Decentralized finance projects like Ren pumped in 2021, only to finish the year right back where they started as high fees on Ethereum (ETH) led to decreased activity for many protocols and DeFi took a backseat to more popular sectors like nonfungible tokens (NFTs).

Now, it appears as though that downtrend is in the process of reversing course after recent global events highlighted the benefits of DeFi and holding assets outside the traditional financial system. This week REN price climbed 69% from a low of $0.247 on Feb. 24 to a daily high of $0.418 on March 3.

Three reasons for the potential price reversal in REN are the launch of its first layer-one application Catalog, the launch of VarenX on Polygon and several new partnerships and integrations for REN and the Ren Virtual Machine (RenVM).

Catalog launches

The biggest development to come out of the REN project lately was the release of Catalog, the first application built on the Ren blockchain.

Say goodbye to multi-chain acrobatics with Catalog♂️

Learn more about what @catalogfi and partners are bringing to the multi-chain ecosystem herehttps://t.co/bRqCyyCsis

Join the waitlist for early access and morehttps://t.co/hb4KyRhA8r

— Ren (@renprotocol) February 26, 2022

Catalog is a “Metaversal” exchange according to Ren and is designed to be a secure cross-chain decentralized exchange (DEX) with built-in liquidity mechanisms that allow users to swap assets across popular networks at a minimal cost.

The liquidity mechanism for Catalog will tap into native asset pools as well as liquidity across third-party DEXes, meaning that Ren will be able to support a wide array of projects without worrying about liquidity constraints.

Other features of Catalog include zero gas fees and low, flat-rate trading fees, the ability to earn passive income on crypto held in a Catalog account without needing to stake or participate in liquidity pools and future plans to add the ability to link a bank account for easy deposits and withdrawals.

VarenX launches on Polygon

A second development boosting the momentum for REN was the integration of its VarenX DeFi hub on the Polygon network.

VarenX is live on @0xPolygon with free GAS thanks to @varenfinance!

Gasless cross-chain swaps are here and it’s a big milestone for improving the native multi-chain user experience.

Learn more below https://t.co/XMyTh0bB5Y

— Ren (@renprotocol) February 25, 2022

Up to this point, VarenX has only operated on the Ethereum network, making it difficult for VarenX to gain traction.

The low fee nature of Polygon has enabled VarenX to offer gasless transactions through its “FreeWei” feature which fronts the gas costs for users, allowing them to conduct cross-chain for free.

Related: REN price at risk of 50% drop after a bearish trading pattern shows up

Partnerships and integrations

A third factor helping to boost the outlook for Ren has been a series of partnerships and integrations that have helped to strengthen its cross-chain ties.

Most recently, Ren partnered with Kava to join the Kava Pioneer program, which will see the RenVM deployed on the Kava Network Ethereum co-chain on March 8.

Announcing a new Kava Pioneer!

Welcome @Renprotocol!

Excited to have RenVM deploying on the Kava Network Ethereum Co-Chain on March 8th!

The Pioneer Program is still open for submissions with a 100K $KAVA pool up for grabs! https://t.co/h3v6URIPmF pic.twitter.com/syTE6bHAHW

— Kava Network (@kava_platform) March 3, 2022

Other notable developments include a partnership with DappBack, a renBTC integration with Vesta Finance and the listing of REN on the Voyager app and exchange.

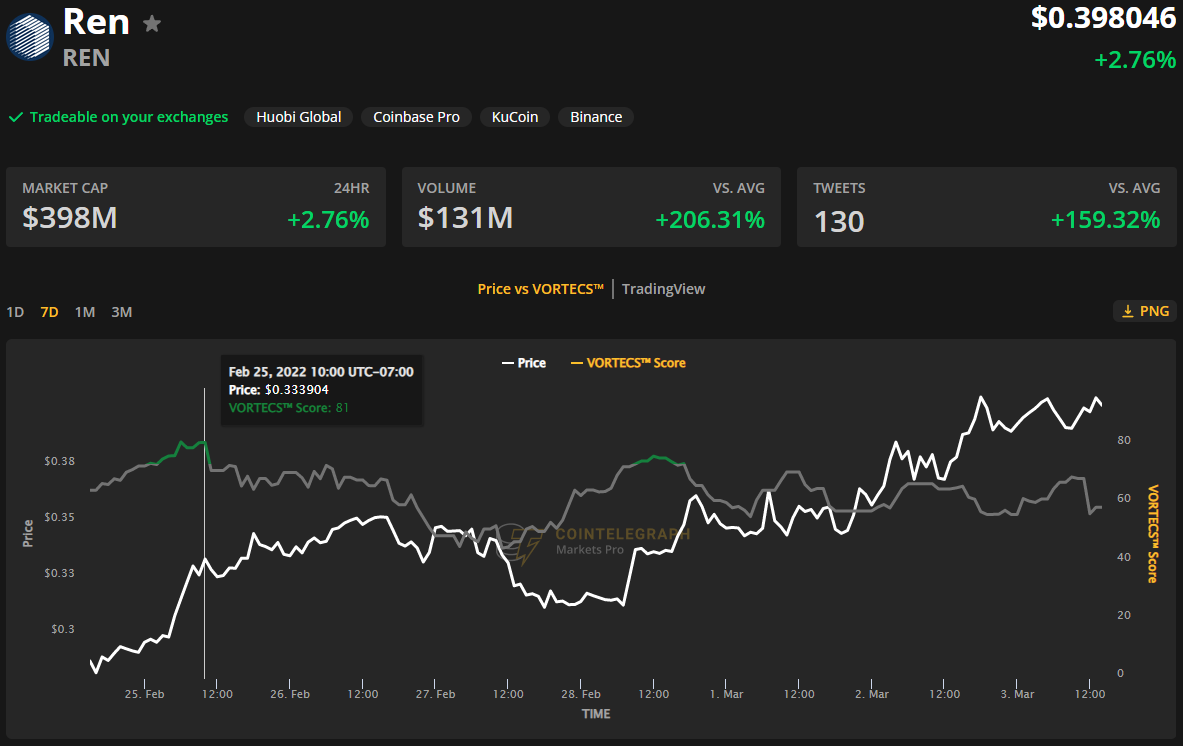

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for REN on Feb. 25, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

As seen in the chart above, the VORTECS™ Score for REN climbed into the green zone on Feb. 25 and reached a high of 81 around 56 hours before the price increased 35.8% over the next three days.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.