Bitcoin (BTC) demanded a $40,000 resistance flip on July as on-chain data revealed large withdrawals from exchanges.

Exchange balances shed 57,000 BTC

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rise to challenge the upper end of its trading range once more on Thursday.

The pair had seen a pullback after initially hitting multi-week highs of $40,600 on Bitstamp earlier in the week.

Bottoming out at $38,800, Bitcoin then returned for its latest trip to the $40,000 mark, with that level still to be flipped to support convincingly at the time of writing.

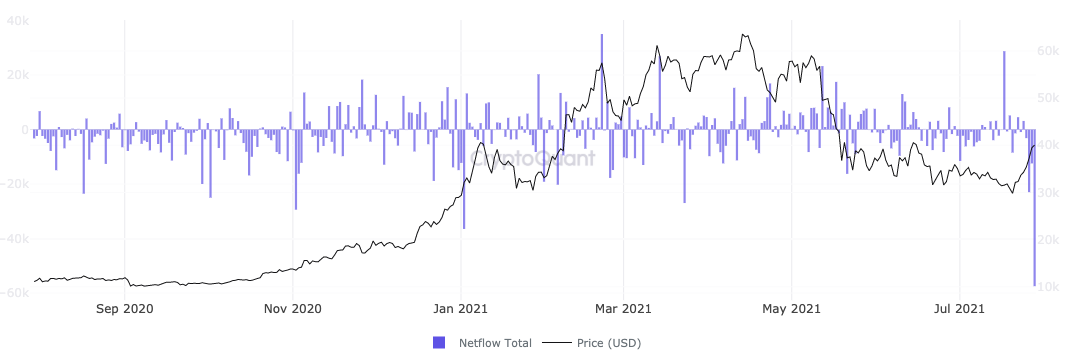

Amid concerns over the strength of this week’s rally, data on Thursday nonetheless pointed to genuine demand for BTC at higher prices.

Shared by Bybt and CryptoQuant, the data appeared to show the largest one-day outflow in at least a year. A total of 57,000 BTC left exchanges in 24 hours.

With that, exchange balances returned to levels last seen in mid-May, just before a major price correction after Bitcoin began reversing from all-time highs of $64,500.

In search of solid support

Despite this demand, however, market participants remained convinced of the need for a higher low construction on BTC/USD before any higher levels could fall.

Related: Bears scattered as Bitcoin hit $40K, but pro traders remain cautious

“I think market needs to go down to put in a HL before continuing up,” popular Twitter trader Pentoshi summarized.

“To put it simply. Been bullish from 29.6k into resistance but today to me signals need to go down for higher low.”

Exactly how low that higher low will be could be anywhere between $36,000 and $32,500, Cointelegraph reported.

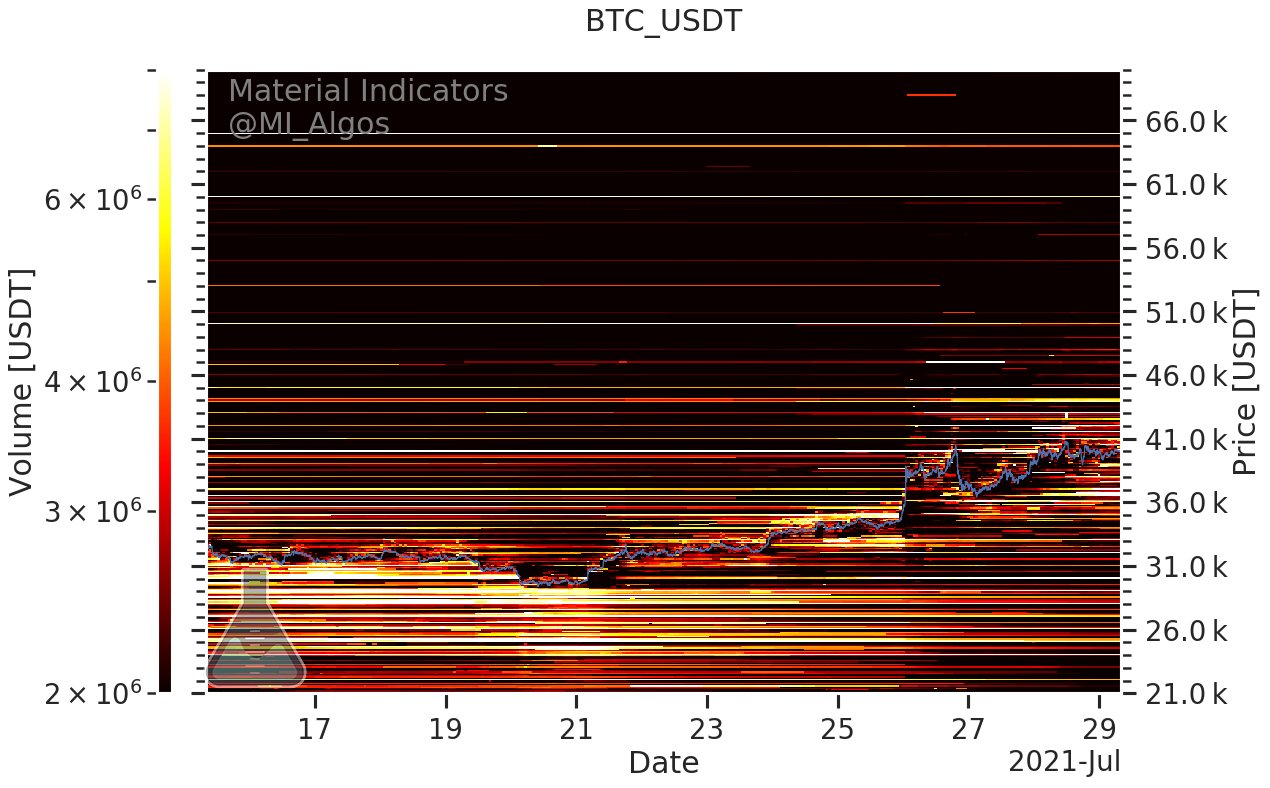

Order book data from major exchange Binance meanwhile confirmed a narrowing range for spot price, with buyers and sellers encroaching on $40,000 from both sides.