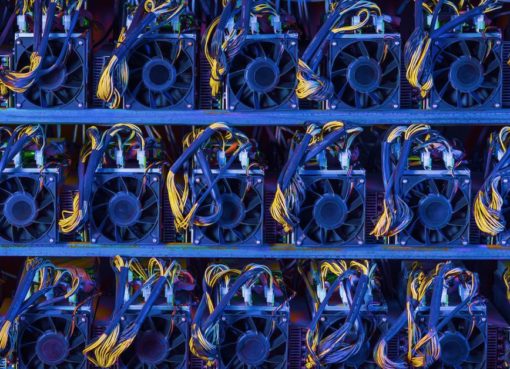

In a relatively young industry with rising competition, expansion is one of the keys for miners to remain profitable. However, with limited access to capital, M&A will likely become more pronounced among cash-strapped miners to fund their growth or production goals. And miners that have orders for new machines but haven’t been able to deploy their rigs yet, as well as companies that don’t have the capital to pay for the machines they have already ordered, could become attractive for potential buyers, Thiel said.

Miners Remain Unfazed by Crypto Sell-Off, Expect More M&A