In DeFi, trading crypto options and hedging volatility can be hard. Divergence, an emerging decentralized protocol, aims to make it simple for users. It offers binary options for blockchain-native asset prices, LP tokens, interest rates, and farmed yields. In just three months after its social media debut, it quickly gained traction with crypto communities.

The protocol is backed by some of the leading VCs in the blockchain industry such as KR1, Mechanism Capital, Arrington Capital, and P2P Capital. Its list of angel investors includes Do Kwon from Terra Labs, Diane Dai from DoDo, Sandeep Nailwal from Polygon, and Igor Barinov from xDai. It recently revealed strategic investments from Huobi Ventures and AscendEx. ‘’To us, we solidly believe Divergence Protocol would be one of the most important pieces in the Defi puzzle,’’ stated Alex Dong, Research Analyst of Huobi Ventures.

Why Divergence

Divergence’s first product is an immediately scalable, easy-to-use AMM-based marketplace for binary options. Traders can trade synthetic binary option tokens on various underlying assets. LPs can permissionlessly create markets of their chosen strikes and expiries, using Divergence’s one-step minting and seeding process. Divergence also simplifies the liquidity provision process by quoting options in collateral units of any fungible tokens. This removes a major barrier of entry for many liquidity providers, who can have more flexibility over capital allocation.

Key features of Divergence include:

Enhanced capital efficiency: Providing liquidity on several on-chain positions is capital inefficient. Option sellers usually over-collateralize their positions to maintain their positions on DEXes. On Divergence, options minting and market-making happen in one single-asset AMM pool. Liquidity providers can provide capital using LP tokens from lending protocols like Aave. Selling a binary call and a binary put requires just 1x collateral and does not involve liquidation. This is because the max loss per sold binary options is pre-determined and reserved by the Divergence smart contracts.

Extensive DeFi asset trading options: Divergence provides liquidity providers with a lot more flexibility than other solutions. They can write binary options of a select strike, expiry, and underlying with any fungible token as collateral. This includes tokens from Ethereum-based DEXes like Sushiswap and Uniswap V3. This feature means LPs no longer have to additionally allocate capital to make an options market.

Automated rollover mechanism. Many derivative platforms have hard expiries of options contracts. Upon expiry, an options market may no longer exist. Divergence’s solution is to automatically roll over options contracts with similar terms after their settlement. This ensures continuity in the options market for LPs. Liquidity providers can save gas since they do not need to remove and add liquidity to make a new market. This feature is uniquely available on Divergence.

How does Divergence work

Divergence has already released a Testnet version of its marketplace on the Ethereum kovan testnet. The entire user experience is simple and straightforward.

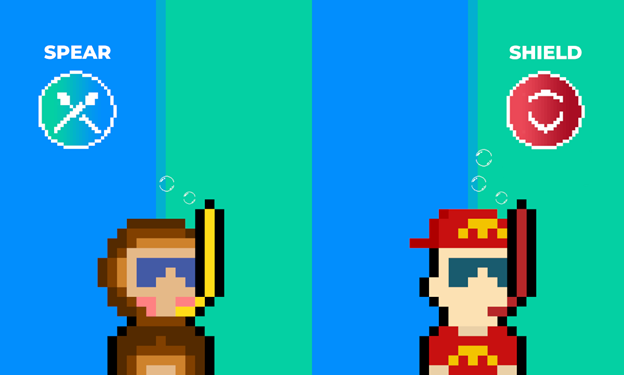

To onboard, users simply connect a supported wallet like MetaMask to the Divergence test app. At the moment, Divergence supports two types of binary options. Those include options with a single strike and options with a range strike. These options are tokenized as Spear and Shield tokens on Divergence. Options with a single strike allow users to get paid one collateral if the underlying price settles above or below the single price level. Range strike options pay collateral when the underlying settles within or outside a specific price range.

One of Divergence’s main innovations is that binary options are tokenized abstractions within smart contracts. This enables users to save gas fees that would have been incurred if these derivative tokens were ERC-20 tokens. Traders can easily roll over options when they expire without the overhead of creating new pools and spending gas. These innovations improve the overall trading experience and allow users to easily trade DeFi options.

What to Expect

Divergence has a governance token called DIVER. DIVER holders are able to vote on protocol parameters and receive rewards from staking activities. The protocol recently announced details for its highly-anticipated IDO. On 20 September 2021, it will launch a public sale for 2% of its DIVER tokens on SushiSwap’s MISO launchpad. Participants will be able to become early holders of the DIVER tokens and have the opportunity to claim from a pool of 256 non-fungible DIVΞR tokens. Following the IDO, it is expected that Divergence will create its DIVER liquidity pool on SushiSwap and proceed with additional token listings at other exchange venues.

Following its IDO and token listings, Divergence plans to launch its mainnet after auditing completion. With the mainnet launch, traders will have access to decentralized options markets for a larger number of assets, more collateral choices and an upgraded interface.