Bitcoin is recovering from Tuesday’s drop while there is a decrease in large-balance ether addresses.

- Bitcoin (BTC) trading around $10,651 as of 20:00 UTC (4 p.m. ET). Gaining 0.66% over the previous 24 hours.

- Bitcoin’s 24-hour range: $10,524-$10,683

- BTC above its 10-day moving average but below the 50-day, a sideways signal for market technicians.

Bitcoin’s price is making gains Wednesday, recovering from a spate of selling Tuesday that coincided with U.S. President Donald Trump’s tweet calling off stimulus negotiations with lawmakers. Bitcoin was able to hit $10,650 on spot exchange such as Coinbase before settling to $10,651, as of press time.

In its weekly investor note, quantitative trading firm QCP Capital indicated bitcoin’s ability to stay above $10,000 in the face of a less-than-optimistic news cycle is promising. “We’d need to see a break below the key $10,000 level to have any downside follow-through,” QCP stated. “We are likely just treading water and building momentum until after the elections, when we think the coast will then be clear for a new bull trend to develop.” Since early September bitcoin has remained in the $10,000-$11,000 price range.

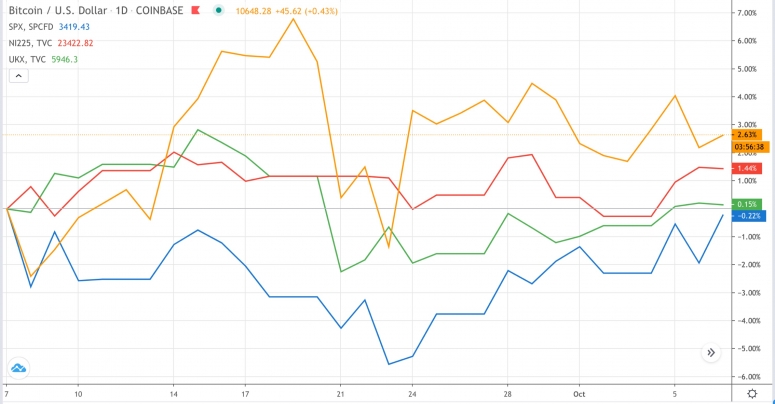

“The crypto markets are still very highly correlated to traditional markets and the broader economy as a whole,” said Michael Rabkin, head of institutional sales for cryptocurrency market maker DV Chain. “We believe that any time markets tick up or tick down this is exaggerated in crypto. The correlation is still very high.” Bitcoin may be operating in tandem with traditional markets as of late, but its returns over the past month have been beating global stock indexes.

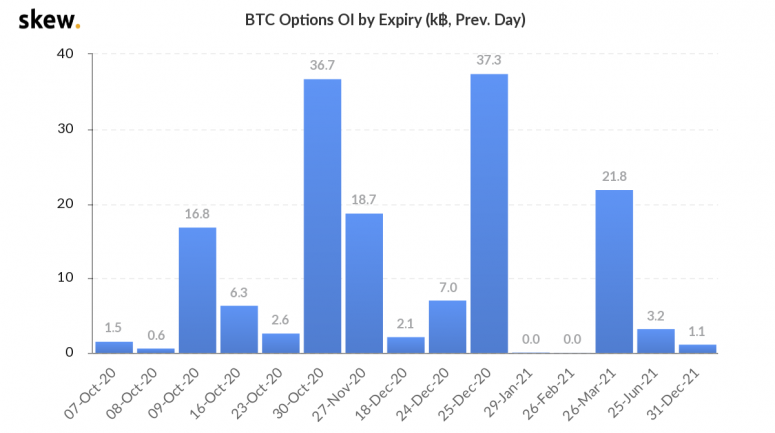

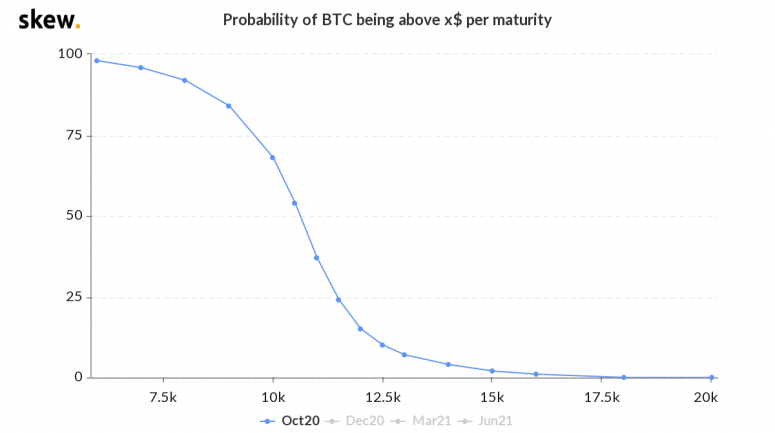

In the options market, traders have over 36,000 BTC in open interest set to expire by Oct. 30.

Based on the probability of those options, bitcoin has a 68% chance of closing out the month over $10,000, a 53% chance of being over $10,500 and just a 37% chance to hit $11,000.

DV Chain’s Rabkin noted that as more sophisticated investors jump into crypto, it may ebb and flow with the traditional market more than ever before. “As bitcoin is becoming a new asset class for institutional market participants, its sensitivity to macro events will rise over time.”

Ethereum high-balance addresses dropping

The second-largest cryptocurrency by market capitalization, ether (ETH), was flat Wednesday, trading around $341 and in the red 0.03% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

The number of Ethereum addresses with a balance greater than or equal 1,000 ETH is at a three-year low. It dropped 7,162 addresses Sept. 27, the lowest since Oct. 17, 2017. As of Tuesday, Ethereum addresses with a balance greater than or equal 1,000 ETH was at 7,220 addresses.

It’s important to note this data from Glassnode don’t include smart contracts, which may help explain why the number of addresses has dropped in 2020. George Clayton, a managing partner of investment firm Cryptanalysis Capital, says many large ether holders are likely moving some of the crypto into smart contract-based DeFi protocols for additional profit opportunities.

“Ethereum believers ought to be DeFi believers as well,” said Clayton. “With billions flowing into DeFi, major ETH holders might be getting in on the action by participating in automated market making pools or staking ERC-20 tokens, thereby reducing ETH balances.”

Other markets

Digital assets on the CryptoX 20 are mixed Wednesday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil was up 0.47%. Price per barrel of West Texas Intermediate crude: $39.96.

- Gold was in the green 0.46% and at $1,886 as of press time.

- U.S. Treasury bond yields climbed Wednesday. Yields, which move in the opposite direction as price, were up most on the 10-year, gaining to 0.785 and in the green 7.2%.