It was a quiet day in the bitcoin market while there was action on Uniswap’s total crypto value locked.

- Bitcoin (BTC) trading around $10,316 as of 20:00 UTC (4 p.m. ET). Slipping 0.13% over the previous 24 hours.

- Bitcoin’s 24-hour range: $10,199-$10,383

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

The price of bitcoin was struggling to trend upward Friday, staying in a narrow $10,200-$10,380 range to start the weekend.

“Bitcoin has traded off this month with other risk assets, such that it is now short-term oversold near former resistance in the $10,055 area,” said Katie Stockton, managing partner at Fairlead Strategies. “We expect the pullback to keep its hold in the near term from a momentum standpoint.”

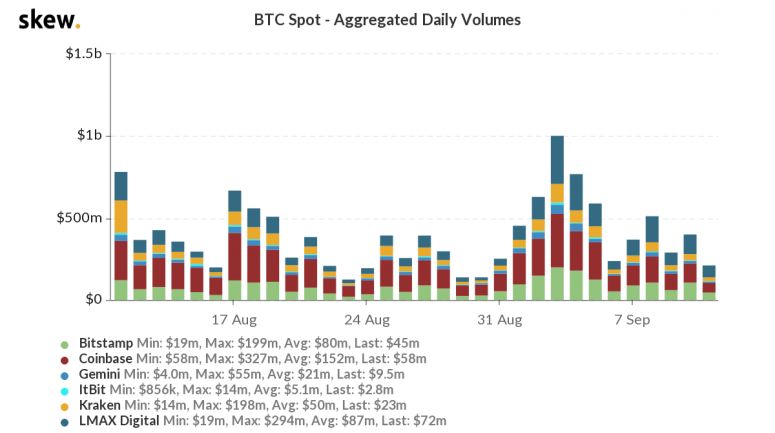

Indeed, bitcoin’s volume numbers Friday were tepid at best, with USD/BTC trades on spot exchanges amounting to just $210 million, whereas daily averages the past month had been $393 million.

Yet, this could be an inflection point for the cryptocurrency, according to Neil Van Huis, director of institutional trading for crypto liquidity provider Blockfills. “Around $10,500 is really the middle of range from a previous breakout from consolidation around $9,000 all the way up to the roughly $12,000 we’ve seen recently,” he said. “If we can stay above $10,000, I’m encouraged and remain bullish. If we stay too long below $10,000, I think we could be more susceptible to a re-test of $9,000.”

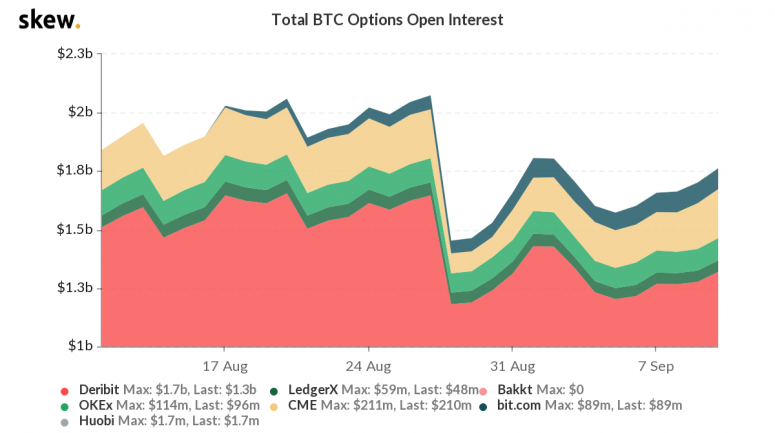

The bitcoin options market appears to be picking up during this low-momentum period and that is an ominous sign, according to William Purdy, an options trader and founder of analysis firm PurdyAlerts. “Bitcoin option open interest is increasing. This suggests a continued downward trend,” noted Purdy.

Karl Samsen, vice president for capital markets at trading firm Global Digital Assets, said some are staying out of the market for the time being. “What we’re seeing is a lot of money on the sidelines,” said Samsen. “The early DeFi investors who didn’t cut gains pre-BTC runup are starting to take gains now.”

Uniswap’s roller-coaster ride

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Friday, trading around $369 and climbing 1.4% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

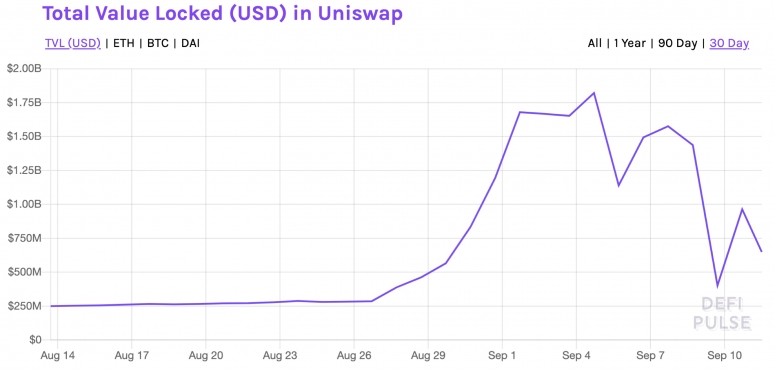

The amount of cryptocurrency “locked” in decentralized exchange Uniswap has shown a high degree of volatility on DeFi Pulse charts the past week. On Sept. 8, value locked was $1.4 billion, then down to $400 million Sept. 9, then up to almost $1 billion Sept. 10. On Friday, the number was at $648 million.

Drama in DeFi, particularly from Uniswap software fork SushiSwap, is playing a role in the volatility.

“The big decline is from the SushiSwap migration,” said a DeFi yield farmer who goes by the username devops199fan. “Basically, SushiSwap converted liquidity from Uniswap over automatically,” they added.

The gyrations show the ephemeral nature of DeFi and its fast movement of funds around various projects, noted devops199fan. “I think the bump right after the decline was from people migrating back to Uniswap so they could use the LP [liquidity provider] tokens to farm in some other new projects that just popped up recently.”

Liquidity provider (LP) tokens are incentives provided to yield farmers in return for contributing liquidity on decentralized exchanges.

Other markets

Digital assets on the CryptoX 20 are mostly in the red Friday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil is up 1.3%. Price per barrel of West Texas Intermediate crude: $37.49.

- Gold was flat, in the red 0.16% and at $1,942 as of press time.

- U.S. Treasury bond yields all slipped Friday. Yields, which move in the opposite direction as price, were down most on the two-year, in the red 12.1%.