Bitcoin’s intense uptrend throughout the past week led its price to highs of $11,400 before it lost some momentum and declined slightly.

This latest uptrend has made it so that BTC is less than 45% below its all-time highs.

It now appears that the benchmark cryptocurrency is poised to see some further upside, as its technical strength has been mounting as it consolidates above $11,000.

There is one set of on-chain data that seems to spell trouble for Bitcoin.

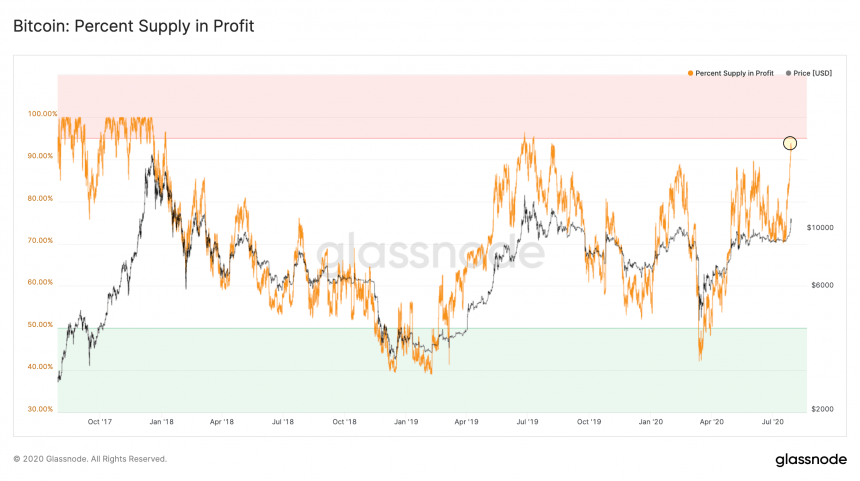

Currently, 93% of the circulating token supply is profitable. Historically, when this percentage is hit, the cryptocurrency forms a mid-term top that results in notable downside.

Of course, there have been times throughout history – like 2017 – in which this number remained above this level for an extended period, but it is one factor to consider while analyzing the cryptocurrency’s short-term outlook.

Bitcoin’s Latest Upswing Brings It Closer to Reaching 2017 Highs

At the time of writing, Bitcoin is trading up over 2% at its current price of $11,170. This marks a notable surge from recent lows of $10,500 that were set yesterday when bulls attempted to invalidate its uptrend.

The strong defense of this level, however, quickly allowed BTC to rebound back into the $11,000 region.

The confirmation of the support-resistance flip also further bolstered the cryptocurrency’s mid-term outlook, as it shows that this movement is more than a fleeting bull trap.

Bitcoin is now trading beneath a dense resistance region between $11,200 and $11,400, and analysts are widely noting that a break above this area could be enough to send it surging significantly higher.

Currently, BTC is trading just under 45% below its previously established all-time highs of $20,000. Each leg higher brings it that much closer to reaching this historic level.

“Less than halfway from the previous top: Bitcoin’s price drawdown from ATH is currently at -44.1%,” research firm Glassnode explained in a recent tweet.

Image Courtesy of Glassnode.

BTC Profitability a Warning Sign Regarding Strength of Ongoing Uptrend

Because the vast majority of the circulating Bitcoin supply was purchased beneath its current price levels, nearly 93% is currently sitting in a state of profit.

Data from Glassnode reveals that the cryptocurrency typically forms a mid-term high once the percent supply in profit hits this level.

“BTC’s break above $11,000 has lead to a sharp increase in the on-chain supply in profit. Currently almost 93% of the circulating Bitcoin supply is in a state of profit – the highest level in over a year.”

Image Courtesy of Glassnode.

This does indicate that the cryptocurrency may soon start struggling to maintain its strong momentum.

Featured image from Unsplash. Pricing data via TradingView.