It’s only been two years since its founding, but decentralized exchange (DEX) protocol 1inch Network has already surpassed $85.8 billion in cumulative trading volume. At a May 2019 hackathon in New York City, 1inch co-founders Anton Bukov and Sergej Kunz developed a prototype DEX aggregator that became the basis of the network. DEX aggregators are platforms that source liquidity from multiple DEXs, thereby providing better token swap rates with less slippage.

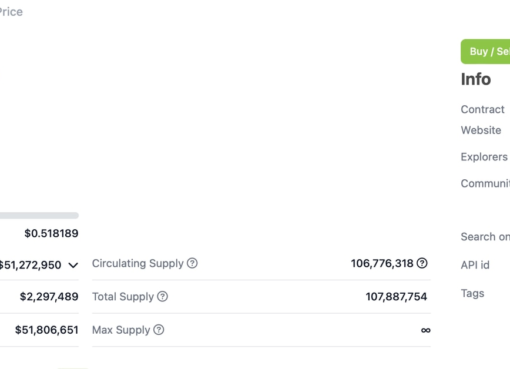

The network has a 57.40% market share in the DEX aggregator industry and well over 820,000 users. According to CoinMarketCap, 1inch Exchange is the eighth-largest DEX in the world, with a trading volume of $277 million in the past 24 hours.

On Monday, Bukov joined the Cointelegraph Markets Pro community for an exclusive ask-me-anything session over Discord.

Cointelegraph Markets Pro: Do you believe that DEXs will serve most crypto users, or will that segment be dominated by algos and bot trading?

Anton Bukov: I believe that in the next three to five years, the DeFi industry will grow massively. It’s already growing rapidly, but the advantages of peer-to-peer technologies can and will be more widely experienced.

Of course, in order for DEXes to dominate over CEXes [Centralized Exchanges], certain conditions have to be met in the future. DEXes and blockchain protocols have to perform 100 times faster than they do now. Users need to understand the core concept of the technology. User journeys have to shorten down and become friendlier for beginners.

The 1inch Network is a collection of strong and composable DeFi instruments, which together enable both veteran and new DeFi users to maximize the financial opportunity of Web3 with clean UX and secure contracts.

CT Markets Pro: What makes 1inch stand out from the crowd?

AB: 1inch is mission-driven to benefit the entire DeFi space. And we work hard and fast to achieve our mission. We aim to unite traders and liquidity providers, facilitating transactions that are profitable for both sides. The core functionality of 1inch is to aggregate data from various decentralized exchanges and to combine the best prices from all bids with the necessary liquidity. In April 2021, we released the 1inch iOS Wallet — a multichain mobile platform that provides an easy-to-navigate interface with secure storing, transaction, and staking capabilities. This versatile wallet was built from the ground up to streamline interacting with 1inch’s features.

CT Markets Pro User: As a DEX aggregator, are there any plans to mitigate the amount of fees that are currently on the entire network at the moment? What are the plans for the future on 1inch?

AB: For sure, recently 1inch Foundation established a program to refund gas spendings for 1inch users.

AB: High profits are usually correlated with high risks. Users deposit more coins; this lowers their profits for sure.

CT Markets Pro: The Binance exchange holds a large 1INCH stake, representing 44% of the governance votes. How does 1inc intend to overcome that?

AB: Binance is staking on behalf of their users; Binance never voted and not going to vote, AFAIK.

CT Markets Pro: How does 1inch solve the front-running bots?

AB: The 1inch Liquidity Protocol has a unique feature that helps protect users from these kinds of attacks, ensuring users get the most out of every trade. To discourage front-runners from attacks of this kind, the 1inch Liquidity Protocol has ‘virtual rates’ Actually; you can check this article for details.

CT Markets Pro: How hard will it be to migrate 1inch to Eth2? Will each liquidity provider be required to move their position?

AB: No one DeFi developer should wait or prepare for ETH 2.0. DeFi scaling will happen through L2; the sharded environment of ETH 2.0 makes no sense for DeFi.

I find ZK Rollups as a real scaling solution because ZK transaction verification complexity is fixed and does not depend on the complexity of the transaction itself. It sounds like magic, but it is like that ^^.

CT Markets Pro User: Any plans for multi-chain trades/transactions? Bridges, etc.

AB: I recently had an exciting twitter thread regarding cross-chain future of 1inch; please take a look:

1/ In recent months, I’ve been asked a lot about a cross-chain future for @1inch. Dozens of projects are actively working on bridges, and some of them have applied for 1inch grants or just asked for my advice/opinion. This thread reveals my thoughts on the subject. https://t.co/25Rgy5cYok

— Anton Bukov ⚖️ (@k06a) October 25, 2021

CT Markets Pro User: What do you think of Uniswap v3?

AB: They dramatically increase the capital efficiency of their pools. This is the ultimate solution for LPs (liquidity providers). But I see traders have really bad exchange rates and huge slippages on Uniswap. Going to make a DuneAnalytics dashboard about this. Using aggregators should be a no-brainer for everyone because 1inch integrated more than 80 sources on Ethereum mainnet only.

CT Markets Pro User: Other than 1inch. do you have any involvement with other projects?

AB: Do only advise/consult on some projects. But full-time working on next big thing at 1inch.

CT Markets Pro User: Building a DEX aggregator seems like an incredibly complex thing. Do you use a single oracle as a price feed, or is there another way price is calculated?

AB: We have our own off-chain oracle to fetch prices from the chain.

CT Markets Pro User: How has the explosion of gas fees affected trading on 1inch?

AB: You can set up a new phrase or enter only the address of your wallet to try it out in read-only mode. Since it is Wallet — it just can’t create transactions and produce signatures without a private key/seed phrase.

CT Markets Pro User: In what ways are you working with layer two solutions to make 1inch practical for smaller trades? Do you have a preferred tech? Sidechain, Optimistic, rollup, ZK rollup, something else I never heard of?

AB: I personally prefer ZK rollups, awaiting for ZKSync 2.0 from Matter Labs. But for sure 1inch will support or popular/major L2/sidechains which have: users/tokens/DEXes/activity.

CT Markets Pro User: With hardware, there are currently some solutions to connect to DEX by connecting Metamask to hardware then to DEX. Do you think we can get a direct connection to hardware without any middleware?

AB: You can use a hardware wallet over WalletConnect protocol, even on a mobile phone using the Ledger Live app. Check out our cool open-source dashboard.

CT Markets Pro: What are some of the recent innovations or exciting development surrounding the 1inch Network?

AB: We are working hard to deliver one more protocol soon, also building 1inch for institutions — 1inch Pro.