A digital asset’s price rally rarely comes out of the blue. Before the token’s market value explodes, some collateral forces come into motion. The asset can suddenly attract abnormally high online attention, its trading volume can go up dramatically, or some market-moving information can go public that triggers the first two examples. Mastering the art of crypto trading means learning to see those subtle cues early on.

Spiking trading volume is one of the signs that something interesting might be brewing around a crypto asset. Often, trading volume simply follows a price trend, with the coin entering a virtuous circle where its rallying price attracts more traders, boosting the volume accordingly. In other cases, abnormally high volume points to robust liquidity and rising investor interest, which can underpin further waves of appreciation.

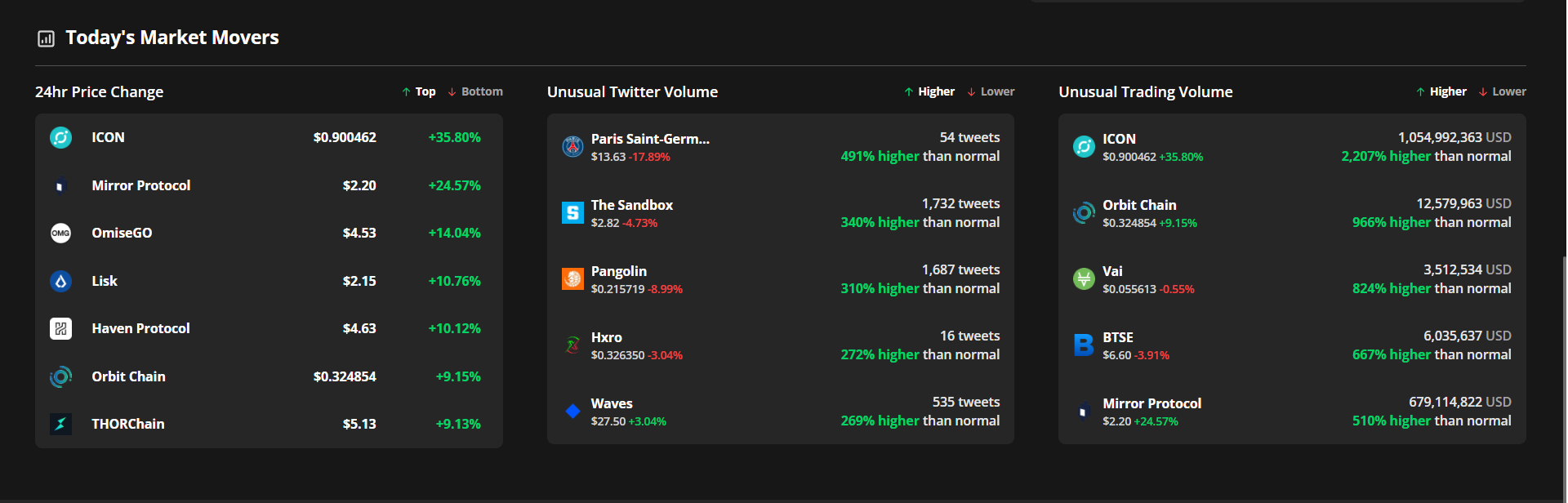

One of the ways to get alerted to potentially informative trading volume pumps is the Unusual Trading Volume bar on the dashboard of Cryptox Markets Pro, Cryptox’s subscription-based data intelligence platform.

Last week, four out of the 10 tokens that showed the greatest increase in week-to-week trading volume flashed weekly volume highs before their prices peaked. Here’s how traders could have profitably put this information to work.

RUNE: Big news boosts both trading volume and price

THORChain’s RUNE had a big week, with a Terra integration and upcoming mainnet launch exerting huge upside pressure on the token’s price. The breakthrough moment came on March 1 when RUNE took off from around $3.70 and breached $5.80 in less than a day. Trading volume spiked alongside the price, with the highest volume of the week coming after the first price peak. Traders who took heed of the volume dynamics were in for a continued rally, as the token’s price remained up, breaching the $6 mark on March 4.

FUN: Two trading volume pumps amid a rolling rally

The price of Funfair’s FUNToken (FUN) steadily went up throughout the entire week, with two trading volume spikes reassuring traders that strong fundamentals fueled the token’s appreciation. The first came on Feb. 28 and preceded a local price peak at $0.0103 registered on March 1. Two days later, an even larger trading volume wave hit, foreshadowing the week’s price high of $0.0105.

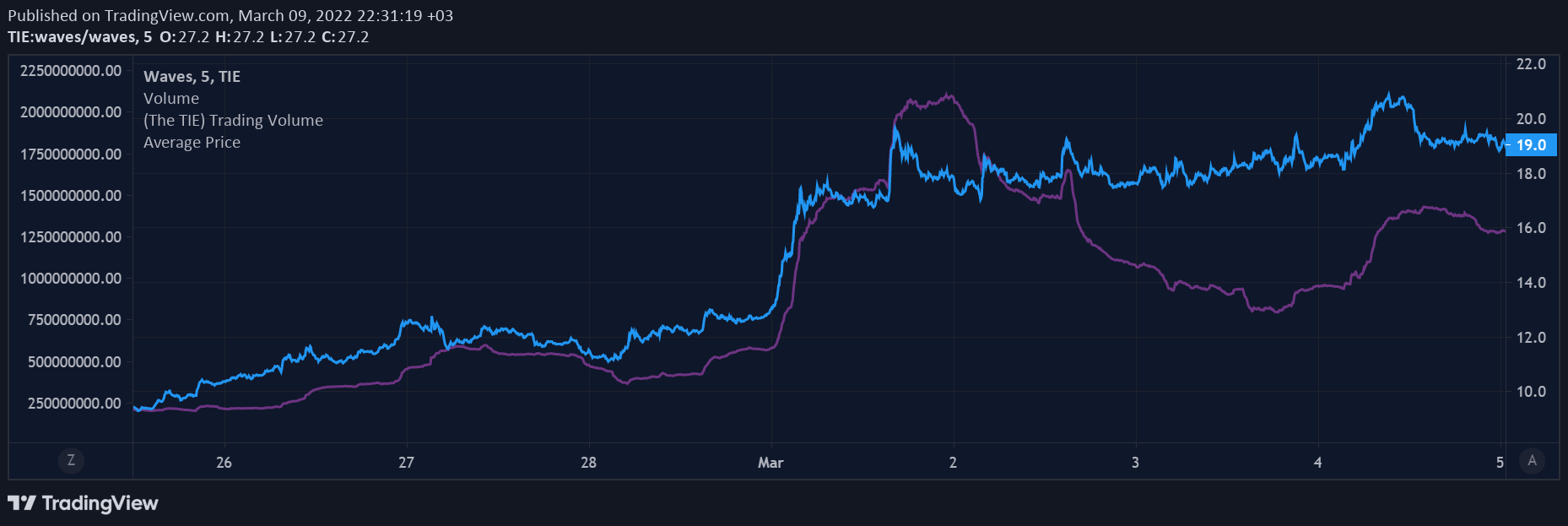

WAVES: Volume spikes following price pump, anticipates even bigger one

WAVES added upward of 80% to its value over last week, thanks to the Waves platform’s ongoing transition to version 2.0, a bullish partnership with Allbridge that will ensure cross-chain interoperability, and the news of the launch of Waves Labs, a $150 million fund that will support the project’s growth in the United States market. On March 1, the token’s price soared from around $13 to over $19 in less than a day, triggering a corresponding pump in trading volume. Even as the wave of liquidity subsided, the price action remained robust, with the token’s valuation going further up to its weekly high at $20.86.

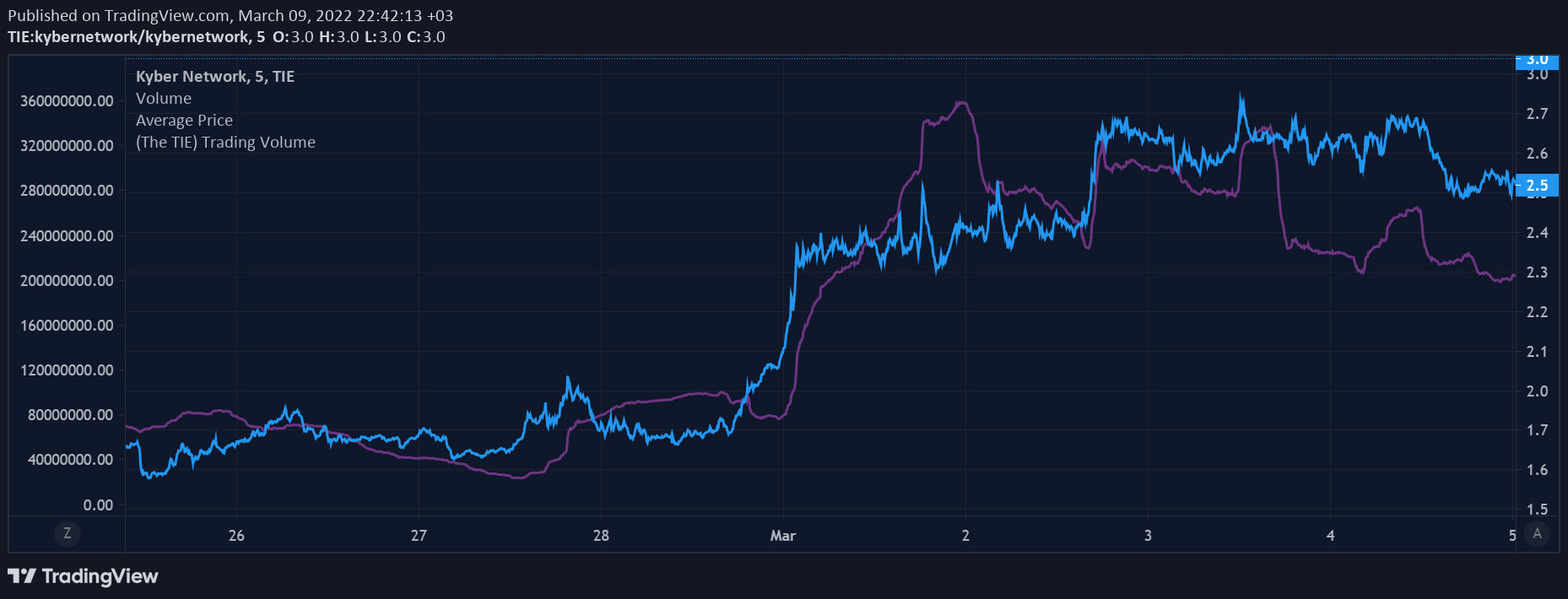

KNC: Strong price momentum following trading volume spike

Kyber Network Crystal (KNC), the utility and governance token of Kyber Network, massively rallied on Feb. 28, dragging the token’s trading volume with it. The volume peaked against a price of $2.51, but the feast carried on as the price continued to soar all the way up to $2.91.

In addition to the raw data on trading volume outliers available on the Cryptox Markets Pro dashboard, the trading volume metric is one of the core components of the VORTECS™ Score. An algorithmic tool for comparing historical and present market conditions around digital assets, the VORTECS™ Score can be used to identify historically bullish or bearish setups around each digital asset it tracks, alerting traders to the coins with the most favorable outlooks.

Cryptox is a publisher of financial information, not an investment adviser. We do not provide personalized or individualized investment advice. Cryptocurrencies are volatile investments and carry significant risk including the risk of permanent and total loss. Past performance is not indicative of future results. Figures and charts are correct at the time of writing or as otherwise specified. Live-tested strategies are not recommendations. Consult your financial adviser before making financial decisions.