Bitcoin’s bounce off the $6.4K support is a positive sign as it shows that stronger hands are not dumping their positions yet.

The crypto markets are currently held tight in the grasp of the bears. At the moment, there does not seem to be any specific news or event that has triggered the strong decline but one possibility is that some short-term investors who had been holding on to their positions in hopes of a rally are dumping at the current prices.

The announcement of the first phase of a trade deal between China and the United States and the likelihood of the US Fed will not raise rates in 2020 appears to have boosted sentiment in the US stock market which are again close to reaching new all-time highs. Hence, it’s possible that some money might flow out of crypto and into the stock markets.

This selling in cryptocurrencies is likely to finish within the next few days after which, the long-term investors who had been waiting on the sidelines to build up positions are likely to start value buying. Bitcoin also appears to be in the early stages of a bottoming process and the price action is similar to 2018 when it had bottomed out in mid-December.

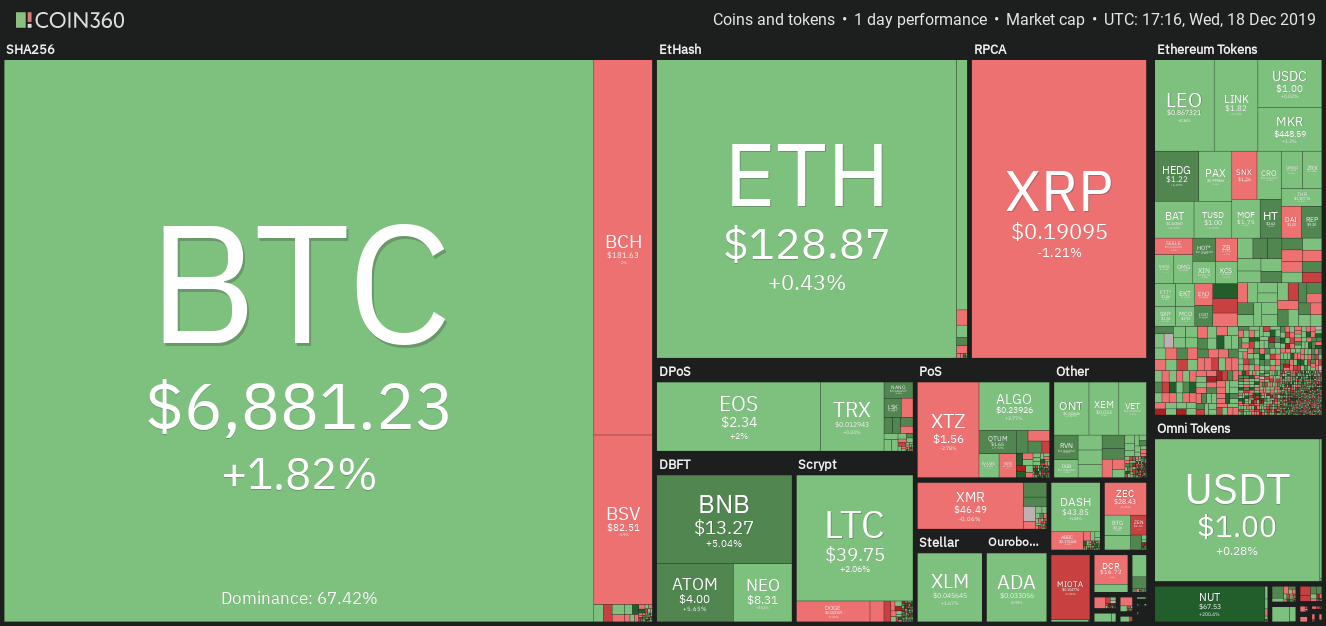

Daily cryptocurrency market performance. Source: Coin360

After such a sharp fall, most cryptocurrencies are likely to go through a bottoming process before starting a new uptrend. Fresh allocations to the crypto space might happen early next year but larger players are unlikely to buy in a hurry. They would try to accumulate at attractive prices before pushing prices higher. Hence, retail traders would have to ride out the volatility before a new uptrend starts.

While short-term traders can trade the relief rallies in a downtrend, positional traders should wait for the trend to change from down to up before buying. Let’s look at the important levels to watch out for.

BTC/USD

Bitcoin (BTC) is currently attempting to bounce off the critical support at $6,512.01. The developing bullish divergence on the RSI is a minor positive which indicates that the selling is about to end. However, unless the price shows signs of sustaining the relief rally, we do not suggest buying on this setup alone.

BTC USD daily chart. Source: Tradingview

The bulls will now attempt to push the price above the 20-day EMA. This is an important resistance to watch out for because the BTC/USD pair has not closed (UTC time) above the 20-day EMA since Nov. 15.

If the bulls manage a close (UTC time) above the 20-day EMA, it will indicate buying by the aggressive bulls. Above the 20-day EMA, a move to $7,856.76 is possible. Aggressive traders can attempt to trade this move but should keep a small position size because the trend is still down. For the positional traders, we will wait for the price to breakout and close (UTC time) above $7,856.76 before recommending a trade in it.

Contrary to our assumption, if the price turns down from the 20-day EMA, the bears will attempt to resume the downtrend. Below $6,512.01, the next support is at $5,533.90.

ETH/USD

Ether (ETH) plummeted below the support at $131.484 on Dec. 16 and followed it up with another down day that dragged the price to $119.61. The RSI has dipped into oversold territory, which indicates that the selling has been overdone in the short-term.

ETH USD daily chart. Source: Tradingview

The bulls are currently attempting a rebound off the support at $120. The first resistance is likely to be $131.484. If this level is scaled, the next resistance will be at the 20-day EMA.

If the ETH/USD pair turns down from the overhead resistance once again, the downtrend could extend to $100 if the $120 support cracks. We will wait for a new buy setup to form before recommending a trade in it.

XRP/USD

XRP dived below the critical support at $0.20041 on Dec. 17. The fall has resumed the downtrend, which has a minor support at $0.18. The RSI has dropped deep into the oversold territory, which indicates that a relief rally is possible.

XRP USD daily chart. Source: Tradingview

The pullback from the current level will face stiff resistance between $0.20041 and $0.2326. If the price turns down from the overhead resistance, the bears will attempt to sink the price below $0.18. If successful, the XRP/USD pair can drop to $0.15.

As the pair has been making new yearly lows consistently, we suggest traders wait for the price to signal a turn around before jumping in to buy.

BCH/USD

Bitcoin Cash (BCH) broke below the support at $192.52 on Dec. 17 and dipped close to our target objective of $166.98. Currently, the bulls are attempting to defend the support at $166.98. The RSI is oversold territory, which also points to a likely relief rally in the next few days.

BCH USD daily chart. Source: Tradingview

The bulls will attempt to carry the price back above the $192.52 to $203.36 resistance zone. If successful, it will indicate demand at lower levels.

However, if the relief rally fails to climb above the overhead resistance, the bears will try to resume the downtrend. If the bears sink the price below $166.98, the BCH/USD pair can extend its fall to $125. We will wait for a new buy setup to form before suggesting a trade in it.

LTC/USD

Litecoin (LTC) is in a firm bear grip. It resumed its downtrend with a break below $42.0599 on Dec. 16 that has dragged the price to our target objective of $36. The decline has negated the bullish divergence that was setting up on the RSI.

LTC USD daily chart. Source: Tradingview

The bulls are attempting a rebound off the support at $36. The deeply oversold readings on the RSI also point to a likely relief rally in the next few days.

If the bounce from the current levels is shallow, it will signal a lack of buyers even at these levels. Below $36, the drop can extend to the $28 to $30 support zone. Our bearish view will be invalidated if the bulls push the LTC/USD pair above the 20-day EMA and sustain it.

EOS/USD

EOS slipped below the support at $2.4001 on Dec. 16. The bulls are currently attempting to defend the $2.2 to $2 support zone. With the fall, the RSI had slipped into oversold territory. During three previous occasions (marked via ellipses on the chart), the price had staged a recovery from close to 25 levels on the RSI.

EOS USD daily chart. Source: Tradingview

We are seeing history repeats itself as a relief rally is underway. However, any attempt to move up will face stiff resistance at $2.4001. If the EOS/USD pair turns down from this resistance, the bears will try to resume the downtrend and sink the price to the next support at $1.55.

Conversely, if the bulls can push the price back above $2.4001 and sustain it, a move to the 20-day EMA and above it to $2.8695 is possible. Aggressive traders can buy if the price sustains above $2.4001 for a couple of days.

BNB/USD

Binance Coin (BNB) plunged below the $14.2555 to $13.88 support zone on Dec. 16. With the fall, the bullish divergence that was developing on the RSI has been invalidated. The next support on the downside is $11.30.

BNB USD daily chart. Source: Tradingview

However, the bulls are currently attempting to defend the support at $12. A bounce from the current level is likely to find stiff resistance at $14.2555. This level, which had previously acted as a strong support will now act as a stiff resistance. If the BNB/USD pair turns down from $14.2555, the downtrend will resume.

On the other hand, if the bulls can scale and sustain the price above $14.2555, it will indicate buying at lower levels. We will wait for a reversal pattern to form before recommending a trade in it.

BSV/USD

Bitcoin SV (BSV) has dropped to the critical support at $78.506. If this support also gives way, the decline can extend to $66.666, which is the intraday low made on Sep. 24. We anticipate the bulls to defend the zone between $78.506 and $66.666 aggressively.

BSV USD daily chart. Source: Tradingview

A bounce from the current levels or from $66.666 is likely to face stiff resistance at the 20-day EMA, which is sloping down.

Our bearish view will be invalidated if the BSV/USD pair rebounds sharply from the current levels and rises above the 20-day EMA. Such a move will indicate a strong demand close to support levels. Traders can wait for a new buy setup to form before initiating a long position in it.

XTZ/USD

The bulls could not propel Tezos (XTZ) above the $1.65 to $1.85 resistance zone in the past two days. This attracted profit booking that has dragged the price to the 50-day SMA. We had suggested caution in our previous analysis due to the negative divergence on the RSI.

XTZ USD daily chart. Source: Tradingview

The bulls are currently attempting to defend the support at the 50-day SMA. If successful, a few days of consolidation between $1.18 and $1.65 is possible.

We are positive on the XTZ/USD pair since it has been a strong outperformer but we will wait for the overall sentiment to improve before recommending a trade in it. Contrary to our assumption, if the bears sink the price below the 50-day SMA, a drop to $1.10 is possible.

XLM/USD

Stellar (XLM) picked up momentum after breaking below the critical support at $0.051014. The decline in the past two days has been sharp and it has dragged the price closer to our target objective of $0.041748. If the selling continues, the next level to watch is $0.036769.

XLM USD daily chart. Source: Tradingview

New yearly lows suggest that bears are in complete command. However, the RSI has declined deep into the oversold territory, which suggests that the selling has been overdone in the short-term.

The bulls are likely to attempt a bounce from the current levels, which will face a stiff resistance at $0.051014. We will wait for the XLM/USD pair to stop declining and signal a turn around before proposing a trade in it.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.