Institutional investors apparently have no interest in altcoins as data from Bybit Research show half of institutional’s portfolio is allocated to Bitcoin.

Institutions are more interested in Bitcoin (BTC), than Ethereum (ETH) or altcoins, according to a new data from Bybit Research.

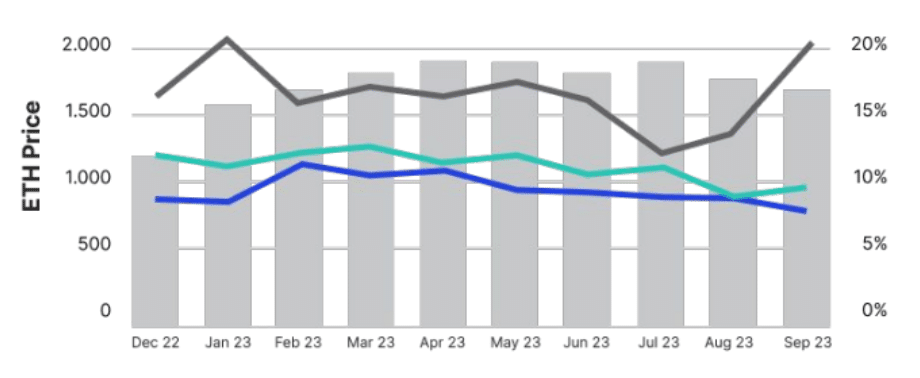

As crypto markets have experienced extreme volatility in 2022, institutional investors increased their Bitcoin holdings during the initial three quarters of 2023, a pattern “distinct from that of other users,” the report says.

“Of particular interest is the fact that, in September, half of INS’s asset portfolio was allocated to BTC.”

Bybit Research

As per analysts, the prevailing positive market sentiment toward Bitcoin can be attributed to “favorable lawsuit outcomes,” as the market anticipates good outcome for spot Bitcoin exchange-traded funds (ETFs). However, retail traders in the meantime “exhibit the lowest holding percentage in BTC” compared to institutions, which might be due to their “comparatively higher leverage levels,” Bybit suggests.

It appears institutions have also started slowly allocating their funds to Ethereum since Sept. 2023, but analysts think this surge of activity may have to do with institutions’ “general upbeat sentiment toward crypto” as VIP and retail traders are demonstrating lack of interest in Ethereum since the Shanghai upgrade (also known as “Shapella”).

For the research report, Bybit generated data based on its active users base from Dec. 2022 – Sept. 2023. VIP traders are said to be investors with holding portfolio worth more than $50,000.

Meanwhile, crypto industry executives have declared the start of a new bull run, with more voices calling for new all-time highs for Bitcoin above $100,000 in 2024. For instance, Pascal Gauthier, CEO of Ledger, noted in an interview with CNBC that 2023 was a year of preparation for the growth ahead, adding that the sentiment for 2024 and 2025 is “very encouraging.”