The crypto market has pulled back but traders might view the current dip as a buying opportunity as long as critical support levels are not violated.

A Bloomberg report, analyzing data from 13 top exchanges, shows that within a very short span of time, Bitcoin (BTC) futures trading volume has grown to about 50% of spot trading volume. This is the sign of a maturing asset class. Successful operation of the futures market may provide regulators with the confidence they need as many are concerned that a few entities can easily manipulate the markets at will.

The institutional players who have been staying away due to wild volatility in the crypto sector are also likely to jump in because the futures and options market provides them with a variety of tools that can be used to hedge their positions and reduce their risk.

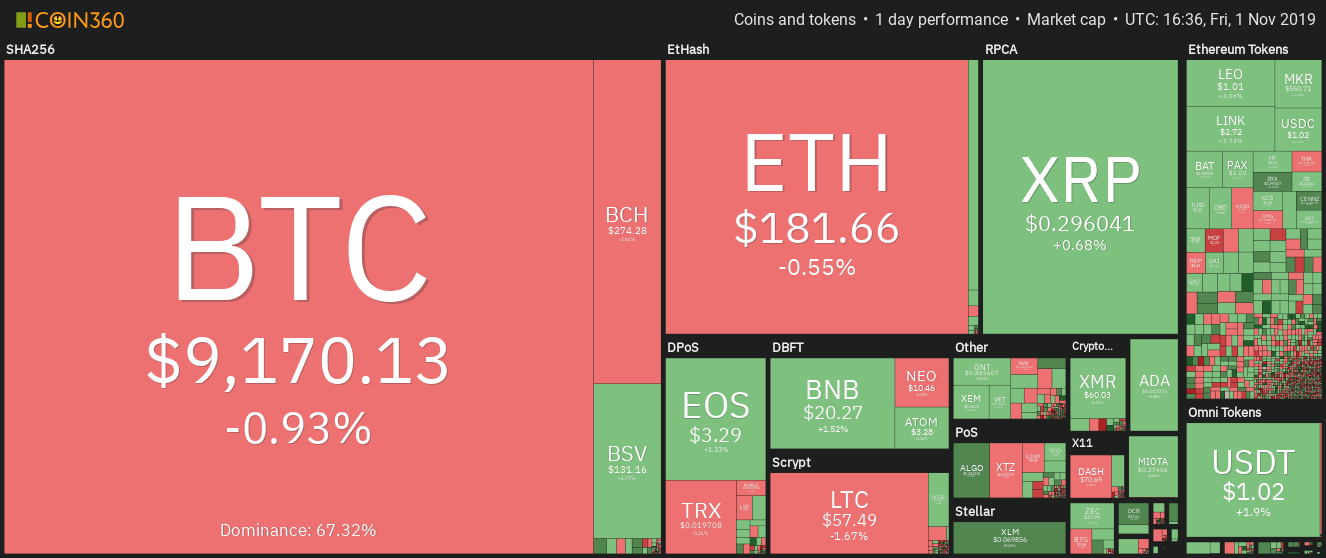

Daily cryptocurrency market performance. Source: Coin360

Along with trading volume, the real usage of cryptocurrency in the economy is also important. A recent analysis by SEMRush found that Bitcoin is the third-most preferred method for online payment in Italy. This ranking places Bitcoin way ahead of traditional credit cards such as American Express, Visa, and Mastercard. This shows that cryptocurrencies are catching up and in some instances racing ahead of the traditional payment methods.

Over the past few days most major cryptocurrencies have given back some of their recent gains, therefore, it is necessary to see if now is a good time to initiate fresh positions or determine whether the pullback will deepen further. Let’s take a look at the charts to see what is happening.

BTC/USD

Bitcoin is attempting to find support close to $8,829.05, which is a 50% retracement of the recent rally. This is a bullish sign as it shows that buyers are keen to enter when the price approaches a strong support.

The moving averages are on the verge of a bullish crossover and are placed just below the previous resistance turned support of $8,777.89. If the leading cryptocurrency bounces off this support, a retest of the recent highs of $10,360.89 will be on the cards.

A breakout of this level will resume the upside move that can reach $13,973.50. Therefore, traders can watch the price action at the moving averages and initiate long positions on a strong rebound off it. This trade could play out instantly, hence, a stop loss can be kept just below $8,467.54, which is 61.8% Fibonacci retracement of the recent rally.

Contrary to our assumption, if the BTC/USD pair fails to find support at the moving averages, it will delay the resumption of the up move. It might also result in liquidation of long positions by aggressive bulls, which can drag the price to $8,467.54. If this support also gives way, a retest of the $7,702.87 to $7,297.21 support zone is possible.

ETH/USD

Ether (ETH) has held the moving averages for the past few days but has failed to bounce off it. This increases the possibility of a break below the 20-day EMA. The next support on the downside is at $161.056.

If the bulls defend $161.056-$151.829 support zone, the ETH/USD pair might consolidate for a few more days. The flattening moving averages and the RSI close to the center also points to a range-bound action.

Our neutral view will be invalidated if the pair bounces off the moving averages and climbs above $196.483. Above this level, a rally to $235.70 will be on the cards. For now, the traders can retain the stop loss on the long positions at $150.

XRP/USD

XRP has dipped to the 20-day EMA, which is a strong support. If the price rebounds off this, the bulls will attempt to carry it to $0.34229. Traders can book partial profits close to this level and trail the stops on the rest of the position.

Conversely, if the bears sink the price below the 20-day EMA, the XRP/USD pair can dip to the 50-day SMA. Below this level, the price can drop to the critical support at $0.24508. If this support holds, the pair might remain range-bound for a few days. Traders can hold their long position with the stop loss at $0.24.

BCH/USD

The failure to breakout of the neckline has resulted in a pullback in Bitcoin Cash (BCH). The altcoin can now dip to the moving averages, which is likely to act as a strong support. If the altcoin bounces off the 20-day EMA, the bulls will again attempt to scale the neckline. If successful, a rally to $360 is likely. The bullish crossover of the moving averages and the RSI in positive territory also indicates that the buyers are in command.

Our positive view will be invalidated if the BCH/USD pair fails to rebound off the moving averages. Below this level, it can dip to $241.85. If this level also cracks, the pair will turn negative and can dip to $203.36. Therefore, traders can retain a stop loss on long positions at $235.

LTC/USD

Litecoin (LTC) has been trading between both the moving averages for the past few days. This shows a balance between both the bulls and the bears. The balance will tilt in favor of the bulls if the price breaks out of $63.3876. Above this level, a rally to $80.2731 is likely.

On the other hand, a break below the 20-day EMA will strengthen the bears. Below this level a retest of $50-$47.1851 zone is likely. The flattening moving averages and the RSI close to the midpoint suggests a consolidation for a few days. A breakdown below $47.1851 will resume the downtrend. Traders can protect their long positions with a stop loss of $47.

EOS/USD

EOS has held the support at the moving averages, which is a positive sign. This shows that the bulls are defending the lower levels. If buyers can push the price above $3.5759, the altcoin is likely to pick up momentum and move up to $4.8719. Therefore, we retain the buy recommendation given in the previous analysis.

However, if the bulls fail to scale above $3.5759, the EOS/USD pair will remain range-bound between $2.4001 and $3.37 for a few days. The trend will turn weaker if it slides below the critical support at $2.4001.

BNB/USD

The bulls purchased the dip to the 20-day EMA on Oct. 30 and 31, which is a positive sign. It shows that the buyers are accumulating at lower levels. The 20-day EMA is sloping up gradually and the RSI is maintaining in positive territory, which shows that the bulls have the upper hand. Binance Coin (BNB) will pick up momentum above $21.2378.

There is a minor resistance at $23.5213 but we expect it to be crossed. Above this level, a rally to $32 is likely. Therefore, the traders can hold their long positions with a stop loss of $16. Our bullish view will be invalidated if the bears sink the BNB/USD pair back into the descending channel.

BSV/USD

The bulls are attempting to defend the support at $121.743, which is 50% retracement of the recent rally. If Bitcoin SV (BSV) can turn around and breakout of the downtrend line, a retest of $155.38 is likely.

If the bulls can propel the price above $155.38, a rally to $188.69 will be on the cards. Therefore, traders can initiate long positions on a breakout and close (UTC time) above the downtrend line. The stops can be kept below the most recent lows after the trade is triggered. Contrary to our expectation, if the BSV/USD pair plummets below the 20-day EMA, it will lose momentum.

XLM/USD

Stellar (XLM) has bounced off the moving averages and broken out of the downtrend line and the minor overhead resistance at $0.069777. If the bulls can sustain the breakout, a rally to $0.088708 is likely. The 20-day EMA has started to turn up gradually and the RSI is in the positive territory. This shows that the bulls have the advantage.

Traders can book partial profits close to $0.088708 and trail the stops on the remaining position. We are not recommending booking profits on the entire position because if the bulls can scale above $0.088708, the XLM/USD pair will pick up momentum. The next target on the upside is $0.130.

Our bullish view will be invalidated if the pair reverses direction from the current levels and plummets below the $0.056 to $0.051014 support zone. Traders can reduce the risk by trailing the stop loss on the long positions to $0.056.

TRX/USD

Tron (TRX) has dipped to the critical support at $0.018660. We anticipate the bulls to defend the zone between $0.018660 and 20-day EMA. A strong bounce off this zone will indicate that the buyers are using the dips to buy.

If the next up move can clear the overhead resistance at $0.0234, a rally to $0.030 is possible. Therefore, traders can watch the price action at the support zone and initiate long positions on a strong rebound off it.

Our bullish view will be invalidated if the TRX/USD pair slides through the moving averages. In such a case, a retest of $0.013694 is likely.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.