While bitcoin has been consolidating for a few days now, a number of other digital assets have seen solid seven-day gains. The two metaverse tokens sandbox and decentraland have skyrocketed over 170% during the last week. Crypto assets like loopring, crypto.com coin, and arweave have spiked in value more than 66% and up to 169% this week as well.

Sandbox, Decentraland, Loopring See Triple-Digit Gains This Week

The price of bitcoin (BTC) has consolidated above the $60K zone for a while now and market performance this week has been rather lackluster. While bitcoin (BTC) gained 0.5% during the last seven days, three top-ten cryptos saw double-digit gains this week.

The third-largest market in terms of overall valuation is held by binance coin (BNB), which is up 24.1% this past week and swapping for $610 per BNB. Solana (SOL) swapping for $235 per unit is up 20.9% this week. Additionally, polkadot (DOT) has climbed 21.9% and is currently changing hands for $51.29 per unit.

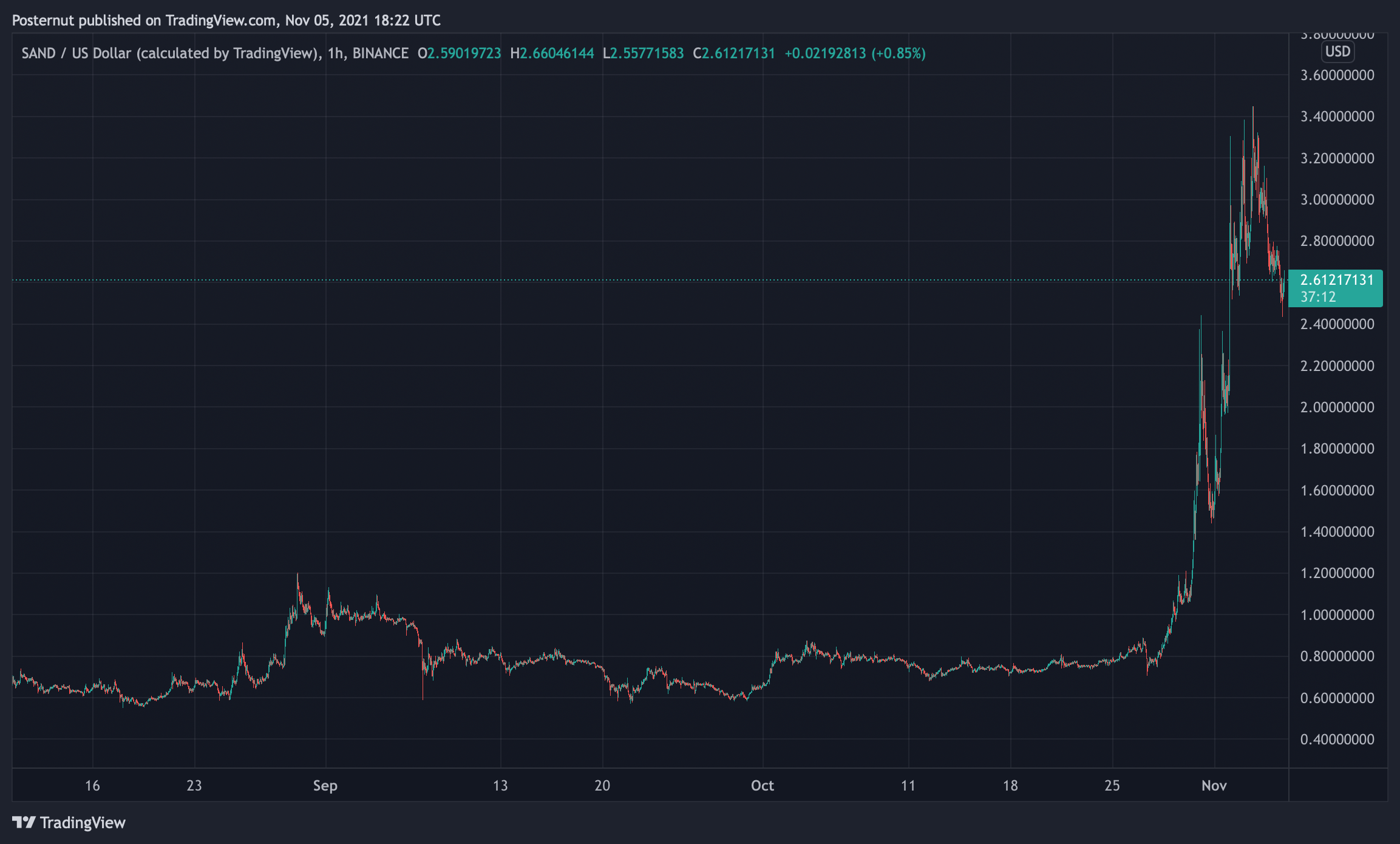

While binance coin, solana, and polkadot saw double-digit spikes this week, sandbox, decentraland, and loopring prices soared this week. Sandbox (SAND) spiked 175.3% and decentraland (MANA) jumped 172.9% in value. During the course of the week, loopring (LRC) lifted by 169.4%.

SAND is ranked number 78 out of the crypto economy’s 10,390 coins as the crypto asset has gained 8,039% year to date. Similarly, decentraland (MANA) has done extremely well during the last 12 months spiking 3,931% year to date. 12-month statistics for loopring (LRC) show the cryptocurrency is up 1,025% over the last 12 months.

Numerous Double-Digit Crypto Gainers — Bitcoin Dominance Close to Sinking Below 40%

Following those three-digit crypto gains, crypto.com coin (78.6%), arweave (66.2%), kadena (64.4%), holo (41.3%), chiliz (40.8%), basic attention token (39.4%), amp (39%), NEM (33.9%), omg network (31%), enjin coin (28.4%), and wonderland (25.1%) saw double-digit gains this past week.

The overall market capitalization of all 10,000+ coins in existence today is nearing $3 trillion at approximately $2.835 trillion on Friday, November 5. While there’s $152.28 billion in global trade volume, $83 billion of that volume is paired with stablecoins. Tether (USDT) commands $71.9 billion of today’s $83 billion aggregate total trade volume.

Out of the $2.835 trillion in value recorded on Friday, bitcoin’s (BTC) dominance is just above the 40% region with 40.6%. Ethereum, on the other hand, has 18.7% and numerous alternative crypto caps have increased dominance percentages.

What do you think about the past week’s crypto market action? What do you think about the triple and double-digit cryptocurrency gainers this week? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.