Good morning. Here’s what’s happening this morning:

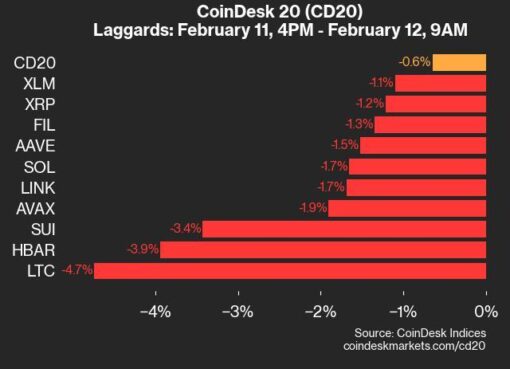

Market moves: Bitcoin rallied in early trading on U.S. markets before dropping.

Technician’s take: Short-term downside is likely into the Asia trading day.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $56,452 -4.6%

Ether (ETH): $4,107 -5.1%

Market moves

After picking up slightly earlier in the day, bitcoin continued its recent downward trend. At the time of publication, the cryptocurrency was trading above $56,500, down more than 4% over the past 24 hours. Ether followed a similar pattern, rallying before dropping to about $4,100.

The cryptocurrencies and equities markets initially rose after the news that U.S. President Joe Biden had renominated Federal Reserve Chairman Jerome Powell for another four-year term as head of the country’s central bank. Speculation had been that Biden would choose Powell or Fed Governor Lael Brainard to replace him.

Some market observers see support holding at $55,000.

“The downward pressure on major crypto assets like bitcoin and ether is to be expected,” BitBull Capital CEO Joe DiPasquale wrote in an email to CoinDesk. “Bitcoin’s price increased more than 50% in the last 45 days to its all-time high. We expect the week to consolidate around $55K before rising again to $60K before the end of the month. We’ve repeatedly seen profit-taking in crypto when there are these quick run-ups.”

DiPasquale added: “The news of Biden’s appointment of Powell is strong for crypto, as the U.S. has shown no signs of quantitative tightening; rather, just tapering the quantitative easing.”

Technician’s take

Bitcoin Struggled at $60K Resistance; Support Above $53K

Bitcoin (BTC) buyers remained active over the weekend, although upside was limited around the $60,000 resistance level.

The cryptocurrency continues to consolidate, with pullbacks limited toward $53,000 support.

Intraday chart signals are neutral, suggesting the current loss of momentum could continue into the Asian trading session. Buyers will need to defend immediate support around $55,000 and decisively break above the short-term downtrend in order to yield further upside targets.

The relative strength index (RSI) on the daily chart is approaching oversold levels, which could support a price recovery similar to what took place in late September. However, previous failed attempts at sustaining an all-time price high near $69,000 is a concern.

Important events

4:15 p.m. HKT/SGT (8:15 a.m. UTC): France Manufacturing Purchasing Managers Index (Nov./Monthly)

4:30 p.m. HKT/SGT (8:30 a.m. UTC): German Manufacturing Purchasing Managers Index (Nov./Monthly)

5 p.m. HKT/SGT (9 a.m. UTC): Euro Zone Manufacturing Purchasing Managers Index (Nov./Monthly)

7 p.m. HKT/SGT (11 a.m. UTC): Speech by Jonathan Haskell, Bank of England Monetary Policy Committee member

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

“First Mover” hosts spoke with Minnesota Congressman Tom Emmer (R) as he joined other lawmakers to introduce the “Keep Innovation In America Act” bill to modify crypto tax provision in the infrastructure law. Bitcoin continued trading below $60K as investors eyed inflation numbers and Biden’s Fed Chair nomination. Arca Chief Investment Officer Jeff Dorman shared his market insights.

Latest Headlines

South China Morning Post Releases White Paper for NFT Standard Built on Flow Blockchain

Rare ‘Dune’ Manuscript Bought on DAO’s Behalf for $3M, but It Only Raised $700K

Biden to Renominate Powell as Fed Chair and Appoint Brainard as Vice Chair

Latin American E-Commerce Giant Mercado Libre to Enable Crypto Investments in Brazil

NFT Music Platform Royal Closes $55M Funding Round Led by A16z

Longer Reads

Turkey Makes the Case for Bitcoin as Erdogan Runs the Autocrat’s Inflation Playbook

What Billions of Dollars in Crypto Fundraising Says About the Bull Market