Rome wasn’t built in a day, and it will also take some time for every country on Earth to adopt BTC.

Bitcoin (BTC) adoption by governments and companies remains a dubious question and the “digital gold” thesis proposed by advocates faced harsh critics after Tesla sold 75% of its holdings in the second quarter of 2022.

Larger entities buying or selling Bitcoin have always moved the needle on how close countries are to using cryptocurrencies as a store of value. Currently, the average purchase price of El Salvador’s Bitcoin holdings stands at $45,000, making it a rather unprofitable investment.

Regardless of how long adoption by the large institutional holders will take, and its subsequent impact on price expectations, it is possible to roughly estimate a minimum price per BTC based on each countries’ foreign currency and gold reserves.

El Salvador might have been the first country to adopt Bitcoin as legal tender, but its 2,381 BTC position represents less than 2% of the country’s total reserves. More importantly, the South American republic does not rank among the top 100 countries in terms of its gross domestic product.

Jamaica, on the other hand, has a population that is 56% smaller than El Salvador and its international reserves are 30% higher at $4 trillion. Even Trinidad and Tobago, a tiny island country in the Caribbean with the same population size as San Diego, California, holds $6.9 trillion in reserves.

What becomes clear is how tiny (economically) El Salvador is in comparison to the aggregate $15 trillion held by the 160 countries included in World Bank data.

Would it be possible for other economies to buy their reserves at Bitcoin’s current $20,000 price, and how many coins could each country potentially acquire depending on the price of BTC?

Could every government match its reserves with BTC?

For starters, $15 trillion is 39 times larger than Bitcoin’s $385 billion market capitalization at the current $20,000 per coin. Theoretically, 750 million BTC coins would be required for every country to replace their gold and foreign currency holdings. Even a conservative 3% allocation would represent 22.5 million BTC, which exceeds the total number of coins in circulation.

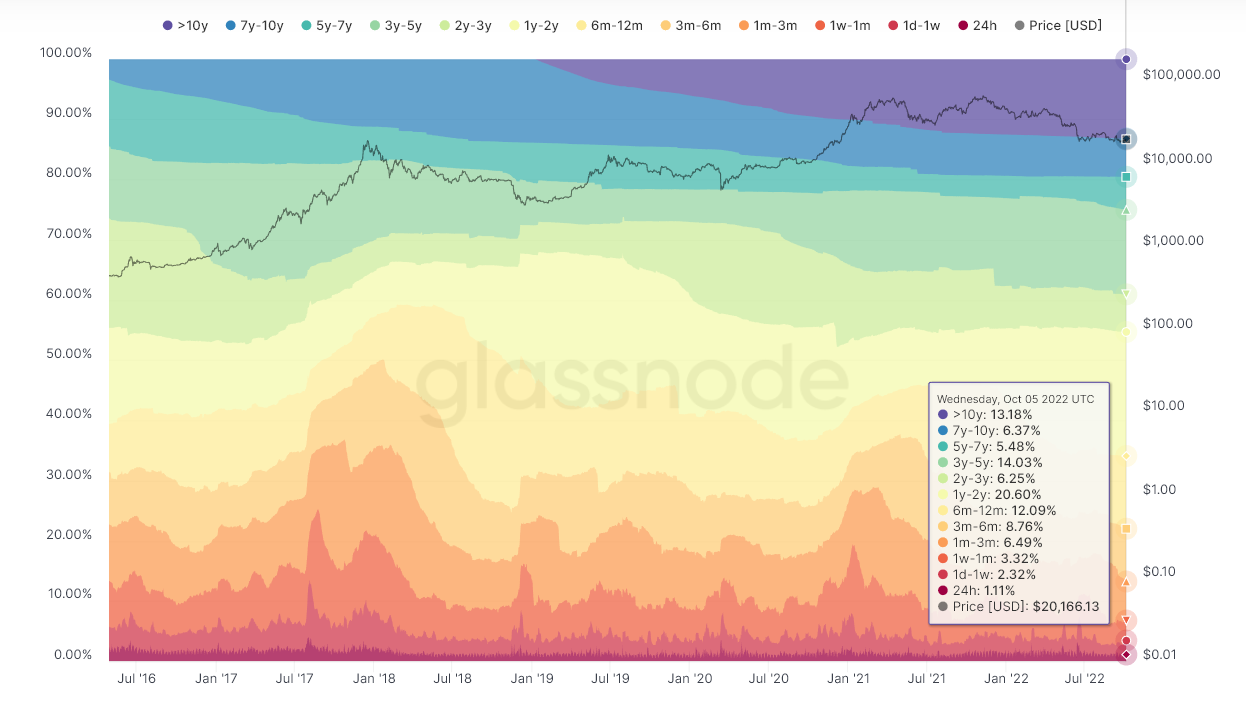

Furthermore, not every Bitcoin is available for sale and an estimated 3.7 million BTC coins have been lost since 2009, according to blockchain forensics firm Chainalysis.

This brings the current supply closer to 15.5 million coins, making the 3% allocation using foreign reserves even more impossible at the current $20,000 price.

Assuming that every holder is willing to sell their coins, the minimum average price needed would be $29,000 for a 3% allocation, equivalent to $450 billion.

However, a more realistic approach is needed since 3.8 million BTC coins have not moved over the past 3 years, meaning the owner held during the sub-$4,000 crash in March 2020 and the $69,000 peak in November 2021. Thus, the adjusted liquid coins currently in circulation is 11.7 million, meaning the minimum average price for a $450 billion allocation would reach $38,500 per Bitcoin.

Here is why $38,500 per BTC would be a “good deal”

The Prisoner’s dilemma is a typical example of game theory study that demonstrates why two rational actors may refuse to cooperate even though it appears to be in their best interest. Betrayal is the dominating strategy for both sides, which is the most likely reaction in all scenarios.

For example, Switzerland alone holds $1.1 trillion in foreign and gold reserves, meaning their 3% allocation would amount to $33.3 billion. It is unthinkable that some entity would be able to grab over 1 million coins without raising alerts. The remaining countries would have a harder time finding large quantities at similar price levels.

For example, on Oct. 8, 2020, Bitcoin price rallied close to $11,000 after Square announced a $50 million BTC purchase. More recently, on Feb. 8, 2021, Bitcoin jumped by almost $3,000 in minutes as reports emerged that Tesla had bought $1.5 billion worth of BTC.

Moreover, the Prisoner’s dilemma theory indicates incentives to suppress coordination efforts in terms of a price or allocation cap. Either a country would front-run others by buying ahead of the group or exceeding the proposed 3% allocation to further protect their balance sheet.

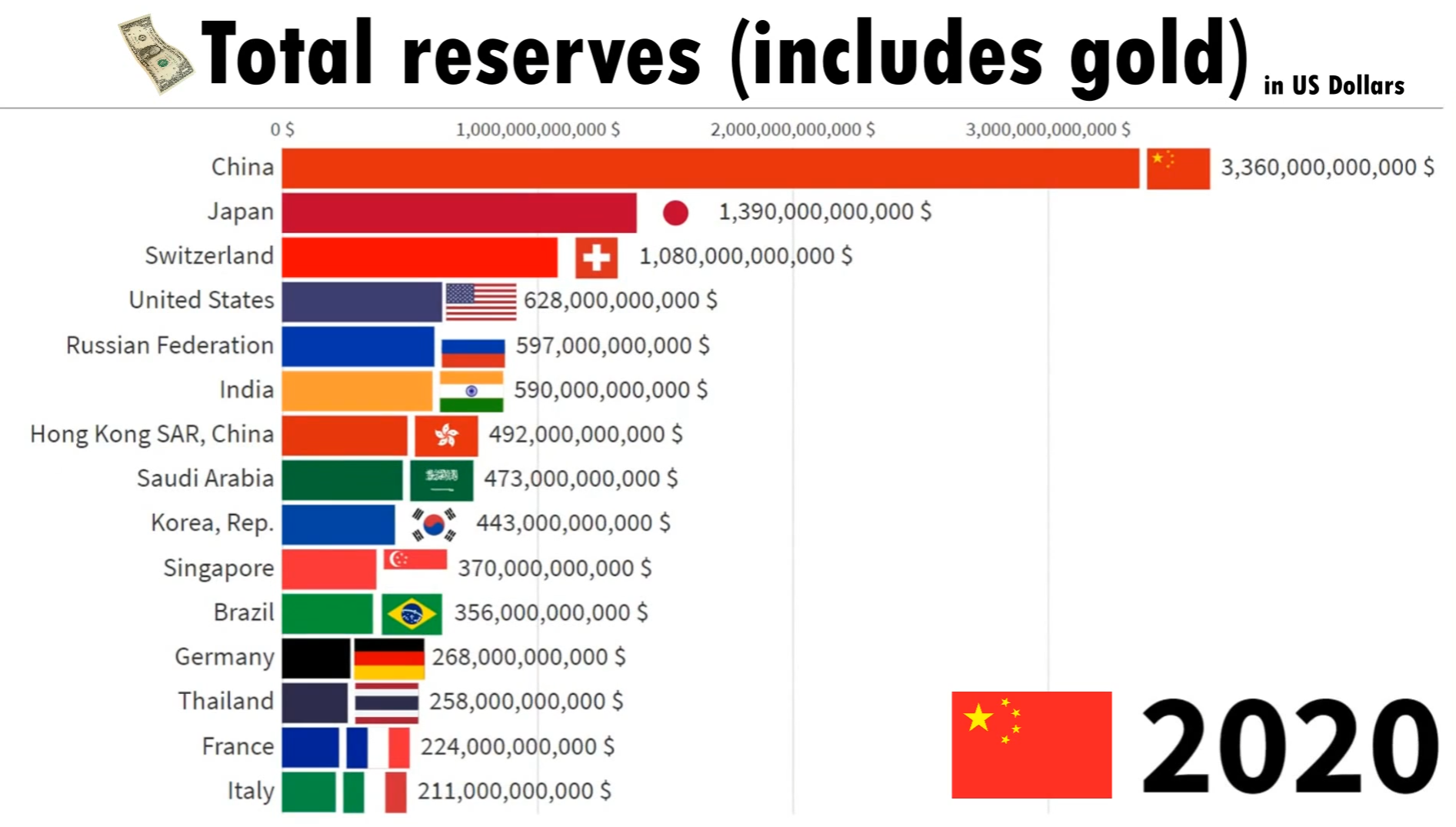

Assuming that countries respect the $38,500 price limit and every Bitcoin coin that has moved in the past 3 years is offered for sale, the holdings —considering foreign and gold reserves— per country would total 2.67 million BTC to China and 1.1 million BTC to Japan. Switzerland would hold 864,800 BTC and the United States would be in possession of 558,000 coins.

Note that the United States’s currency holdings have not been included in the World Bank data, but the Federal Reserve currently holds $8.8 trillion of assets on its balance sheet.

Ultimately, El Salvador’s investment was a drop in the bucket and Bitcoin adoption as a global store of value is still in its infancy.

Furthermore, game theory would present incentives for countries to surpass any agreed limit and not observe price caps, making the theoretical $38,500 estimate way too conservative.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.