LINK was among the biggest crypto gainers in the last 24 hours as its price jumped 20 percent.

The Chainlink token rose to $13.40 before correcting lower on intraday profit-taking sentiment. As of the early Monday session, LINK/USD was trading at $12.50, just above the technical support offered by its 50-day simple moving average (the blue wave).

Chainlink starts the week correcting lower. Source: TradingView.com

On a broader outlook, LINK/USDT is trading downwards in a Descending Channel, confirmed by at least two lower highs and lower lows. The downside began after the pair established its record high at $20.71 on August 17, following a 1,080 percent rally.

LINK’s correction this week could be a part of a broader bearish correction. The token, therefore, expects to find a concrete price floor before it resumes its uptrend. The near-term outlook point to the lower trendline of the Descending Channel to offer support. Historical behavior poses $8.96 as a level of pullback.

Meanwhile, bounce-back amounts to a small upside move towards the Descending Channel resistance. A break above it would have traders open long positions towards $17.75.

Fundamentals

LINK traders managed to secure exponential gains earlier this year because of Chainlink’s strength as a blockchain project.

Its core protocol wrote the playbook for the emerging oracle sector. Chainlink is building a massive pipeline of future integrations by feeding them with data feeds. Over 200 independent blockchain and non-blockchain projects have signed up with its data services.

They include smart contract platforms Harmony and NEAR, as well as Bancor, which just launched the second version of its AMM protocol. That has dramatically coincided with a price rally in LINK, a collateral token that powers the Chainlink network.

“Chainlink has announced 112 new partnerships in 2020, with LINK up 628% over that same period,” wrote data aggregator Messari in its August report. “It’s also hard to ignore how LINK price movements have reflected the frequency of monthly announcements, even if it’s merely coincidental.”

LINK Technicals

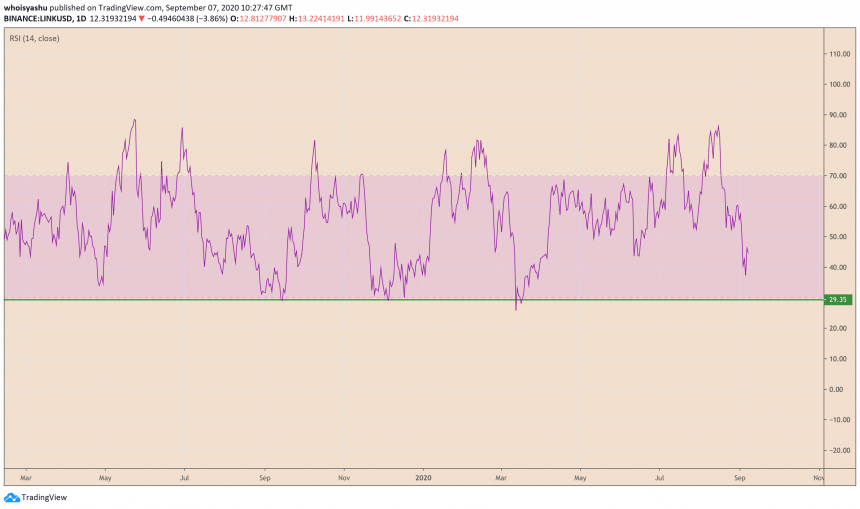

But the rally eventually made LINK an overbought asset, according to readings provided by its daily Relative Strength Indicator. The token’s latest correction, therefore, neutralized the sentiment – and later placed it in an entirely buy-worthy area.

Chainlink Relative Strength Indicator hints more correction is due. Source: TradingView.com

The RSI Indicated that LINK has more room to correct lower.

Meanwhile, market analyst Cantering Clark sees the oracle token crashing to at least $5 in the coming sessions.

You hate to see it. But I am confident in it.

“Dread it. Run from it. Destiny still arrives all the same.”$LINK pic.twitter.com/btn4EoY9jy

— Cantering Clark (@CanteringClark) September 5, 2020

You hate to see it. But I am confident in it.

“Dread it. Run from it. Destiny still arrives all the same.”$LINK pic.twitter.com/btn4EoY9jy

— Cantering Clark (@CanteringClark) September 5, 2020