You’re reading First Mover, CryptoX’s daily markets newsletter. Assembled by the CryptoX Markets Team and edited by Bradley Keoun, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

Market moves

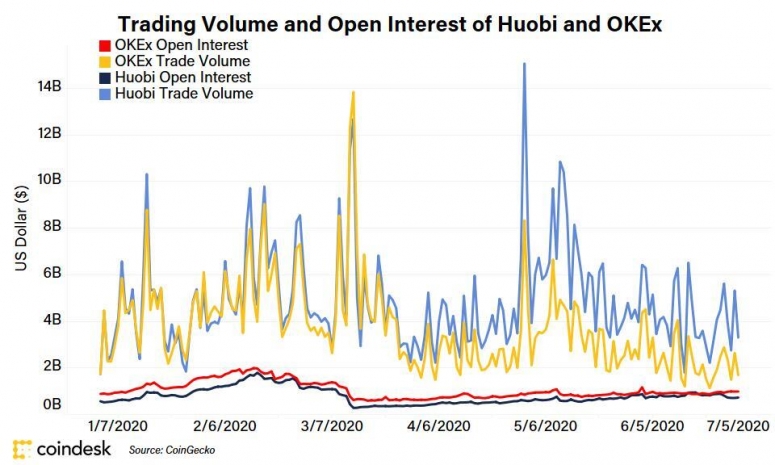

Cryptocurrency exchange Huobi is taking aim at competitor OKEx in the business of trading bitcoin futures and other derivatives contracts, opening up a new front in a longstanding rivalry between the Chinese-led exchanges.

OKEx, which is led by Chinese executives and based in Malta, is the world’s biggest crypto derivatives exchange, with outstanding contracts valued at $1.26 billion, according to the data site CoinGecko. Huobi, also led by Chinese brass but based in Singapore, is close behind, tied for second place with another exchange, BitMEX, at $1.25 billion.

In a report this month, Huobi said it has “managed to push new boundaries against other well-established exchanges when it comes to futures trading volume.” Huobi is already beating OKEx in a few market segments, according to the report, including “coin-margined futures” – where traders can post their initial down payment, known as margin, using cryptocurrencies. Huobi claims to also regularly beat OKEx in weekly and quarterly bitcoin futures contracts.

“Before Huobi launched its futures contract in December 2018, OKEx had the largest market share of the world,” Ciara Sun, vice president of Huobi Global Markets, told CryptoX in a Telegram message. “Huobi Futures always looks up to the best of the market.”

The battle for supremacy in cryptocurrency futures – and China – adds to the tension between the two exchanges, which have been at loggerheads at least since 2018, when then-OKEx CEO Chris Lee defected to Huobi to become vice president of global business development.

OKEx CEO Jay Hao, in a company update in March, called Huobi “our doppelgänger,” insisted “imitation was the sincerest form of flattery” and said he “would like to think that Huobi was able to withstand this market volatility by following our footsteps.”

Experts on China’s often-murky cryptocurrency markets say the rivalry between the two exchanges likely stems from the fight for customers in the world’s second-largest economy.

“There’s a natural friction between OKEx and Huobi,” Matthew Graham, chief executive officer of Beijing-based crypto consultancy Sino Global Capital, told CryptoX in an email. “While they have both pushed to enlarge their international footprints, they still prioritize their Chinese user base.”

Read more: Huobi and OKEx Battle for Supremacy in China

Bitcoin watch

While bitcoin is eyeing an August gain for the first time in three years, the cryptocurrency is lagging U.S. stocks over the month.

- Bitcoin is trading near $11,610 at press time, up 2.3% on the month, according to CryptoX’s Bitcoin Price Index.

- It was the first time the cryptocurrency gained in August since 2017, when prices rallied by 66%.

- As of Friday, the S&P 500, Wall Street’s benchmark stocks index, was eyeing a 7.25% gain for August, as per data provided by TradingView.

- Bitcoin faced rejection at highs above 12,400 on Aug. 17 and has been restricted largely to a range of $11,100 to $11,800 ever since.

- The rally from July lows below $9,000 has stalled with the weakening of demand from institutions and macro traders, as indicated by the recent 30% decline in open positions in futures listed on the Chicago Mercantile Exchange.

Click here for the full story: U.S. Stocks Closing on Bigger August Gain Than Bitcoin

Token watch

SushiSwap (SUSHI): Alternative to Uniswap is poised to become next DeFi meme with new liquidity incentive.

YearnFinance (YFI): Delta Exchange launches perpetual swaps for YFI tokens, with 20x leverage and margined and settled in bitcoin, as Forbes calls YFI ” the altcoin star.”

Ethereum Classic (ETC): Frequently-attacked blockchain gets hit by third 51% attack in a month.

What’s hot

Inflation will outstrip both bond yields and corporate earnings for the foreseeable future (CryptoX)