Several cryptocurrencies have turned down sharply from their overhead resistance levels. This is a sign of weakness.

Though crypto markets are in a consolidation phase, the number of first-timers investing in this nascent space has almost doubled, according to data from Square Cash App. This is a positive sign as it shows that investors are using the dips to buy cryptocurrency.

In another positive for the crypto space, research by the recruitment firm Indeed.com has found that cryptocurrency job requirements have risen in the past year even as searches for blockchain and cryptocurrency roles have reduced. This indicates that the sentiment among the crypto companies remains bullish.

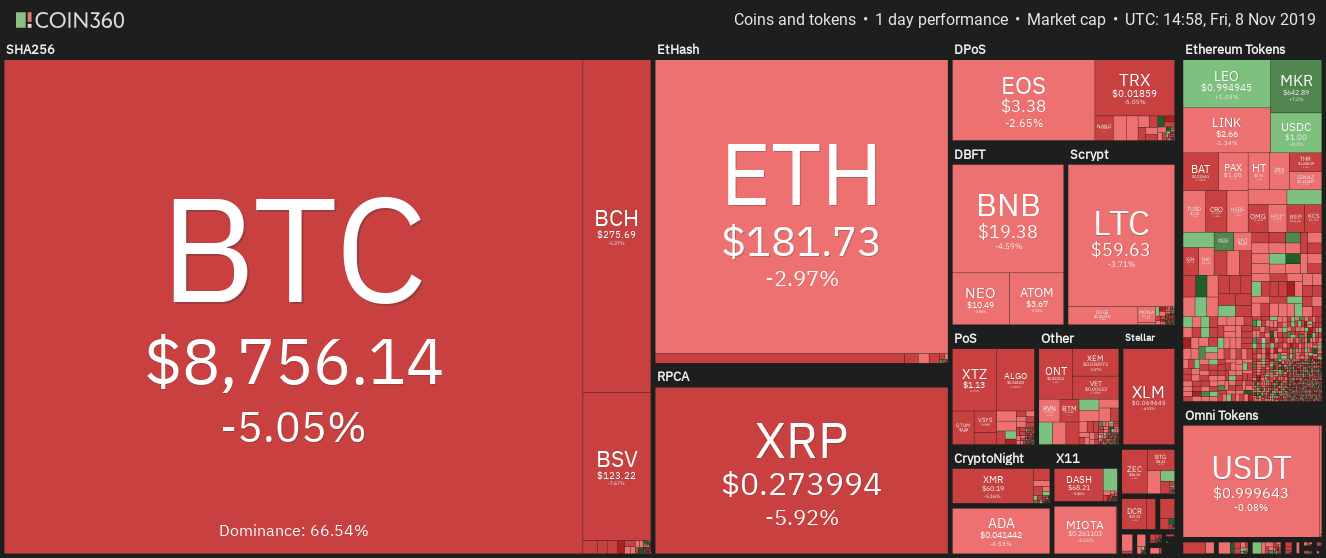

Daily cryptocurrency market performance. Source: Coin360

While the long-term outlook looks good, Ripple CEO Brad Garlinghouse has warned that only 1% of the cryptocurrencies in existence now will survive. However, the ones that survive are likely to grow significantly. Should traders buy the current dip in major cryptocurrencies or does today’s Bitcoin price pullback signal the start of a deeper correction? Let’s analyze the charts.

BTC/USD

Bitcoin (BTC) has broken down of the 20-day EMA and can now slide to the 50-day SMA. The failure of the bulls to break out of the downtrend line is a negative sign. It shows a lack of demand at higher levels.

If the bears sink the price below $8,467.54, which is a 61.8% Fibonacci retracement of the most recent rally, a drop to the $7,702.87 to $7,297.21 support zone is likely. A break below this zone will be a huge negative.

Conversely, if the BTC/USD pair bounces off the current levels, the bulls will again attempt to scale above the downtrend line. If successful, the pair is likely to pick up momentum. We will wait for a new buy setup to form before proposing a trade.

ETH/USD

Ether (ETH) turned down from the overhead resistance of $196.483 on Nov. 6 for the third time. This shows that bulls are defending $196.483 aggressively. If the price slips below $173.841, it can slide to $161.056.

Both moving averages are flat and the RSI is close to 50, which suggests a balance between demand and supply.

If the ETH/USD pair bounces off the $161.056-$151.829 support zone, it will remain range-bound for a few more days. The pair will pick up momentum above $196.483 while it will turn negative below $151.829. For now, traders can keep the stop loss on the long positions at $150.

XRP/USD

XRP turned down sharply from the overhead resistance of $0.31491 on Nov. 7. Though the bulls defended the support at the 50-day SMA, they could not sustain the rebound. This shows selling at higher levels.

The 20-day EMA has started to turn down and the RSI has dipped into the negative zone. This suggests that bears have the upper hand.

If the XRP/USD pair sustains below the 50-day SMA, it could drop to the critical support at $0.24508. A break below this support will be a huge negative. Hence, traders can keep the stop loss on the long position at $0.24.

Contrary to our assumption, if the price rebounds off the 50-day EMA, the bulls will again attempt to break out of $0.31491. If successful, a rally to $0.34229 is likely.

BCH/USD

The bulls are struggling to sustain Bitcoin Cash (BCH) price above the neckline of the head and shoulders pattern. This shows that bears are defending the neckline. The pullback can reach the 20-day EMA, which is likely to offer support.

If the price bounces off the 20-day EMA, the bulls will again attempt to push the price to $360. Nonetheless, if the bears sink the price below the 20-day EMA, the BCH/USD pair will turn negative. Hence, traders can trail the stop loss on long positions to breakeven.

LTC/USD

Litecoin (LTC) broke above $63.3876 on Nov. 5 but the bulls could not build upon the gains. This shows a lack of demand at higher levels. The price has pulled back to the 20-day EMA, which is gradually sloping up. This suggests that the buyers have the upper hand in the short-term.

If the price rebounds off the 20-day EMA, the bulls will attempt to extend the recovery and carry the LTC/USD pair to $80.2731. Contrary to our assumption, if the pair dips below the moving averages, it will remain range-bound for a few days. For now, the stop loss on the long positions can be kept at $47. We might suggest closing the position if the price sustains below the moving averages.

EOS/USD

EOS broke out of the overhead resistance at $3.58 on Nov. 5, which triggered our buy recommendation given in the earlier analysis. However, contrary to our assumption, the bulls could not sustain the momentum and carry the price higher. Profit booking has dragged the price back towards the critical support a $3.37. The 20-day EMA is sloping up and is placed just below $3.37. This indicates that the bulls have the upper hand.

If the price bounces off the 20-day EMA, the buyers will attempt to push the price to $4.8719. Our bullish view will be invalidated if the bears sink the price below the 50-day SMA. Therefore, traders can keep the stop loss on the long positions at $2.95.

BNB/USD

The bulls have not been able to propel Binance Coin (BNB) above $21.2378 for the past few days. This shows that buying dries up at higher levels. If the bulls fail to defend the 20-day EMA, a drop to $18.3 is possible.

If the price rebounds off $18.30, the BNB/USD pair could remain range-bound for a few days. The pair will pick up momentum on a breakout and close above $21.2378.

However, if the bulls fail to defend $18.30, a drop to $16.50 will be on the cards. If the price re-enters the channel, it will be a huge negative. Hence, traders can continue to retain the stop loss on long positions at $16.

BSV/USD

Bitcoin SV (BSV) broke out and closed (UTC time) above the downtrend line on Nov. 5, which triggered our buy recommended in the previous analysis. However, contrary to our assumption, the price could not reach $155.38.

The altcoin turned down from $143.04. This is a bearish sign as it suggests a lack of buyers at higher levels. The BSV/USD pair has slipped below the most recent low of $124.50, which triggered our stop loss proposed in the previous analysis.

If the price bounces off the 20-day EMA, the bulls will again attempt to reach $155.38. However, if bears sustain the price below the 20-day EMA, a deeper correction is likely.

XLM/USD

Stellar (XLM) rallied close to our first target objective of $0.088708 on Nov. 5 where traders could have booked partial profits on the long positions as suggested in our previous analysis. Profit booking at the resistance has dragged the price to the 20-day EMA, which should have triggered the trailing stop loss.

Both moving averages are flattening out and the RSI has dipped to the midpoint. This suggests a range formation in the near term.

Our neutral view will be invalidated if the XLM/USD pair rebounds sharply and rises above the overhead resistance of $0.088708. However, we give it a low probability of occurring. Alternatively, if the price slips below the 20-day EMA, a dip to the 50-day SMA is likely. We will wait for a new buy setup to form before recommending a trade in it.

TRX/USD

Tron (TRX) has been range-bound between $0.01866 and $0.020488 for the past few days. Attempts to breakout or breakdown of this range have failed. This shows a balance between both buyers and sellers. The flat moving averages and the RSI just above the midpoint also suggests a few days of consolidation.

The balance will shift in favor of bulls if the TRX/USD pair breaks out and closes above $0.020488. Above this, a move to $0.0234 and above it to $0.030 is likely. On the other hand, if the pair breaks below $0.01866, bears will be at an advantage. The next support on the downside is at the 50-day SMA and below it $0.0136655.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.