Solana (SOL) is trading just 6% below its all-time highs, fueled by a remarkable 16% surge from the $212 demand level. The rally has caught the attention of traders and investors alike, as SOL’s price action showcases a strong uptrend.

Top crypto analyst Johnny shared his technical analysis on X, predicting that Solana may retrace to its previous yearly highs before launching a new attempt to break its all-time highs. This forecast comes during a period of euphoria, with SOL delivering a stunning performance by soaring over 55% in less than two weeks.

Related Reading

The rapid climb has positioned Solana as one of the market’s standout assets, driven by increasing demand and strong fundamentals. However, Johnny’s outlook suggests a healthy pullback could be on the horizon, potentially offering a key buying opportunity before SOL challenges its historic price levels.

With SOL’s recent performance reigniting optimism in the crypto space, all eyes remain on its ability to maintain strength in the face of potential volatility. Will Solana defy expectations and reach new heights, or is a cooldown inevitable?

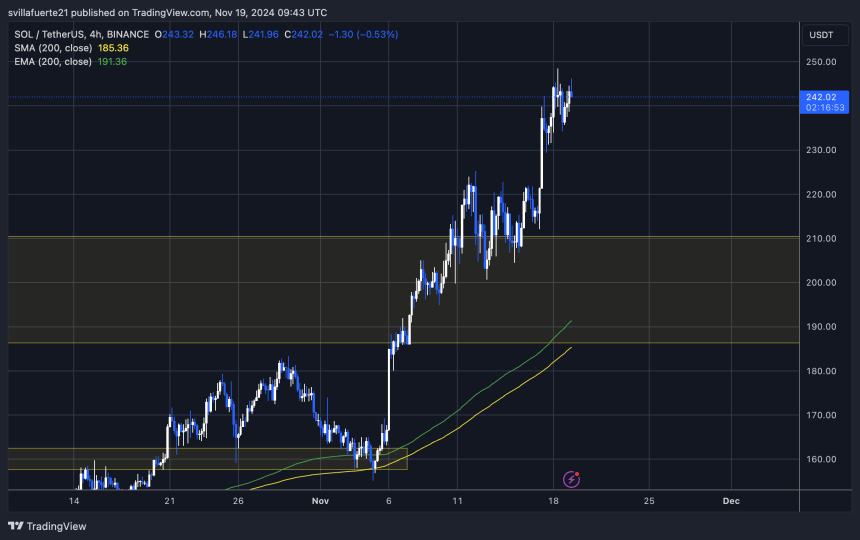

Solana Testing Critical Supply Level

Solana is testing a critical supply level just below $250, following a significant surge that has propelled it closer to its all-time high (ATH). This level serves as a key battleground, marking the last stronghold for sellers before SOL enters price discovery—a phase where it could carve out new highs.

Crypto analyst Johnny recently shared his perspective on X, highlighting that while Solana’s price action remains robust, a temporary retrace to lower levels may be necessary to gather momentum.

According to his technical analysis, SOL could dip into the $220 demand zone, a level he sees as crucial for buyers to step in and refuel the rally. Johnny predicts that Solana could stage a strong recovery from there, targeting an aggressive move above its ATH at $260.

Solana’s bullish momentum cannot be ignored despite the possibility of a retrace. The asset’s price action suggests a 6% surge above its ATH is well within reach if market conditions remain favorable. Continued strength in the broader crypto market could amplify buying pressure, helping SOL shatter its ATH and enter uncharted territory.

Related Reading

For now, all eyes are on Solana’s ability to navigate this supply zone. A successful breakout could pave the way for new highs, while a retrace to $220 might provide an ideal launching pad for the next leg of its rally. Either way, SOL’s trajectory highlights its growing prominence in the market as traders anticipate its next big move.

Price Action Details

Solana is trading at $242, holding steady after a few days of consolidation below the $250 mark. This level represents a critical resistance as SOL inches closer to its all-time high (ATH). Despite this pause, the price action remains robust, supported by the broader bullish sentiment across the crypto market.

However, SOL’s ability to break above $250 will be a key factor in determining its next move. A successful push beyond this level could set the stage for a retest of its ATH and potentially a rally into price discovery. Conversely, if SOL fails to overcome this resistance, a retrace to lower demand zones becomes likely.

Related Reading

In this scenario, the next logical support level to watch would be around $222, where buyers could step in to reignite momentum. Should the retrace extend further, SOL might revisit previous yearly highs at $210, a critical level that proved significant for price action.

Featured image from Dall-E, chart from TradingView