Several altcoins have made their first move from longtime lows and if Bitcoin is able to confirm a bottom, a marketwide rally is likely to pick up steam.

The price of an asset class is determined by its fundamentals and the sentiment towards it. At times of panic or exuberance, fundamentals take a back seat and sentiment dictates the price action. Currently, the US-Iran tension has sent investors scurrying towards safety. This has seen a move away from stocks and into assets that are considered safe havens.

However, it is unlikely to be a one-way move. There will be periods of calm that would be followed by statements from both parties that would reignite the conflict. Accordingly, the volatility will remain high as the market participants interpret and digest the news and events.

If the tension cools down, the price might give up some of its recent gains as the bulls and the bears again battle it out for supremacy. At this juncture, the fundamentals of the asset class will play a major role in setting the next course of direction.

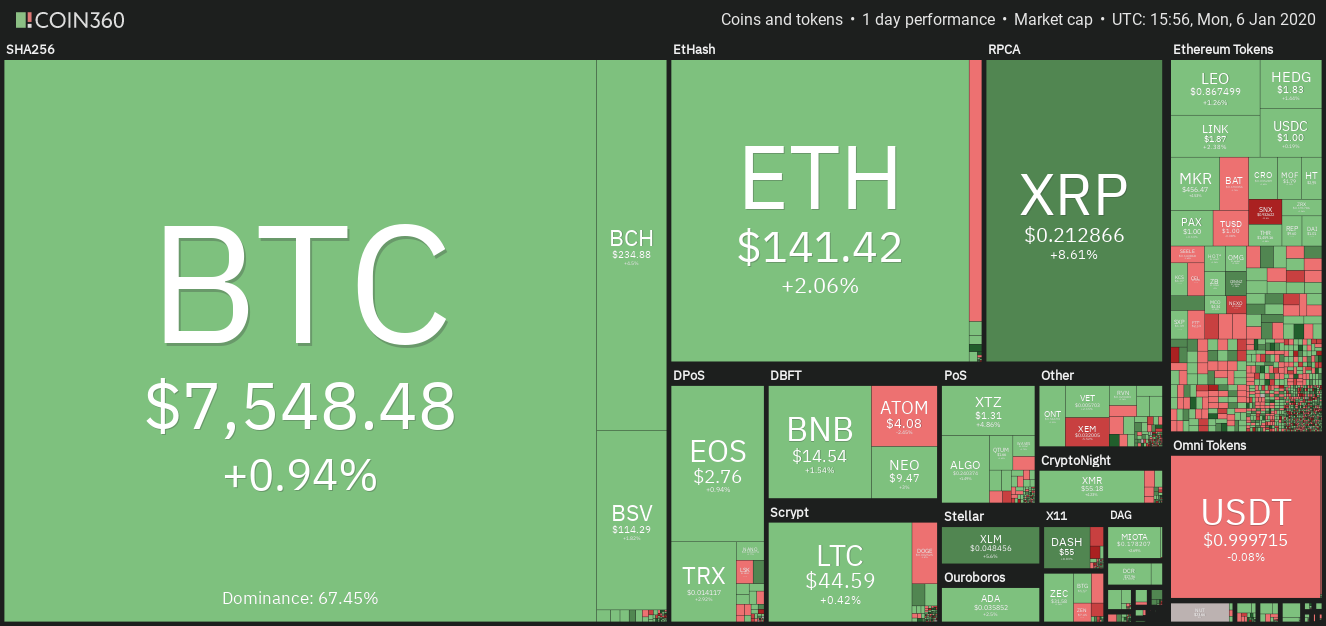

Daily cryptocurrency market performance. Source: Coin360

For the next few days, the short-term traders might get several opportunities to ride the small rallies. We believe that traders should book profits intermittently instead of waiting for a large windfall profit. Let’s study the charts of the top cryptocurrencies and determine the best possible course of action.

BTC/USD

Bitcoin (BTC) has risen above both moving averages, which are on the verge of a bullish crossover. The RSI has also risen into the positive zone, which suggests that bulls have a slight advantage. The price can now move up to the overhead resistance at $7,856.76.

BTC USD daily chart. Source: Tradingview

If the bulls can carry the price above $7,856.76, the momentum is likely to pick up and a rally to $10,360.89 is possible. As the risk to reward ratio is attractive, we suggest traders initiate long positions as suggested in our earlier analysis.

However, if the bears defend $7,856.76, the BTC/USD pair might remain range-bound for a few more days. A break below $7,000 will be the first sign that bears are back in action. The downtrend will resume below $6,435.

ETH/USD

Ether (ETH) broke and closed (UTC time) above the resistance line of the symmetrical triangle on Jan. 5, which triggered our buy suggested in an earlier analysis. The price has reached the 50-day SMA, which might act as a minor resistance.

ETH USD daily chart. Source: Tradingview

If the bulls push the price above the 50-day SMA, the ETH/USD pair is likely to rally to the $151.829 to $157.50 resistance zone. We anticipate the bears to mount a strong defense of this zone, hence, traders can book partial profits close to the zone. For now, the traders can keep the stop loss on the long position at $122.

Our bullish view will be invalidated if the price turns down from the current levels and plummets below $125.841. Such a move will increase the possibility of a retest of the recent lows at $117.090.

XRP/USD

XRP has surged above the overhead resistance at $0.20041 and is attempting to scale above the 50-day SMA. The strength of the breakout from the tight $0.18339 to $0.20041 range suggests that the bulls have overpowered the bears.

XRP USD daily chart. Source: Tradingview

There is a minor resistance at the 50-day SMA, above which a rally to $0.2326 is possible. The flattening 20-day EMA and the RSI in positive territory suggest that the bears are losing their grip.

However, as the price has risen sharply, we suggest traders wait for a dip towards the breakout level of $0.20041 or a minor consolidation to happen before initiating long positions. Hence, we withdraw the buy proposed in an earlier analysis.

Contrary to our assumption, if the bulls fail to sustain the price above $0.20041, the bears will once again attempt to sink the price below $0.18339.

BCH/USD

After a minor consolidation for the past two days, Bitcoin Cash (BCH) has broken out of the overhead resistance at $227.01, which is a positive sign. The price is nearing the next resistance at $241.85. The traders can book partial profits at the current levels and trail the stops higher on the remaining long position to $215.

BCH USD daily chart. Source: Tradingview

If the bulls can push the price above $241.85, the next target is a move to $306.78. The moving averages are on the verge of a bullish crossover and the RSI is in the positive territory, which suggests that the bulls are in command.

Our bullish view will be invalidated if the BCH/USD pair turns down from the current levels and break below the moving averages.

LTC/USD

Litecoin (LTC) is attempting to break out of the 50-day SMA. If successful, it can move up to the overhead resistance at $50. The moving averages are on the verge of a bullish crossover and the RSI is in the positive zone, which suggests that bulls have the upper hand.

LTC USD daily chart. Source: Tradingview

If the bulls can scale the price above $50, a move to $60 is possible. However, if the price turns down from $50, the LTC/USD pair might remain range-bound for a few more days.

The traders can watch the price action close to $50 and book profits if the bulls struggle to break above it. However, if the price breaks out of $50, the traders can trail the stops higher to protect the paper profits. For now, the traders can maintain the stops on the long position at $38.

EOS/USD

EOS has risen close to the overhead resistance at $2.8695. The moving averages are about to complete a bullish crossover and the RSI is in the positive zone, which is a positive sign. This shows that bulls are in command.

EOS USD daily chart. Source: Tradingview

If the bulls can push the price above $2.8695, a rally to the downtrend line is likely. We anticipate the bears to defend the downtrend line aggressively, as the price has repeatedly turned down from it in the past few months. Therefore, traders can keep a close watch and book partial profits close to the downtrend line.

However, if the EOS/USD pair scales above the downtrend line, a move to $3.50 is possible. For now, the traders can keep the stop loss on the long positions at $2.40, which can be trailed higher after the pair rises above $2.8695.

BNB/USD

Binance Coin (BNB) has broken out of the overhead resistance at $14.5201 and held it for four hours. This has triggered our buy recommendation given in an earlier analysis. There is a minor resistance at the 50-day SMA, above which a rally to $16.50 is possible. The stop loss on the long position can be kept at $12.95.

BNB USD daily chart. Source: Tradingview

Contrary to our assumption, if the price turns down from the 50-day SMA and plummets back below $14.5201, it will be a negative sign. It will signal a lack of buyers at higher levels. The BNB/USD pair might thereafter remain range-bound for a few days. The downtrend will resume if the bears sink the price below the support at $12.1111.

BSV/USD

The bulls have propelled Bitcoin SV (BSV) above the overhead resistance at $113.96. This is a positive sign as it shows that the momentum favors the bulls. The moving averages have completed a bullish crossover and the RSI has risen close to the overbought levels, which suggests that the advantage is with the bulls.

BSV USD daily chart. Source: Tradingview

If the price sustains above $113.96, a move to $140 is possible. Therefore, the traders can trail their stop loss on the long positions to $102.

Our bullish view will be invalidated if the price turns down from the current levels and sustains below $113.96.

XLM/USD

Stellar Lumens (XLM) has broken out of the first overhead resistance at $0.047799. If the price closes (UTC time) above this level, it will trigger our buy recommended in the previous analysis.

XLM USD daily chart. Source: Tradingview

The 20-day EMA has flattened out and the RSI has risen into the positive territory. This suggests that the bears are losing their grip.

If the price continues its move northwards and breaks above $0.051014, a rally to $0.06 and above it to $0.088 is likely. Conversely, if the price fails to sustain above $0.047799, the XLM/USD pair might remain range-bound for a few more days. The pair will turn negative on a break below $0.042133.

XMR/USD

Monero (XMR) has made it to the list of top ten cryptocurrencies by market capitalization. This shows that the altcoin is finding favor from the bulls. The price broke out of a long-term descending channel on Jan. 03, which suggests that the downtrend might be over.

XMR USD daily chart. Source: Tradingview

However, the end of a downtrend does not automatically signal the start of an uptrend because, at times, the price consolidates in a range before starting a new uptrend.

Currently, the price has risen sharply from the lows of $44.50 and has reached the overhead resistance at $57.1199. A breakout of this level can propel the XMR/USD pair to $67. However, if the bears defend the resistance at $57.1199, the pair might remain range-bound for a few more days.

Though we are positive, we do not find a trade with a good risk to reward ratio, hence, we are not proposing a long position in it.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.