55 days from now will be the hundred-year anniversary of when the American industrialist and business magnate Henry Ford talked about a unique “energy currency” that could “stop wars.” The well known founder of the Ford Motor Company suggested that a currency could be backed by energy in kilowatt-hours (kWh) in a similar fashion to the way energy is leveraged to mine bitcoin.

New York Tribune, December 4, 1921: ‘Ford Would Replace Gold With Energy Currency and Stop Wars’

Close to 100 years ago on December 4, 1921, Henry Ford discussed an idea he conceived in the New York Tribune. The title of the published article was called “Ford Would Replace Gold With Energy Currency and Stop Wars.”

Ford is well known for developing the assembly line technique and creating one of the first mass-produced American-built automobiles. Ford’s energy currency concept describes a digital currency much like Satoshi Nakamoto’s Bitcoin and one that is also scarce.

Not only would Ford’s energy currency be backed by energy measured in kilowatt-hours (kWh) he also discussed with the Tribune that the currency would “be issued only to a certain definite amount and for a specific purpose.”

It has always been understood that Henry Ford was well ahead of his time, but he also thought about a concept that is very similar to what’s described in the Bitcoin white paper. Ford even had a location planned to kick start the idea at Muscle Shoals Dam. The treacherous and wild Muscle Shoals section of the Tennessee River produces a lot of energy as the dam provides electrical power, flood control, and a water supply.

Ford even took shots at the banking cartel in 1921, which are basically the same financial institutions and family members running the world’s finances today. “It’s simply a case of thinking and calculating in terms different from those laid down to us by the international banking group to which we have grown so accustomed that we think there is no other desirable standard,” Ford stressed.

While the cypherpunks like Timothy May and Eric Hughes wrote about concepts that looked closer to today’s cryptocurrency, many others had visions similar to Henry Ford’s energy currency concept. The Nobel laureate and Austrian economist Friedrick Hayek discussed the idea of a free market currency.

“I don’t believe we shall ever have good money again before we take the thing out of the hands of [the] government,” Hayek stressed. “That is, we can’t take it violently out of the hands of [the] government, all we can do is by some sly roundabout way [to] introduce something that they can’t stop.”

In addition to Hayek, Milton Friedman discussed the idea of a cryptocurrency in 1999. “I think that the Internet is going to be one of the major forces for reducing the role of government,” Friedman said during his interview that went viral in 2014. “The one thing that’s missing, but that will soon be developed, is a reliable e-cash, a method whereby on the Internet you can transfer funds from A to B, without A knowing B or B knowing A,” the economist added.

Henry Ford: ‘It Would Mean Changes in World Finance — Bankers Always Oppose Changes’

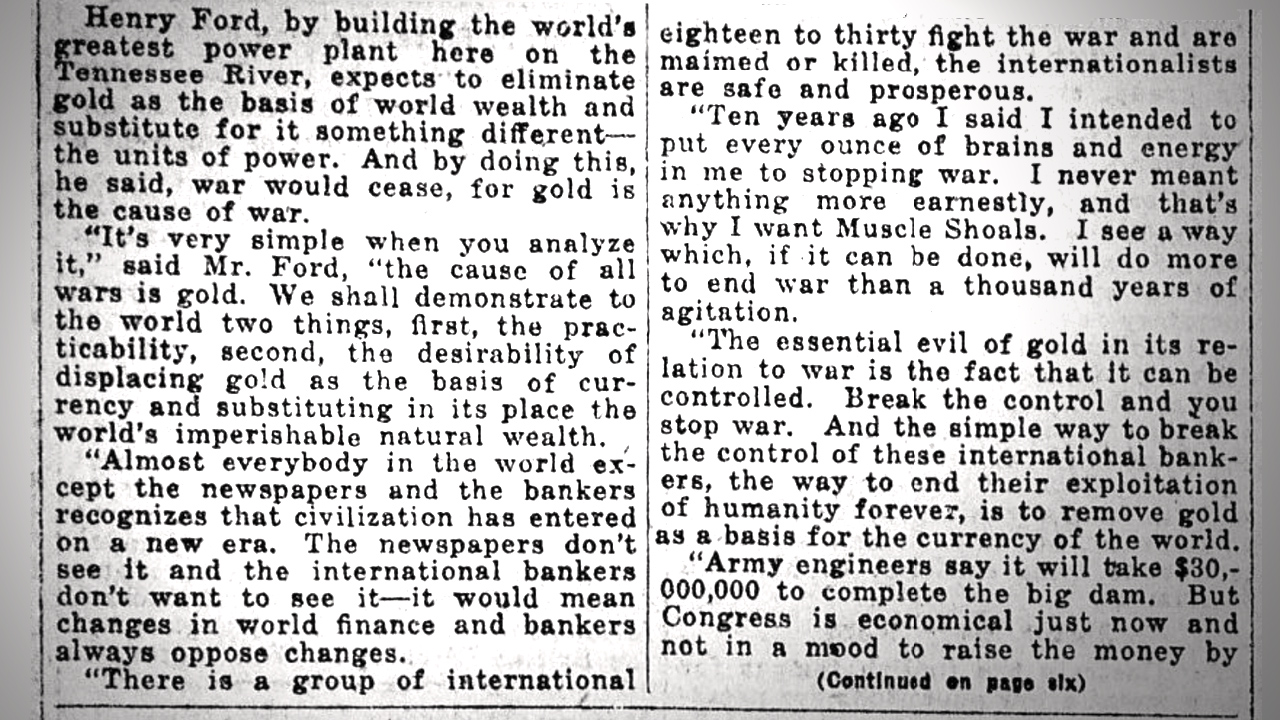

Ford’s energy currency editorial in the New York Tribune not only takes aim at the bankers but blames gold as well. “It’s very simple when you analyze it,” Ford emphasized. “The cause of all wars is gold. We shall demonstrate to the world two things, first, the practicability, second, the desirability of displacing gold as the basis of currency and substituting in its place the world’s imperishable natural wealth.” Ford continued:

Almost everybody in the world, except the newspapers and bankers recognizes that civilization has entered on a new era. The newspapers don’t see it and the international bankers don’t want to see it — It would mean changes in world finance and bankers always oppose changes.

It could be said that the trend in America has already entered a realm of digital currency which is done mostly by the banking system’s databases. In many respects, Ford got his way because the powers that be essentially replaced gold with unbacked fiat. However, fiat is a far cry from a scarce and energy-backed currency Ford dreamt up long ago.

The banking cartel moving off the gold standard has pushed a “desirability of displacing gold” from both sides of the spectrum. Decentralized crypto assets like bitcoin (BTC) are indeed displacing gold even if the measurement of displacement is still quite small.

These days people use cryptocurrencies as a hedge against fiat and the central banks’ massive monetary expansions just like precious metal (PM) collectors and ‘gold bugs.’ In this line of thinking there is also a “desirability of displacing gold” forming among the masses as digital currencies offer benefits that PMs like gold cannot provide.

According to assetdash.com bitcoin (BTC) is the sixth top asset by market cap. The web portal companiesmarketcap.com says bitcoin (BTC) is positioned in the eighth spot. The top position held by Gold is an $11.161 trillion market valuation, while BTC’s is roughly $1.041 trillion, according to the website’s metrics. Gold’s valuation is 972% larger than BTC’s as the crypto asset has a long way to go to catch up if it wants to displace gold.

What do you think about Henry Ford predicting a currency similar to bitcoin close to 100 years ago? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.