Months ago when Bitcoin price made it through $13,000 top analysts said “the train has left the station,” and they were right. Or maybe a rocketship would have been a better analogy. The cryptocurrency took off and has yet to refuel, until now.

With momentum waning, bears have staged an “island reversal” that could push off higher prices again for some time. Here’s what to expect from the tropical-sounding pattern that could leave bulls stranded for some time.

Technical Analysis Education: What Is An Island Reversal?

According to Investopedia, an “island reversal” is a price pattern on a daily candlestick chart that has a gap on each side of a the structure. “This price pattern suggests that prices may reverse whatever trend they are currently exhibiting, whether from upward to downward or from downward to upward,” a description reads.

The recent Bitcoin price action fits the pattern and the conditions that validate its existence to a “T.” An island reversal forms after a long trend leading into the pattern. Bitcoin’s performance has been incredible since March of last year.

Related Reading | The Bearish Bitcoin Chart Bulls Definitely Don’t Want To See

At the climax of the trend, there’s an initial price gap, followed by a consolidating price cluster. Finally, there’s a gap back down on the daily chart, establishing the “island of prices isolated from the preceding trend.”

The theory behind the pattern suggests that the gaps left behind will go unfilled for some time.

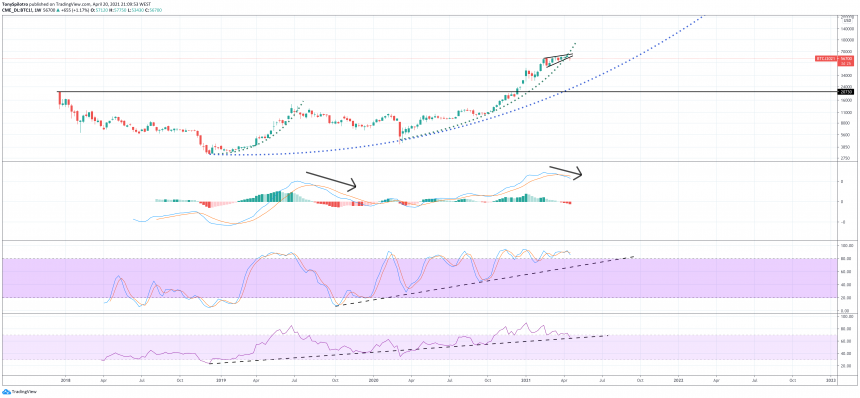

The price action matches the "island reversal" pattern | Source: BTCUSD on TradingView.com

Will Bulls Be Left Stranded On Bitcoin Bear Island?

The island reversal was initially spotted by one of crypto Twitter’s top technical analysts on the CME BTC Futures chart. And although islands are typically associated with sun and sand, the island left behind here in Bitcoin could be deserted for some time – but how long?

A zoomed out look at the chart could provide some ideas of what’s to come.

Bitcoin could lose the RSI, but find support at the trend line on Stochastic | Source: BTCUSD on TradingView.com

Bitcoin’s island reversal comes at a time when indicators are finally turning down, the short-term parabolic curve has been violated, and a bearish wedge has formed on higher timeframes.

Fundamentals are bullish and more BTC is leaving exchanges each week. Perhaps a selloff could scare stronger hands into selling their coins.

Related Reading | Two Patterns, One Coin: Is Bitcoin Currently Bearish Or Bullish?

But all is not lost for Bitcoin. The stock-to-flow model and the world’s best analysts are projecting much higher prices of hundreds of thousands per coin.

There’s also potentially another parabolic curve in process not fully developed yet that keeps the predominant bull trend in tact, even if things get volatile over the next several weeks ahead.

Featured image from Pixabay, Charts from TradingView.com