HBAR price rose 15% on Feb. 6 to reach a 20-day peak of $0.78, hours after the Hedera team confirmed a $250 million agreement with the Saudi Arabian Ministry of Investment.

Hedera’s recent five-year partnership agreement with the Saudi Arabian government has initiated positive price action. But notably, a vital market metric suggests derivatives traders could scuttle the HBAR price rally.

Hedera price soared 15% as investors reacted to Saudi partnership

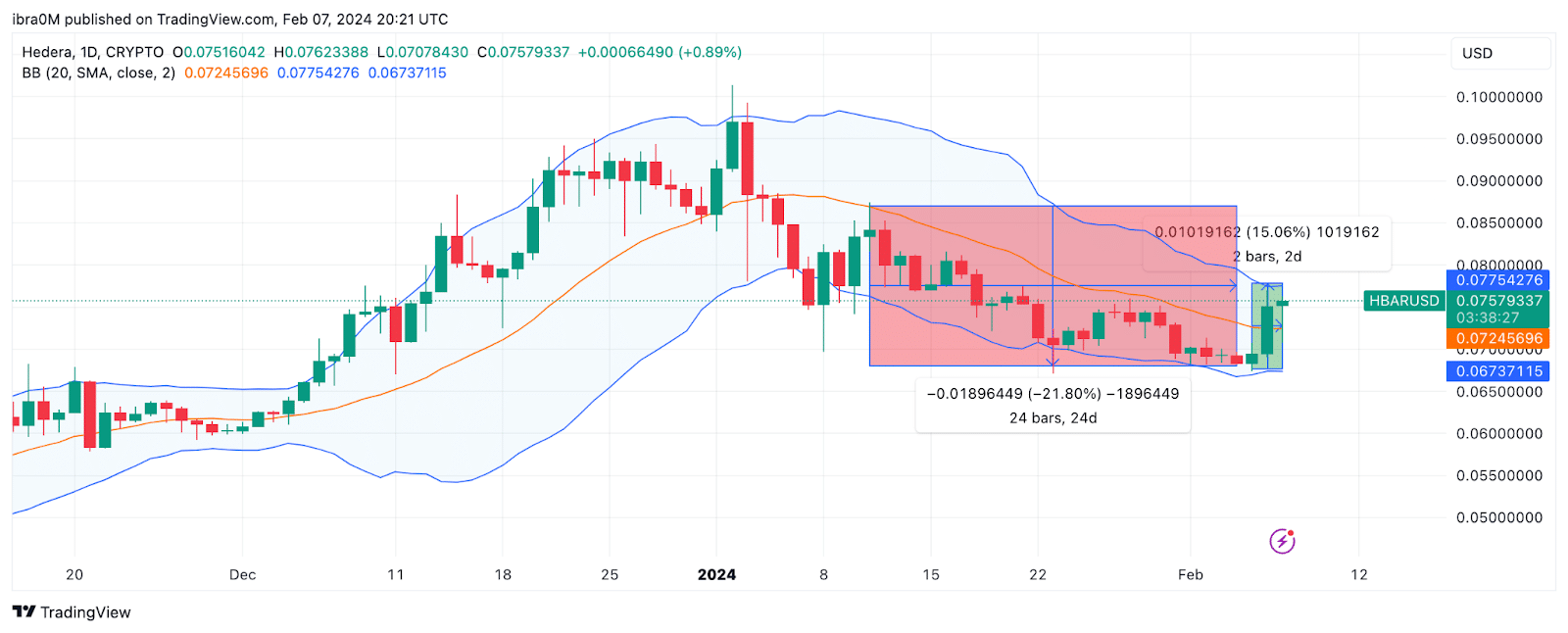

HBAR price has been trending down since the crypto market correction that heralded the Bitcoin ETF approval in mid-January.

The Hedera blockchain native coin had tanked 22% between Jan. 11 and Feb. 5, But the momentum flipped bullish following the announcement of Hedera’s partnership with the Saudi Arabian government on Feb. 6.

Details of the partnership outlined an investment plan enabling companies to create advanced technological solutions at the newly launched DeepTech Venture Studio in Riyadh.

In a dramatic turn of events, HBAR price gained 15%, rising from $0.69 to $0.77 within 24 hours of the announcement, as depicted in the chart above.

Speculative traders placing large bets on retracement

The rare rally sent Hedera to a 20-day peak after three consecutive weeks on the back foot. However, a vital market metric shows that speculative traders may scuttle the recovery phase.

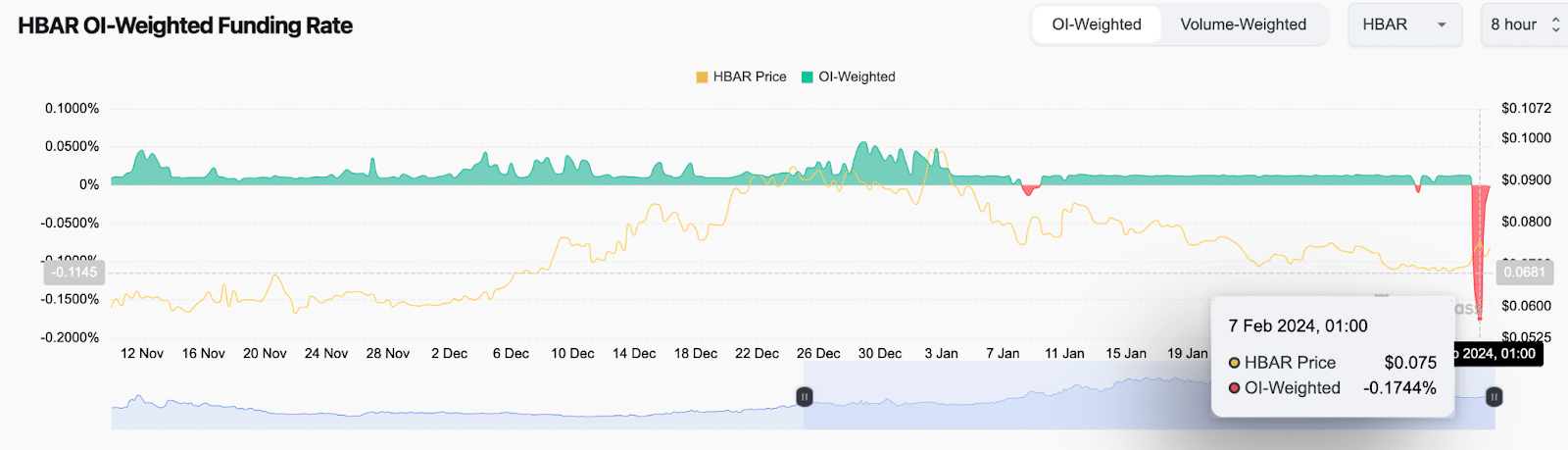

Coinglass’ funding rate metric tracks real-time swings in fees paid by long and short trades in the derivatives markets to keep their contract positions open.

The HBAR funding rate has recorded a noticeable decline in the negative zones as market activities swung bullishly in the spot markets. A close look at the chart below shows that the funding rate sank to a 90-day low of -0.02% on Feb. 7.

When the funding rate rapidly swings negative during a rally, most speculative short traders pay record fees to keep their futures position open in hopes of booking profits when prices fall.

Essentially, the negative trend in HBAR funding rates implies that the prevailing sentiment in the derivatives markets is skeptical about the sustainability of the price rally. If the bulls fail to counteract these positions and establish a stronger upward momentum, HBAR spot prices could soon be at risk of a sharp downturn.

HBAR price forecast: Bears could target $0.65

Drawing inferences from the market data trend analyzed above, the bullish impact of the $250 million Saudi Arabia partnership on Hedera price could be shortlived.

And having recently traded as low as $0.67 on Feb. 5, before the recent rally, the bears could set their sights on a more audacious downswing below $0.65 during the next attempt.

However, the Bollinger band’s technical indicator shows that the bulls could mount a formidable support line around the $0.67 area. But if that support level cannot hold steady, a bearish reversal toward $0.60 could be on the cards.

On the upside, if the bulls can build on the momentum from the Saudi partnership, they could invalidate this negative Hedera price prediction by staging a $0.80 retest.

However, as depicted by the upper Bollinger band in the chart, a looming sell-wall at $0.78 could scuttle the rally.