.

Tether (USDT), trueUSD (TUSD), gemini dollar (GUSD), paxos standard (PAX), binance USD (BUSD), USD coin (USDC), Huobi’s HUSD, and MakerDAO’s DAI are some of the best-known stablecoins. These major stablecoins are based on Ethereum’s blockchain.

The market capitalization of major stablecoins has risen from $3.5 billion to over $7 billion over the last two months, according to Coin Metrics.

Also, as of April 21, the market capitalization of all stablecoins operating on Ethereum’s blockchain was over $9 billion, according to crypto investor and founder of Mythos Capital Ryan Sean Adam.

The uptick in the demand for and the issuance of stablecoins has coincided with the coronavirus-induced dollar shortage influencing the global economy.

Since the start of the pandemic, indicators of dollar funding costs in foreign exchange markets have risen sharply. For instance, three-month euro-dollar swaps, a widely followed indicator of dollar-funding costs in the foreign exchange markets, rose to a nine-year high of 150 basis points in March.

While the dollar-funding stress has eased somewhat over the past few weeks due to the U.S. Federal Reserve’s massive liquidity injections, the crisis looks far from over for emerging markets, which lost around $1.5 billion in forex exchange reserves per day in March, according to Bloomberg.

Some observers think the crisis has boosted stablecoins’ appeal as less-volatile instruments of transferring value on-chain.

“The economic impacts of COVID-19 have created USD shortages around the world, especially in emerging markets,” said Nuzzi. “As such, USD stablecoins could be providing an alternative to physical dollars in jurisdictions experiencing stricter capital controls and currency devaluation.”

Yet, the increase in transactions may not be entirely due to stablecoin growth. Connor Abendeschien, crypto research analyst at Digital Assets Data, cited Ethereum’s impending transition from the proof-of-work (PoW) to proof-of-stake (PoS) mechanism, dubbed Ethereum 2.0, as one of the possible reasons for the rise in Ethereum’s on-chain transactions.

In PoW, miners solve cryptographically hard puzzles to complete transactions on the network and get rewarded. In PoS, instead of miners there are validators, which lock up some of their ether as a stake in the ecosystem. A block validator is then selected based on its economic stake in the network via a pseudo-random election process.

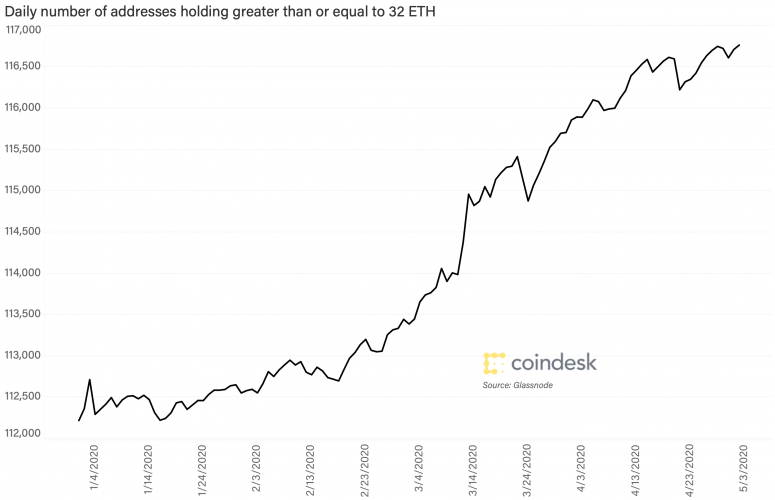

Backing Abendeschien’s argument is the recent sharp rise in the number of addresses holding more than or equal to 32 ETH, an amount a holder is required to maintain as a balance to become a validator on 2.0.

The number of validator addresses rose sharply in the days leading up to the launch of the testnet version of Ethereum’s 2.0 upgrade on April 18 and hit a record high of 11,6750 on April 28. That boosted the transaction count, according to data provided by the blockchain intelligence firm Glassnode.

Broad range intact

While there has been a recent uptick in the transaction count, the metric is still within the broad range of 900,000 to 400,000 seen since February 2018.

Gavin Smith, CEO of cryptocurrency consortium Panxora, expects the transaction count to grow organically in the future. “One important factor to take into account is that Ethereum is still by far the favored smart contract vehicle in the crypto space and the upcoming transition to PoS will help the network cope with the ever-growing demand,” said Smith.

Also, a rally in ether’s price could boost transaction count. “On-chain activity tends to follow price,” said Wilson Withiam, research analyst at Messari, a provider of crypto data, tools, and research.

The recent growth in Ethereum’s transaction count is accompanied by a stellar rise in price. At press time, the second-largest cryptocurrency is trading around $205 on major exchanges, representing a 127% gain on the low of $90 observed on March 13.

Disclosure Read More

The leader in blockchain news, CryptoX is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CryptoX is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.