Bakkt, an institutional derivatives platform, broke into the limelight with its plan to launch the first-ever physically settled Bitcoin futures contract. After the successful launch of said product, the company has confirmed they will be facilitating cash-settled futures on ICE Futures Singapore, November 22, 2019.

Crypto Derivatives See Major Boost

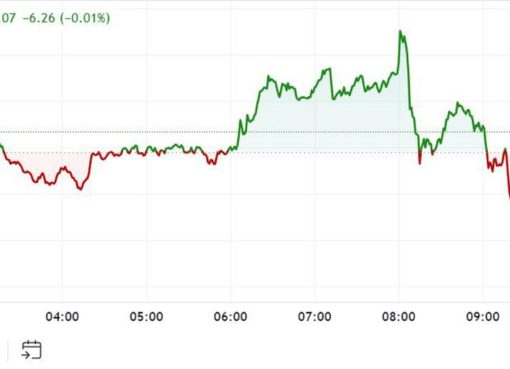

In September of this year, Bakkt finally went live with its much-awaited physically settled Bitcoin futures contracts. After a lackluster start, the platform started to gain traction, setting a record daily transaction volume at $15.3 million on October 25.

Singapore has gradually become one of the most receptive jurisdictions when it comes to crypto asset regulation. The decision to launch cash-settled futures on ICE’s domestic platform in the country is not a major surprise by any means.

Launching in Singapore poses a major benefit for Asian miners and investors, who would otherwise need to trade on the United States-based exchange. President and COO of ICE Futures and Clear Singapore, Lucas Schmeddes, was available for comment:

“Our new cash settled futures will offer investors in Asia, and around the world, a convenient, capital efficient way to gain or hedge exposure to Bitcoin markets. Building off the success of our deliverable futures contract, the cash settled futures will leverage ICE’s regulated, globally accessible market to offer safe, secure, and compliant environment for trading bitcoin.“

Competition and Infrastructure

Bakkt’s product range started with physically settled futures, and the company continues to expand with their foray into cash-settled futures and options, both of which are launching on the same day. At the same time, they are diversifying beyond derivatives to launch a consumer app for simplified payment via bitcoin.

At this stage, their closest competitor is the world-renowned Chicago Mercantile Exchange (CME). Yet Bakkt has a significant advantage in terms of its product mix considering CME is only interested in cash-settled derivatives.

For an investor with a wide range of strategies that include the use of cash settled and physically settled futures, the easiest – and only – option is to use Bakkt as it offers a more comprehensive set of options for the customer.

Derivatives infrastructure is growing immensely with the advent of Bakkt and CME, along with retail focused Deribit. Competition in this particular segment is expected to ramp up significantly in the coming years.

Like CryptoX? Send us a tip!

Our Bitcoin Address: 3L9D5KYVmCATWzqYmXoWDo2WpQfoLeRkbK