Bitcoin (BTC) is not seeing capitulation among miners despite its price dipping over 15% in the past week, new data suggests.

According to estimates of Bitcoin’s hash rate from monitoring resource Coin Dance, participation remains as strong now as before the price drop. Hash rate refers to the amount of computing power dedicated to maintaining the Bitcoin network.

Hash rate sees 2nd all-time high

According to some measures, the hash rate on Nov. 23, in fact, nearly matched its previous all-time high. At 134 quintillion hashes per second, Saturday’s reading was almost identical to that from Oct. 10, Coin Dance statistics suggest.

BTC/USD traded at around $7,200 on that day, compared to $8,600 in October.

Bitcoin network hash rate (in orange). Source: Coin Dance

Previously, CryptoX reported on the rising consensus that Bitcoin miners were exiting their positions as losses mounted. According to statistician Willy Woo, that process had already almost completed as of this week.

Taking an opposing position based on the fresh data, entrepreneur Alistair Milne suggested miners were in fact little concerned with current price action.

“There is NO miner capitulation,” he summarized in a tweet on Sunday. He continued:

“They are acutely aware of the upcoming halving and are apparently unphased by the recent dip.”

Difficulty reverses upwards

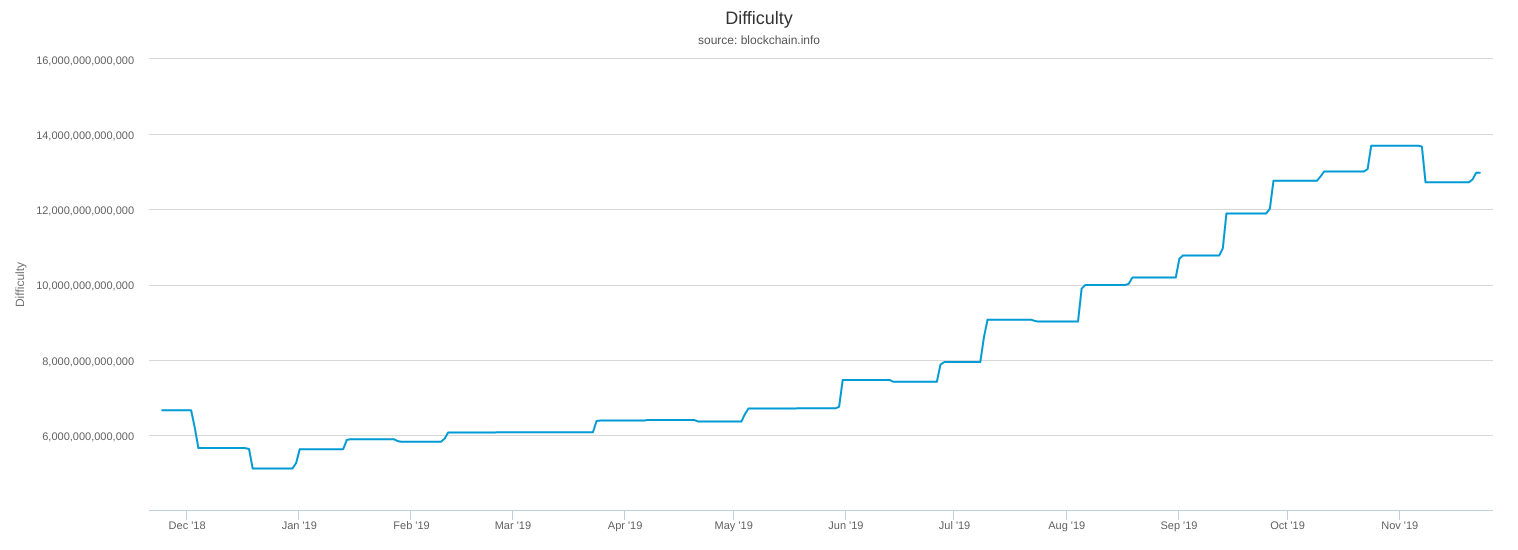

Milne also linked to the rising difficulty in mining Bitcoin, an indicator which until recently had been in decline.

The difficulty is a measure of the effort required to solve Bitcoin block equations and regularly adjusts to suit current miner sentiment. Earlier this month, difficulty saw its biggest drop of the year, falling 7%. Since then, a roughly 2% uptick likewise contradicts the idea that miners are staying away, according to Blockchain figures.

Bitcoin mining difficulty. Source: Blockchain

For analyst PlanB, creator of the highly-popular Stock-to-Flow Bitcoin price model, difficulty trends also point to continued faith in mining profitability.

“+2% difficulty adjustment: no miner capitulation,” he wrote on Friday, adding the historical precedent called for a price rise after such behavior.

According to Crypto This’ real-time difficulty generator, the next adjustment on Dec. 5 could be almost 5% higher than current levels.

Unlike difficulty, the hash rate is difficult to estimate beyond a limited degree of accuracy, and should not be taken as a definitive guide to miner involvement.