- Home prices rose 0.8 percent in the second quarter of 2020.

- Overall, prices are up 5.4 percent nationwide compared to a year ago.

- Investors are thinking about housing more than ever as further potential lockdowns loom.

The U.S. housing market secured a modest advance in the second quarter of the year, experiencing a 0.8 percent overall rise in home prices. That followed a 0.9 percent rise in June, amidst a slight dip earlier in the second quarter.

Why the U.S. Housing Market Has Remained Robust

On average, housing prices are up 5.4 percent in the past year. That’s larger than official inflation measures, showing that homeowners have created real wealth amidst a global pandemic.

What gives? A few reasons come to mind.

First, home prices have been rising every quarter since late 2011. The housing market bust a decade ago stopped a number of projects, and demand came back faster than new supply could come onto the market. That’s a classic formula for higher prices.

Second, interest rates are low, which has made home prices more affordable.

And despite a decade of low interest rates, lenders exercised tremendous restraint in underwriting risky loans. They learned their lesson from the mistakes of the housing crisis. Even home equity loans, a second loan on a home, have gradually declined by half over the past decade.

With housing prices on the rise and total housing debt on the decline, homeowners have massive amounts of equity. Remarkably, there’s little evidence of homeowners trying to tap into that equity as they have in the past.

Emigration Away From Big Cities Continues

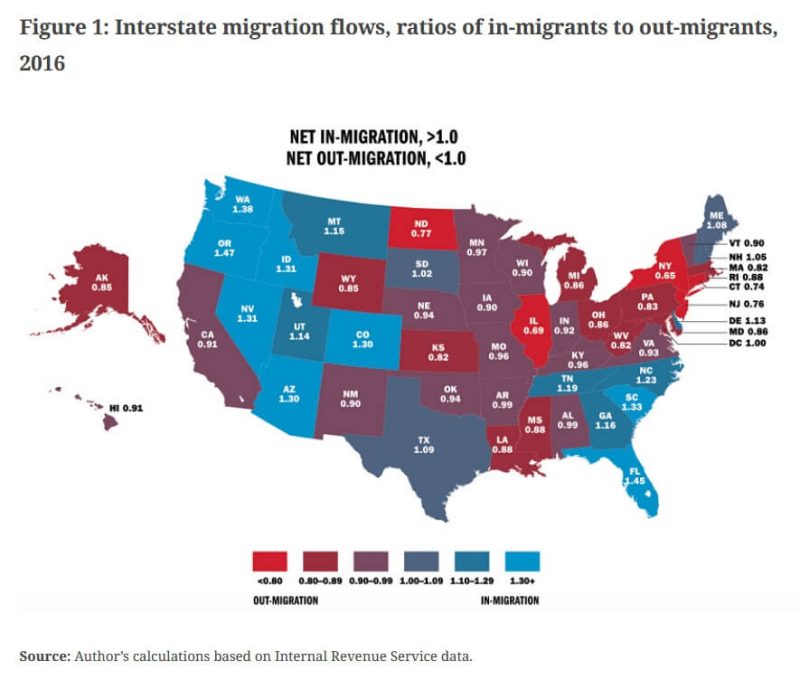

Not every local housing market has fared well. There’s been a general trend of moving out of big cities and towards the suburbs for several years, and that trend appears to have accelerated due to Covid-19.

Changing tax law, notably capping state and local taxes (SALT), has contributed to a migration out of high-tax states and into lower ones.

Of the 25 highest-taxed states, a full 24 of them have seen a net migration out of state, with New York being a leader well before the pandemic. States with low or nonexistent income tax rates, such as Nevada and Florida, have seen massive growth.

One surprising name seeing a massive population influx? Idaho, where low prices and scenic views are attracting massive numbers of Californians.

Forget “location, location, location,” when it comes to real estate. It may come down to “taxes, taxes, taxes.” That’s why many are leaving New York City in droves, despite what some near-billionaire comedian thinks about the city’s eventual recovery.

Overall, the U.S. housing market looks impressive. For those living in a low-tax state, the future trends look even better. With today’s low rates and shifting demand, buying a home in a growing area and renting it out may prove to be an attractive investment strategy for investors turned off by lofty valuations in the stock market.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author owns a rental property.