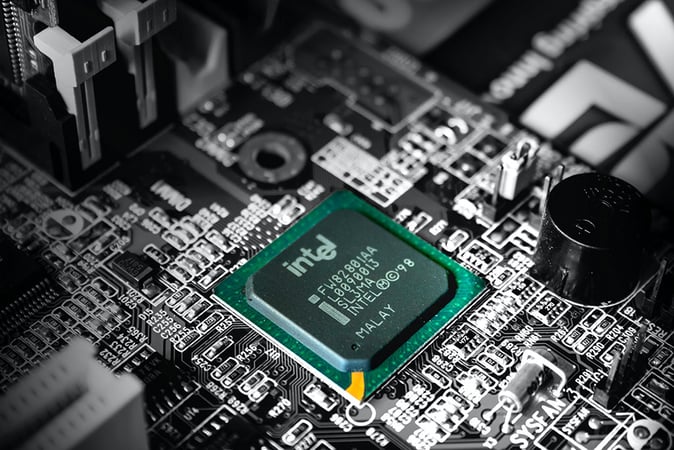

Intel is making a strong push in the semiconductor industry with FPGAs, which can be highly flexible, efficient, and used in various industries, are in high demand.

Chip-making giant Intel is planning to treat its programmable chip unit as a standalone business. As a result, the company is going to spin out an Initial Public Offering (IPO) for the same.

Following the announcement on Tuesday, the stock price of the chipmaker saw a 2.3% increase in after-hours trading. Intel’s Programmable Solutions Group (PSG) is set to transition towards independence, with its own separate balance sheet.

While Intel will maintain majority ownership and continue supporting the business, it also has the option to seek private investment. Sandra Rivera, currently leading Intel’s Data Center and AI group, will assume the role of PSG CEO, with Intel handling the manufacturing of the group’s chips.

This decision comes in the wake of Intel’s spinoff of Mobileye, its self-driving subsidiary, last year. It aligns with CEO Patrick Gelsinger’s strategic direction, which emphasizes cost management and a focus on the foundry business and core processors, with the goal of competing with Taiwan Semiconductor Manufacturing Co. in manufacturing capabilities by 2026.

The FPGA business became part of Intel through its acquisition of Altera for $16.7 billion in 2015. Speaking on the current development, Gelsinger said:

“Our intention to establish PSG as a standalone business and pursue an IPO is another example of how we are consistently unlocking more value for our stakeholders.”

Intel’s Push for FPGA Semiconductors

This move also underscores the robust demand in the semiconductor sector for field programmable gate arrays, commonly known as FPGAs. Lattice Semiconductor, a notable FPGA manufacturer, has witnessed a roughly 30% increase in its stock value in 2023 and reported an 18% growth in sales during the latest quarter. Intel’s primary competitor, AMD, acquired FPGA producer Xilinx for $35 billion in 2022.

FPGAs, while less complex than the high-powered processors found in servers and PCs, offer greater flexibility, faster response times, and enhanced power efficiency. They are suitable for specific applications in data centers, telecommunications, video encoding, aviation, and various other industries after their shipping. FPGAs can also execute certain artificial intelligence algorithms.

Intel markets its FPGAs under the Agilex brand. While specific sales figures for the Programmable Solutions Group (PSG) are not disclosed by Intel, the company stated in July that PSG had achieved three consecutive record quarters, offsetting a decline in server chip sales. PSG operates within Intel’s Data Center and AI group, which generated $4 billion in sales in the second quarter.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.