In the run-up to the 2017 market peak, stories abounded of traders who bought bitcoin in the spot market just a few months before only to cash out to the tune of hundreds of thousands, if not millions, of dollars.

The days of tripling or quadrupling your money in just a week or two just by buying bitcoin may be behind us. But since those heady days of three years ago, the crypto derivatives market has taken up the mantle of being the place where astonishing returns can occasionally be had by taking huge risks.

Indeed, some traders with bullish outlooks have recently generated significant profits by taking long positions using the cheap out-of-the-money call options. That has given them the same reward as holding multiple bitcoins in the spot market but at a significantly less cost, albeit with more risk.

That’s what a bullish call options trade executed five weeks ago on the world’s largest crypto options exchange, Deribit, has achieved.

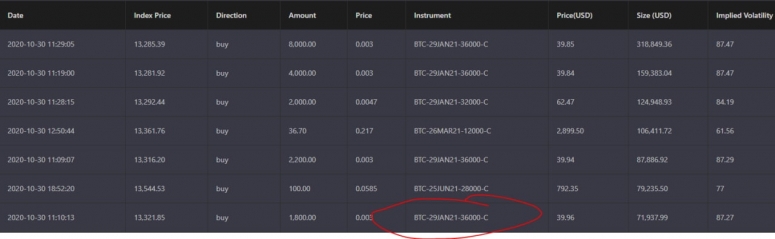

On Oct. 30, someone (a single trader or small group) bought 16,000 January expiry call options at the $36,000 strike for 0.003 bitcoin per contract, according to data shared by Deribit. The total cost was 48 bitcoin – the number of contracts (16,000) multiplied by the per-contract premium of 0.003 bitcoin.

In dollar terms, the per-contract premium at the time was around $39.90, and the entire trade required an initial outlay of approximately $638,400.

As bitcoin rallied from $13,400 to over $19,000, the premium drawn by the $36,000-strike January expiry call rose from 0.003 bitcoin to 0.0145 bitcoin, generating a paper profit of more than $4 million.

Here is how the net return is calculated:

= [(Option’s current price of 0.0145 BTC x 16,000 contracts) x bitcoin’s current spot market price of $19,200] minus (-) cost of trade.

= [232 bitcoin x $19,200] – $638,400

= $4,454,400 – $638,400

= $3,816,000

If the position were to be liquidated now, and assuming dumping on the market 16,000 far-out-of-the-money calls wouldn’t drop the price, the net return ignoring the fees charged by the exchange would be seven times the initial outlay.

A call option gives the holder the right but not the obligation to buy the underlying asset at a predetermined price on or before a particular date. A put option represents a right to sell. Options on Deribit are also cash-settled, which means when they are exercised it is only the profits that are paid. One options contract represents the right to buy or sell one bitcoin.

As of now, the $36,000 call is an out-of-the-money call option – one which has no intrinsic value due to the spot price hovering below the strike price.

Theoretically, the purchase of the $36,000 call expiring on Jan. 29 is a bet that prices will rise above $36,000 before the end of January, making the option “in-the-money.”

The crypto derivatives market has taken up the mantle of being the place where astonishing returns can occasionally be had by taking huge risks.

However, as markets move higher, the probability of the out-of-the-money option turning into one that is in-the-money rises, boosting the option’s premium, as seen in this case.

If the bull market maintains its pace, the option premium will continue to rise, all things being equal. However, a potential price consolidation would reduce bitcoin’s probability of rising above $36,000 by the end of January and erode the option’s value as the time to expiration draws near (referred to as “theta decay” in options parlance).

Taking on an options trade brings with it even more risk than just buying bitcoin outright. For one, the trader could get wiped out. That’s because the long call position would expire worthless on Jan. 29, yielding a loss of $638,400 (the total premium the trader paid) if bitcoin settles below $36,000 on that day. Then again, the maximum loss the option trader can suffer is limited to the extent of premium paid, which is $638,400 in this case.

If the trader is seeking to liquidate a little bit of the position now, he or she may have a willing buyer out there near current prices for small amounts. As of now, the $36,000-strike call looks somewhat active. A few other traders seem to have bought call options at that strike price.

“Options offer a different strategy to make leveraged profit,” said Shaun Fernando, head of risk and product at Deribit. “In this case, extremely bullish sentiment could be done through buying leveraged futures. However from trading far out-of-the-money calls, it offered the trader a low-risk, high-reward strategy with limited down side. Increase in option price was as a result of underlying move and increased volatility. Underlying [bitcoin] does not necessarily have to cross the strike for a trader to profit.”

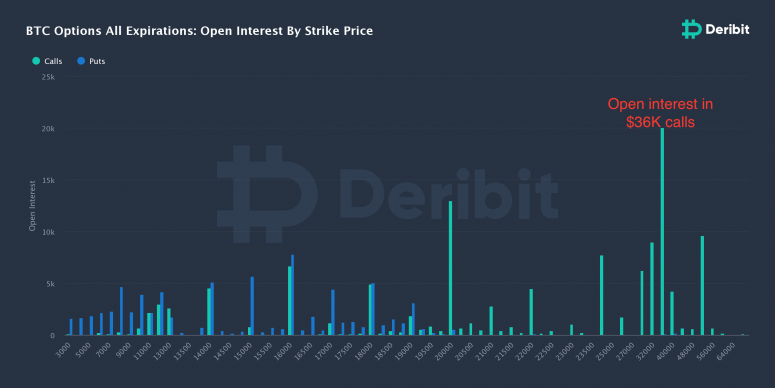

At press time, there are more than 20,000 call option contracts open at the $36,000 strike – that’s the highest concentration of open interest at a single strike.

A big open interest buildup in a deep out-of-the-money option is often considered a bullish sign. However, sometimes the data is skewed by a few large trades and thus not reliable as a market indicator, as in this case.