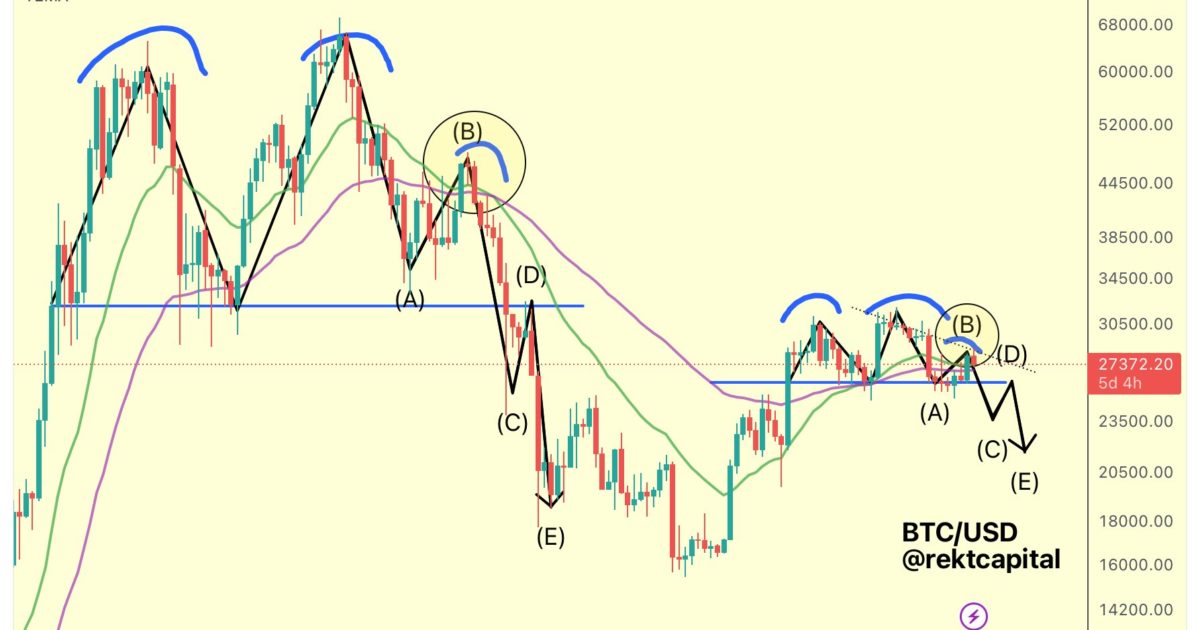

A detailed analysis by well-regarded crypto analyst Rekt Capital has spotlighted a recurring bearish fractal in the historical price data of Bitcoin, raising prospects of a potential crash below the $20,000 mark. Notoriously seen in 2019 and 2022, this pattern seems to be reemerging in the current 2023 market.

For those unfamiliar, the fractal indicator identifies potential turning points on a price chart by highlighting repetitive price patterns. In simple terms, a bearish fractal suggests a potential decline in price. Such a pattern materializes when there’s a peak price with two consecutively lower high bars/candles on its flanks. An up arrow typically marks a bearish fractal, indicating the potential for price descent.

Here’s Why Bitcoin Price Could Drop Below $20,000

The essence of this bearish pattern begins with a double top. Contrary to expectations, this double top doesn’t validate with a dip below a significant support level. Instead, the price typically sees a relief rally, forming a lower high, only to crash below the previously mentioned support.

This support then morphs into a new resistance level, driving the price further down. This sequence was observed in both 2019 and 2022, and the current market scenario in 2023 mirrors the initial stages of this pattern. Rekt Capital suggests that the market is potentially in the middle of this bearish fractal, with uncertainty around where the relief rally might conclude.

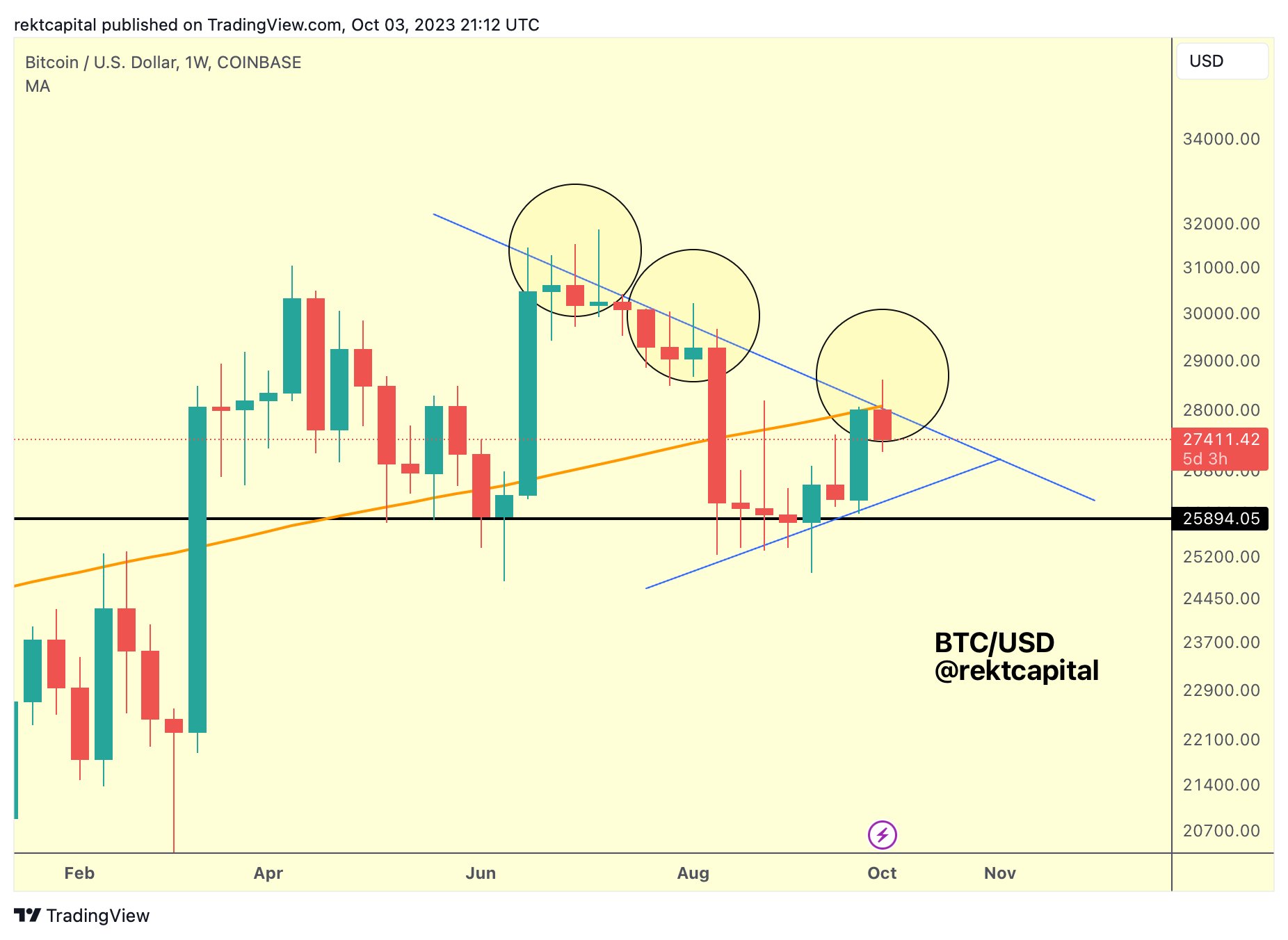

From the beginning of April to the end of August, BTC formed a double-top pattern in the weekly chart. However, the Bitcoin price held above the neckline at around $26,000. Then, in mid-August, BTC started its relief rally which took the price up to $28,600. “We’re probably in the A to B [phase of the] bearish fractal,” the analyst added.

Diving deeper into potential scenarios, the analyst believes Bitcoin’s price could rally up to approximately $29,000 before experiencing further declines. Some key events to watch for include potential overextensions beyond the bull market support band. If Bitcoin fails to retest and maintain this band as support after breaking out, the bearish fractal remains valid.

Another important point to monitor is the revisit of the lower high resistance. Even if the price wicks beyond this resistance, a subsequent rejection would keep the bearish outlook intact. There are, however, criteria that could invalidate this bearish perspective: the bull market support band (blue) consistently holds as support, a weekly close beyond the lower high resistance ($28,000), and breaking past the $31,000 yearly highs.

On the topic of other technical indicators, Rekt Capital highlighted that Bitcoin has recently rallied to the 200-week MA. This moving average (MA), however, seems to be acting as a current resistance. Additionally, the 200-week MA aligns with the lower high resistance, presenting a crucial juncture for Bitcoin’s price in the near future. Despite his macro bullish stance on Bitcoin, Rekt Capital cautions that Bitcoin has yet to overcome the $28,000 lower high resistance in the 1-week chart.

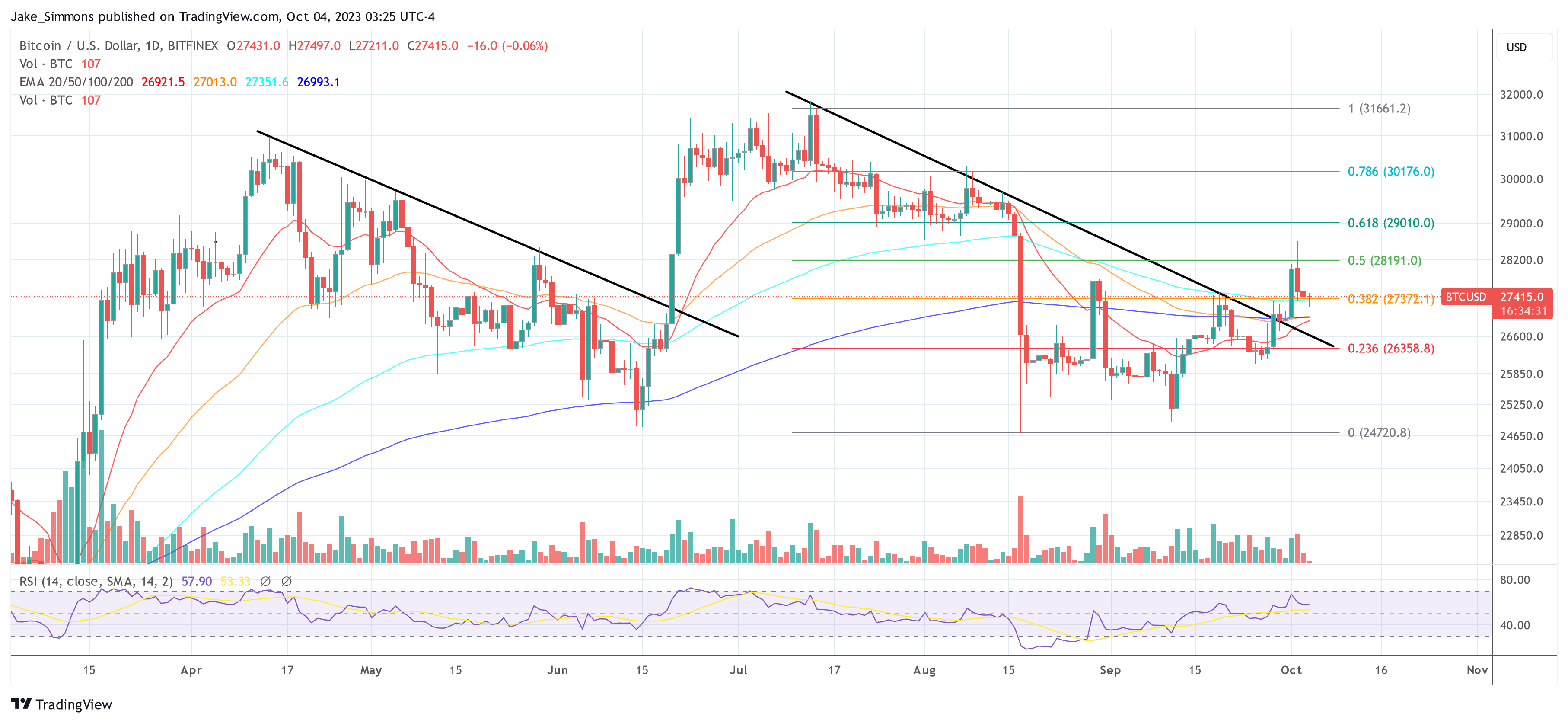

On the daily chart, Bitcoin is hovering slightly above the 38.2% Fibonacci retracement mark. For Bitcoin to avoid a descent beneath the established trend line (represented in black), it’s crucial for it to maintain a position above $27,372.

Featured image from Shutterstock, chart from TradingView.com