A rally could be on the cards as Bitcoin continues to lead the market and a few altcoins attempt to form a higher low.

In its “Imagine 2030” report, Deutsche Bank strategist Jim Reid forecast that by 2030, digital currencies could replace cash. Reid said that in order for mainstream integration to occur, digital currencies will have to convince regulators that they are safe for investors and find solutions for issues such as cyber attacks, electricity consumption and digital war.

Cryptocurrency adoption by a large traditional financial institution could also signal that digital assets could one day replace fiat currencies in the future.

To counter the possibility of fiat currencies being undermined by cryptocurrencies, several governments are planning to issue their own central bank digital currency (CBDC). The latest to confirm working on a CBDC is France. Bank of France governor François Villeroy de Galhau recently announced that the bank will test a digital euro pilot project for private financial sector players.

However, the United States Secretary of the Treasury Steven Mnuchin has a different opinion. In his comments to the House Financial Services Committee, Mnuchin said that he and Federal Reserve Chairman Jerome Powell do not see any need of a national digital currency in the next five years.

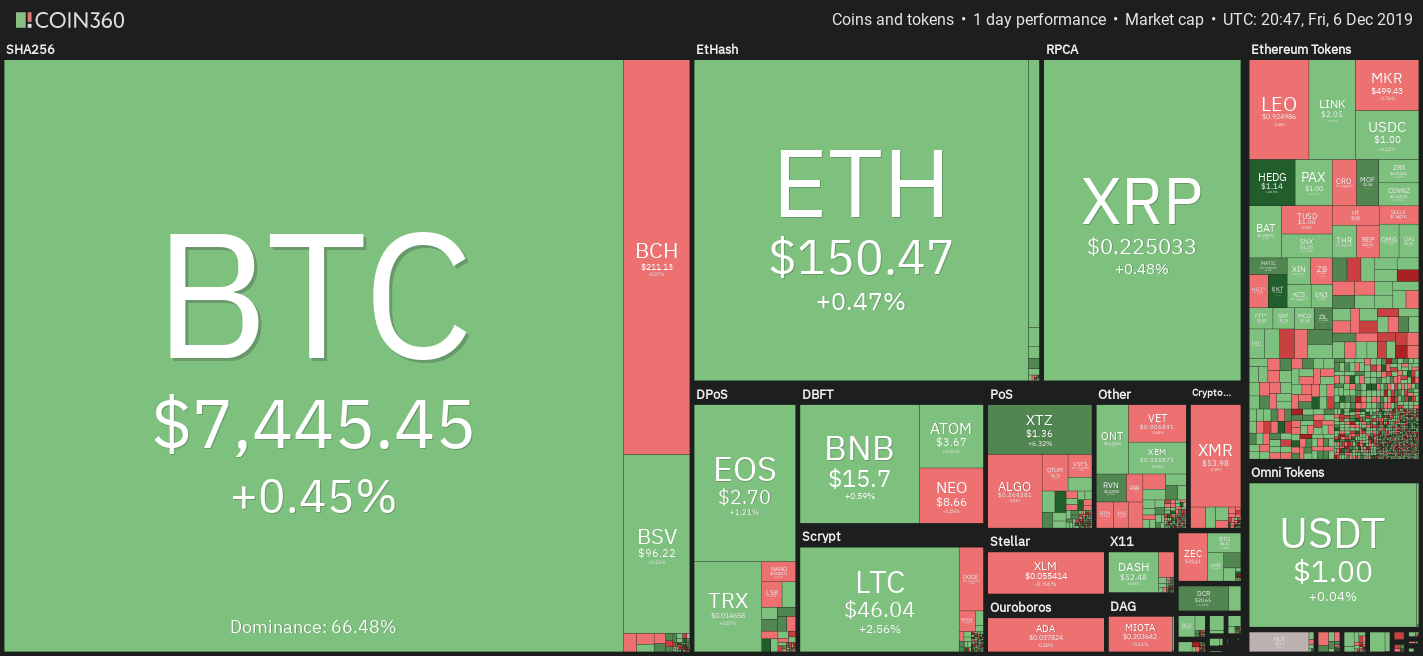

Daily cryptocurrency market performance. Source: Coin360

The European Union (EU) authorities also said that they won’t allow any stablecoin project to begin operation in the EU until risks to monetary sovereignty are addressed. This shows that the path to acceptance by the governments and regulators is not going to be easy.

While a few major cryptocurrencies are showing signs of bottoming out, others are on the verge of resuming their downtrend. Let’s analyze the charts to find the ones that could reverse direction and start a new uptrend.

BTC/USD

The bulls are attempting to keep Bitcoin (BTC) above $7,000. This is a positive sign as it shows that buyers are not waiting for a deeper correction to step in. If the bulls can carry the price above $7,856.76, it will signal strength.

Above $7,856.76, a rally to the downtrend line is likely. This is an important resistance to watch out for because the price has repeatedly turned down from it.

A breakout of the downtrend line could start a new uptrend. Therefore, we retain the buy recommendation given in the previous analysis.

Contrary to our assumption, if the BTC/USD pair reverses direction from the current levels or from the downtrend line and plummets below $6,512.01, the downtrend will resume. A breakdown to new yearly lows will be a huge negative and will hurt sentiment. Therefore, we do not suggest buying until the markets signal a possible change in trend.

ETH/USD

The bulls have been attempting to push Ether (ETH) back into the large range of $151.829 to $235.70. If the price can sustain above $157.50, it will signal that the markets have rejected the lower levels.

ETH USD daily chart. Source: Tradingview

If the bulls propel the price above $157.50, the next level to watch out for is $173.841 and above it $197.750. The short-term traders can look for buying opportunities after the price sustains above $157.50.

Conversely, if the bulls fail to propel the price above $157.50, the ETH/USD pair will consolidate between $131.484 and $157.50 for a few more days. A break down of this range will be a huge negative as it will resume the downtrend.

XRP/USD

The bears have not been able to sustain the price below $0.22 in the past few days. This shows buying at lower levels. However, buying dries up at higher levels as the bulls have not been able to propel XRP above the critical overhead resistance of $0.24508.

XRP USD daily chart. Source: Tradingview

As a result, the price is stuck close to $0.22 for the past few days. A break above $0.23260 to $0.24508 resistance zone will be the first indication that the downtrend is over. Hence, we might suggest long positions after the price sustains above $0.24508.

Conversely, if the bears sink the XRP/USD pair below $0.20041, the downtrend will resume. We do not find any reliable buy setups at the current levels.

BCH/USD

The bulls are attempting to defend the support at $203.36. This is a positive sign. However, they have not been able to achieve a strong bounce off it, which shows a lack of demand at higher levels. Therefore, Bitcoin Cash (BCH) might spend some more time consolidating between $192.50 and $227.01.

BCH USD daily chart. Source: Tradingview

If the BCH/USD pair breaks out of this range, it will indicate accumulation by the stronger hands. Above $227.01, the first target objective is $261.50 and above it $306.78. As the risk to reward ratio looks attractive, the traders can initiate long positions on a close (UTC time) above $227.01 and keep a stop loss of $192.

Contrary to our assumption, if the bears sink the price below $192.50, it will indicate distribution in the range. The next level to watch on the downside is $166.98.

LTC/USD

Litecoin (LTC) has been trading close to the recent low of $42.0599. This shows a lack of aggressive buying by the bulls even at these levels. In the absence of buying, the bears will attempt to sink the price below $42.0599 and resume the downtrend. With the 20-day EMA sloping down and the RSI in negative territory, the advantage is with the bears.

LTC USD daily chart. Source: Tradingview

However, if the bulls defend the support at $42.0599 aggressively, the LTC/USD pair might consolidate between $42.0599 and $50 for a few days.

The pair will indicate strength and offer a buying opportunity after it breaks above the overhead resistance at $50. Until then, we suggest traders remain on the sidelines.

EOS/USD

EOS has been trading just below the 20-day EMA for the past few days. Though the bulls have not been able to scale above it, they have not given up ground either. Both moving averages are flattening out and the RSI is gradually rising towards the center. This points to a range-bound action in the short-term.

EOS USD daily chart. Source: Tradingview

A breakout of $2.8695 will be a positive sign that is likely to attract buyers. Above this level, a rally to the downtrend is likely. The short-term traders could ride this up move.

Our bullish view will be invalidated if the bears defend the overhead resistance at $2.8695 and sink the EOS/USD pair below $2.4001. Such a move will resume the downtrend.

BNB/USD

Both bulls and bears are battling it out for supremacy between $16.50 and $14.2555. After one party emerges as the victor, Binance Coin (BNB) will start a trending move. Longer the time spent in the range, stronger will be the eventual breakout or breakdown from it.

BNB USD daily chart. Source: Tradingview

A breakout of $16.50 will indicate that the bulls have gained the upper hand and a rally to $21.2378 is possible. Though there is a minor resistance at the 50-day SMA, we expect it to be crossed.

Conversely, if the BNB/USD pair plummets below $14.2555, it will signal a victory for the bears. The next support on the downside is $11.30. We will wait for the price to sustain above $16.50 before recommending a long position in it.

BSV/USD

Bitcoin SV (BSV) is looking weak as the bulls have not been able to sustain the rebound off the support at $92.693. A break below $92.693 can drag the price to the next support at $78.506. Below this level, the next support is $66.666.

BSV USD daily chart. Source: Tradingview

Contrary to our assumption, if the BSV/USD pair bounces off the current levels and breaks out of the downtrend line, it can move up to $113.960. This is an important resistance to watch out for because if it is scaled, a rally to $155.380 will be on the cards.

We will wait for the price to close (UTC time) above $117 before turning positive.

XLM/USD

Stellar (XLM) has been trading below $0.056 for the past two days, which is a negative sign. It shows a lack of demand even at these levels. If the bulls do not push the price back above $0.056 within the next few days, the possibility of a drop to $0.051014 increases. If this support also cracks, the downtrend can reach $0.041748.

XLM USD daily chart. Source: Tradingview

Nonetheless, if the bulls quickly push the price above $0.056, it will indicate that buyers are making a comeback. The XLM/USD pair will gain strength on a break out of $0.06.

We might suggest a long position after watching the price action at $0.06. Until then, we remain neutral on the pair.

ADA/USD

Cardano (ADA) has risen to the tenth spot replacing Tron (TRX). Hence, it finds a place in our analysis. Though the bulls have defended the $0.035778 support since late September, they have not been able to achieve a strong and sustained bounce, which is a negative sign.

ADA USD daily chart. Source: Tradingview

If the bears sink the price below the $0.035778 to $0.0329526 support zone, the downtrend will resume. The next support on the downside is $0.0282710.

Conversely, if the ADA/USD pair rebounds off the current levels, the bulls will try to push it to $0.0461161. Above this level, a rally to $0.0560221 is possible. The short-term traders could attempt to trade the range on the long side.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.