Bitcoin is looking bearish while Ethereum miners are reaping more fee revenue than ever before.

- Bitcoin (BTC) trading around $11,298 as of 20:00 UTC (4 p.m. ET). Slipping 3.8% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,102-$11,786.

- BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians.

Read More: ‘Bitcoin Rich List’ Reaches All-Time High

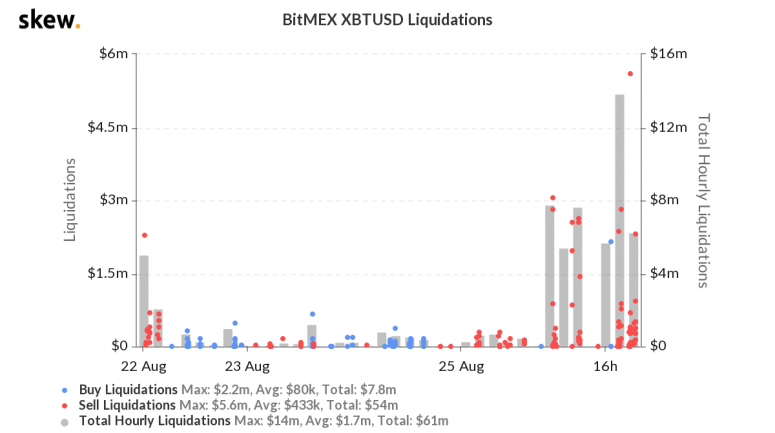

Bitcoin’s price declined to as low as $11,102 on spot exchanges such as Coinbase Tuesday, wiping out long derivatives traders on BitMEX. In just one hour, up to $5.6 million in leveraged positions were automatically liquidated, the crypto analog to a margin call.

Daniel Ladinsky, trader at quantitative trading firm Efficient Frontier, worries that if price stays beneath $12,000 per one BTC for too long it may signal a larger downward trend. “BTC has been hovering below $12,000 for quite some time, which is a crucial zone,” Ladinsky told CryptoX.

Michael Gord, CEO of cryptocurrency brokerage firm Global Digital Assets, sees Tuesday’s price dip as temporary profit-taking by some investors. ”Institutional traders take profits the whole way up to hedge their risk,” he said. ”We are now seeing more institutional traders take some of that profit and reallocate it into ‘riskier’ low- to medium-cap altcoins.”

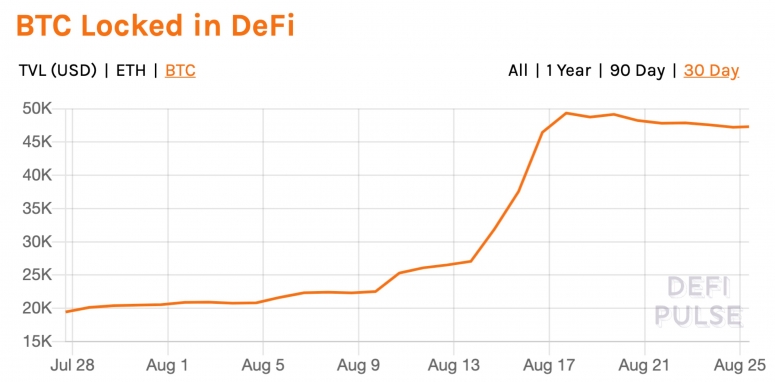

One interesting development: Bitcoin locked in decentralized finance, or DeFi, is down a little bit after it had previously doubled in August, according to data aggregator DeFi Pulse.

Efficient Frontier’s Ladinsky says traders continue to see more alluring profit opportunities in DeFi, which might help explain the decline. “Recently, the market has been quiet for BTC and most of the attention and hype is on the DeFi front, where coins are surging very hard,“ he said.

Ether mining difficulty at 2020 high

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Tuesday, trading around $379 and slipping 5.9% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

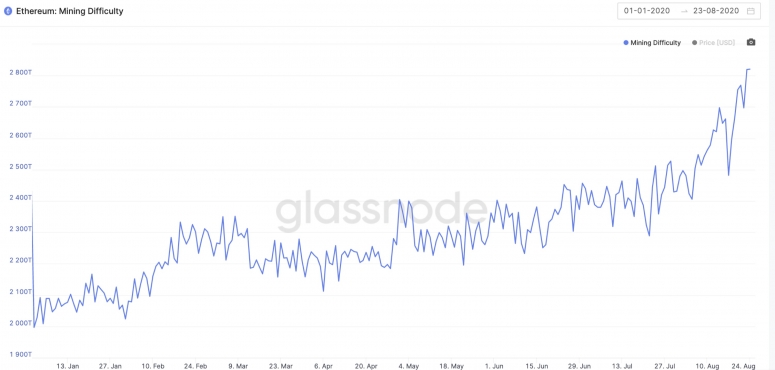

Ethereum’s mining difficulty has hit a 2020 high, at 2,820 terahashes, its highest level since Dec. 13, 2019.

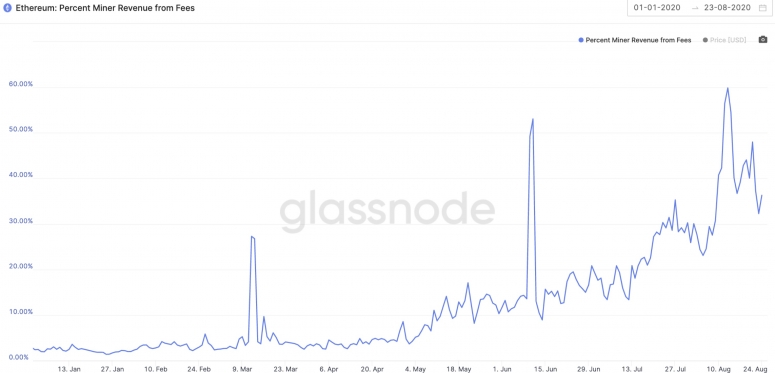

The amount of gas, or the fee required to successfully conduct a transaction or execute a contract on the Ethereum blockchain, is at an all-time high, meaning the resources used per block are increasing. This means more miner revenue coming from fees and, as a result, more machines being turned on, causing mining difficulty to increase.

Smart contract developers in the ecosystem like Jun Dam, who is working on a DeFi project based on the competing EOS platform, tell CryptoX the Ethereum fee situation may be helping miners, but it isn’t benefiting anyone else. “ETH gas fees are not user- or developer-friendly,” Dam said.

Other markets

Digital assets on the CryptoX 20 are mostly in the red Tuesday. One notable winner as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil is up 2.2%. Price per barrel of West Texas Intermediate crude: $43.35.

- Gold was flat, in the red 0.05% and at $1,927 as of press time.

- U.S. Treasury bonds all climbed Tuesday. Yields, which move in the opposite direction as price, were up most on the 10-year, in the green 3.4%.