Bitcoin traders are hitting the sell button Friday while the ether options market loads up on lower prices.

- Bitcoin (BTC) trading around $11,674 as of 20:00 UTC (4 p.m. ET). Slipping 1.4% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,605-$11,892.

- BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians.

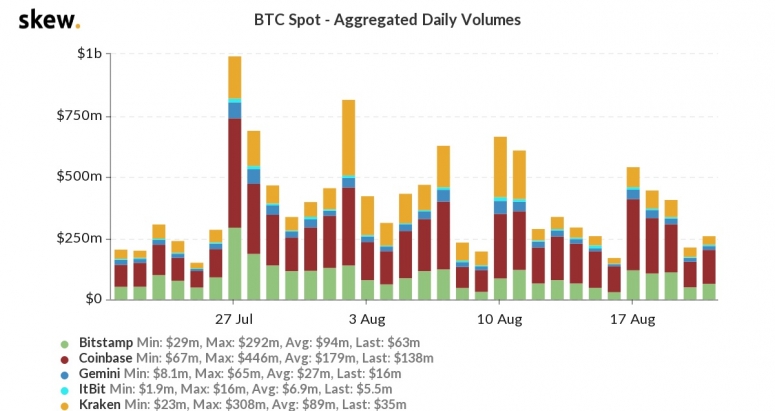

After holding around $11,800 Thursday into Friday, bitcoin started to slide downward around 08:00 UTC (4 a.m. ET), dropping to a 24-hour low of $11,605. Spot volumes were lower to cap off the workweek. It was $138 million on major spot USD/BTC exchange Coinbase, lower than its $179 million average over the past month.

Over-the-counter crypto trader Henrik Kugelberg expects a bullish, if not record, fourth quarter ahead for bitcoin, even if the number of sluggish market days pile up. “I expect a slower curve but would not be surprised if we reach a $15,000 BTC in October and somewhere around $18,000-$20,000 at year end.”

Kugelberg points to the uncertain economy as giving people reason to swap fiat for crypto investments. “There’s the falling value of the dollar to be priced in; we have not seen the end of the dollar’s fall that is for sure,” he added. Indeed, while the U.S. Dollar Index, a measure of the greenback’s strength versus a basket of other fiat currencies, is up 0.52% Friday, it’s still at lows not seen since June 2018.

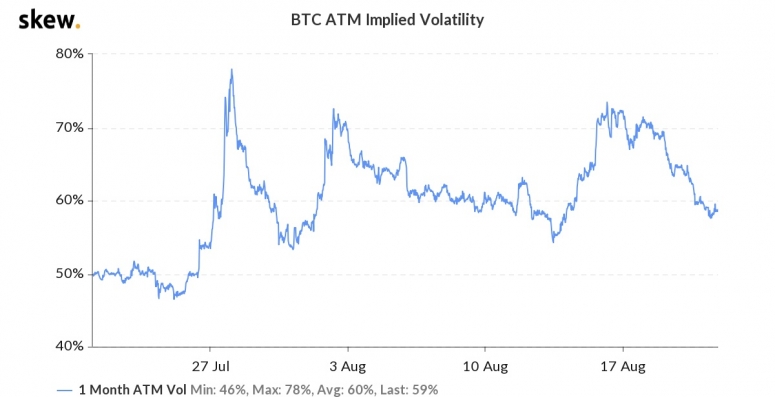

In the bitcoin options market, Neil Van Huis, director of sales and institutional trading at liquidity provider Blockfills, noted volatility decreased this week. Bitcoin’s at-the-money implied volatility, which is a metric to forecast movement in prices, has dropped from 71% Monday to 59% Friday. “Looks like some normalization of volatile trading as of late,” Van Huis said.

Opportunities in Ethereum-powered DeFi are taking some traders’ focus away from the bitcoin market, Kugelbrg told CryptoX. “The crypto community is in a total FOMO to DeFi-related altcoins,” said Kugelberg. “I believe the run-up for bitcoin may be slower than expected and fueled by retail sales to newcomers wanting a somewhat steadier haven.”

Ether options market bearish

Ether (ETH) was down Friday, trading around $399 and slipping 3.8% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

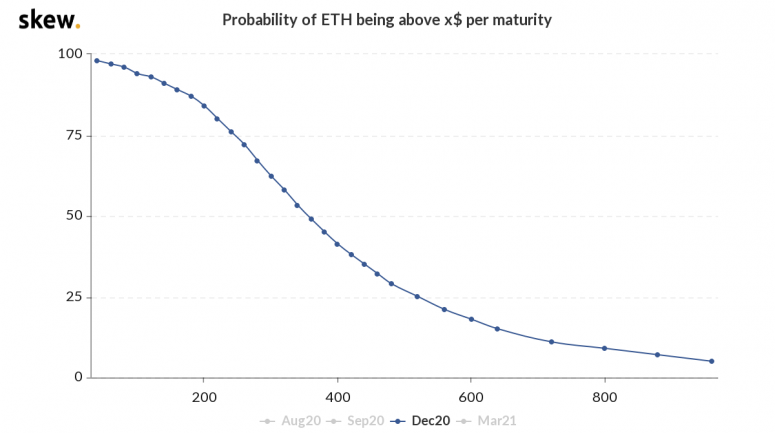

The ether options market is predicting prices by the end of 2020 won’t be much higher than they are now for the world’s second-largest cryptocurrency. December 20 maturities only give ether a 25% chance of being over $520, a 38% probability of being over $420 and a 41% chance of being over $400, according to data aggregator Skew.

Despite the probabilities, Jean-Marc Bonnefous, managing partner for Tellurian Capital, which has been investing in crypto projects since 2014, is still bullish on ether. He doesn’t see Ethereum’s fundamental issues, such as fees constraining the network, as anything but a speed bump on the fast-moving DeFi highway. “Structurally, no,” said Bonnefous. “But short term, ether needs a new trigger to go higher.”

Other markets

Digital assets on the CryptoX 20 are mixed Friday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil is down 1.1%. Price per barrel of West Texas Intermediate crude: $42.24.

- Gold was in the red 0.40% and at $1,938 as of press time.

- U.S. Treasury bonds were mixed Friday. Yields, which move in the opposite direction as price, were up most on the two-year, in the green 2.8%.