- Ray Dalio has warned investors of the perils of holding cash. He argues the U.S. dollar has become a risky asset as a result of fiscal stimulus and debt production.

- The market would largely agree with Dalio’s assessment, given its fight to gold, other currencies, and equities.

- But the flight away from the dollar has eased over the past month, while Dalio has a commercial interest in bashing cash.

Ray Dalio has warned investors of the dangers of holding cash. The Bridgewater Associates founder has said in an interview that the high level of spending in America means the U.S. dollar is no longer a safe investment.

Dalio isn’t the only trader to think that cash will perform poorly compared to other asset classes. Gold’s rise to $2,000 also shows that the market no longer believes in cash. As does the rise of the euro and other major currencies against the U.S. dollar.

And with the Fed relaxing its attitude to inflation, now may be the worst time to hold dollars for years.

Ray Dalio is Bearish On Cash

Speaking to CNBC, billionaire hedge fund manager Ray Dalio warned that cash “is not a safe investment.” It lulls investors into a false sense of security, based on the U.S. dollar’s historical role as a reserve asset.

I think there’s an instinct to think that cash is the lowest risk asset, because it has less volatility … also because we look at everything through the lens of cash — what everything in dollars is worth.

While it may have once been true that the U.S. dollar was safe, this is no longer the case. According to Dalio, the Federal Reserve’s spending spree since March has seriously weakened the value of cash.

But you don’t realize that when there’s so much production of debt, and so much production of cash, that it does poorly relative to other asset classes.

Dalio thinks that holding cash is equivalent to accepting a 2% annual stealth tax, as a result of inflation. And this is likely to get worse from this year onwards, with the Fed now targeting an “average” inflation rate of 2%. This means it will tolerate an actual rate well above 2% for considerable lengths of time.

Dalio advocates a diversified approach to investment in the face of these changes.

Cash is a poor asset class … It’s a quietly bad asset class. Diversification is much better than cash.

U.S. Dollar Weakening

Dalio certainly isn’t alone in his disdain for cash. The market appears to agree with him, with the price of gold still much higher than usual.

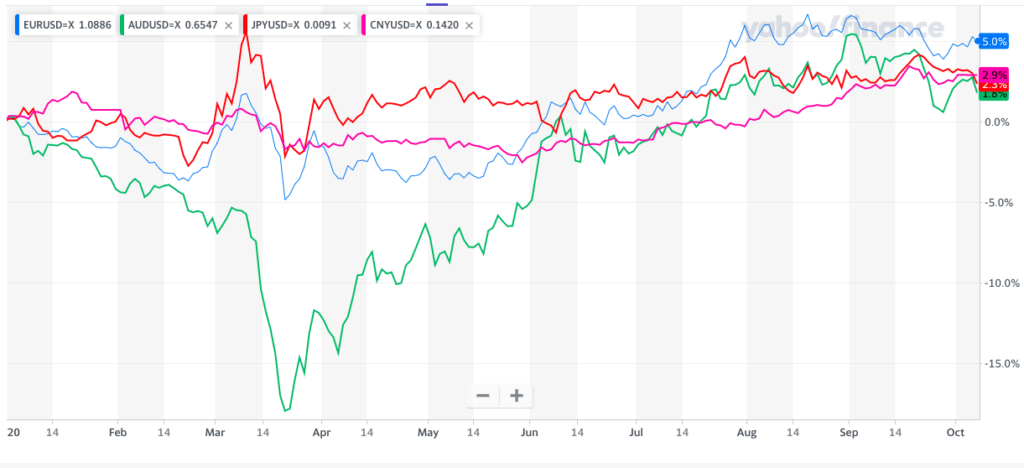

The market has also shifted away from the U.S. dollar to other fiat currencies. The euro has risen against it this year, as have the Japanese yen, Chinese renminbi, and Australian dollar.

This year’s crazy stock market rally is also a clear signal that the market doesn’t have much faith in cash. Despite the U.S. and global economy tanking, it would seem many investors would prefer equities to the U.S. dollar.

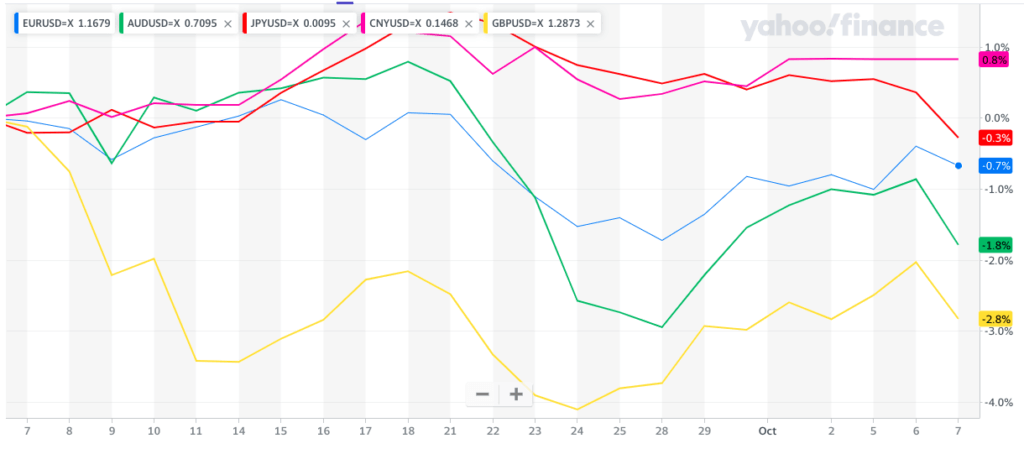

But it’s arguable that the tide may be turning. Most major currencies have fallen against the dollar over the past month, with only the Chinese renminbi enjoying a modest 0.8% rise.

The price of gold has also sunk by 1.7% over the past 30 days. The S&P 500 and Nasdaq have also fallen by 1.9% and 1.4%, respectively. A stock market correction may also be on the cards, due to the ongoing coronavirus pandemic.

Financial Interest

This could all result in the U.S. dollar — and cash — holding its own in the coming months.

It’s also worth mentioning that Ray Dalio has a huge financial interest in bashing cash. As the founder of Bridgewater Associates, he wants investors to pump their growing cash reserves into his fund. This is why you should take what he says with a pinch of salt.